Track Branch Transactions

Once you’ve created branches, included new GSTINs and associated the transaction series, you can start creating transaction. Let’s take a look at how you can include transactions to each branch and track them in Zoho Books:

IN THIS PAGE…

Associate Branches to Transactions

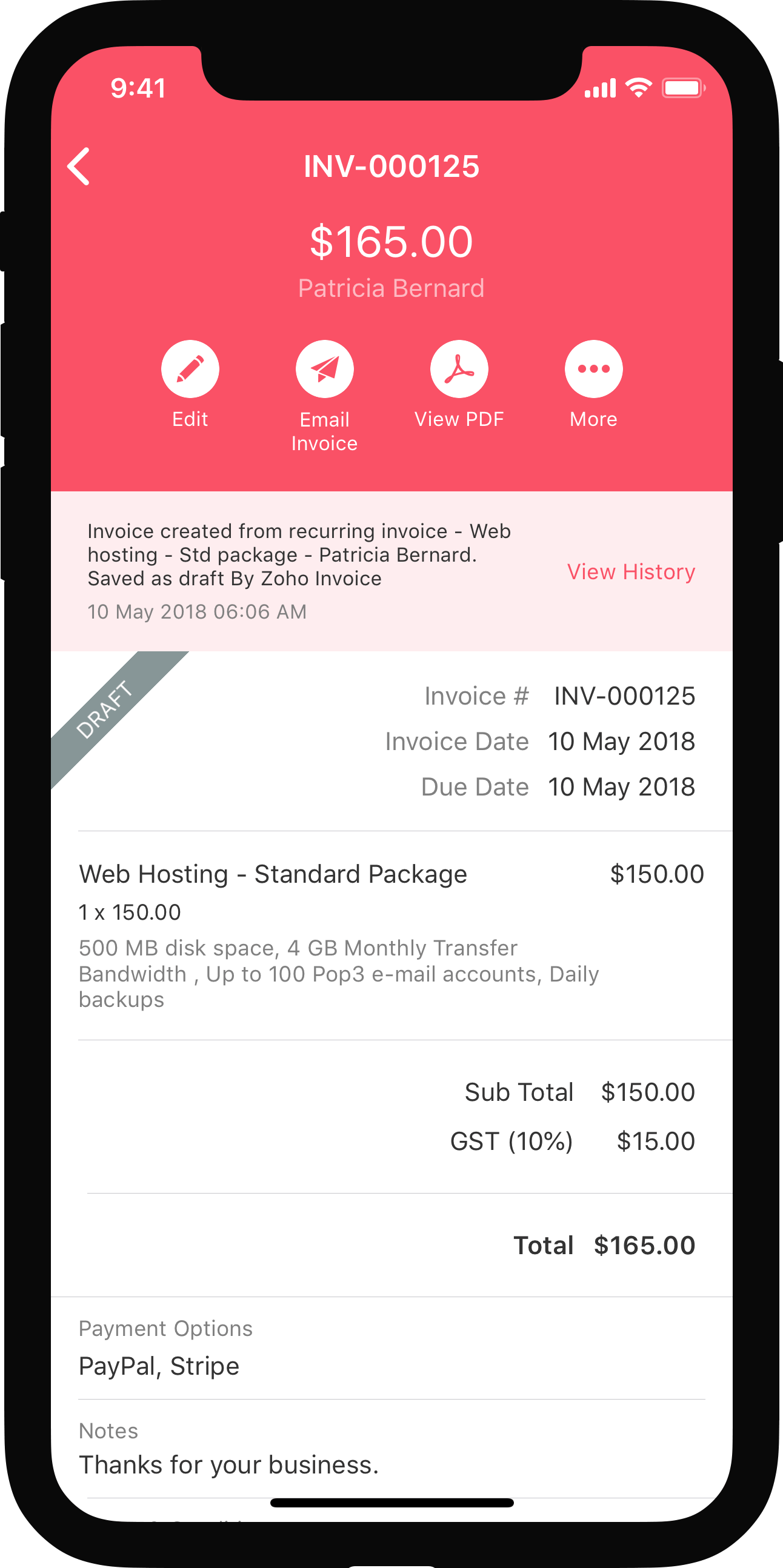

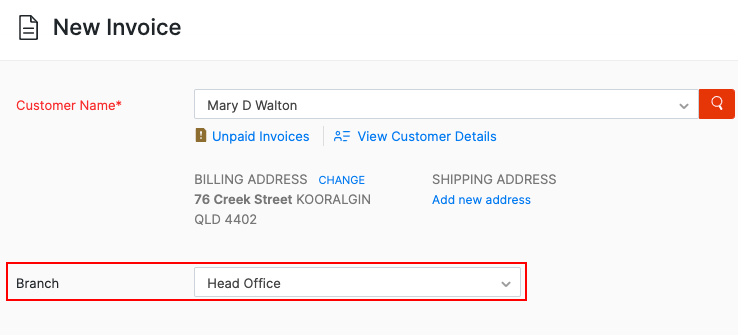

Each time you create a new transaction, you will be able to associate the branch with your transactions. You will be able to associate them with all your sales, purchase transactions, manual journals, bank transactions, and e-Way bills. To associate:

- Go to any transaction module such under Sales, Purchases, e-Way bills or Journals. For example, let’s associate branches to Invoices.

- Click + New in the top-right corner to create an invoice.

- Select the Customer and the Place of Supply.

- Select the Branch for which you’re creating the transaction.

- Based on the branch chosen, the relevant GSTIN and address will be updated in the transaction.

Insight: As the GSTINs are associated with branches, it tracks the transactions and helps generate relevant business and tax related reports.

- Enter other details and click Save.

Similarly, you will be able to create transactions and associate branches for other modules as well.

Pro Tip: If you’ve been maintaining a branch’s transactions separately, you can import them to your organisation along with the branch and map them accordingly

Here are some points to note:

- All the transactions added before enabling the branches feature will be associated to the head office/primary branch.

- By default, all the transactions you create will be tracked under the head office/primary branch. You will have to manually select the branch each time you create a transaction.

- The inter and intra-state taxes will be calculated for each transaction based on the branch chosen.

- The transaction series and address will be chosen according to the branch selected while creating the transaction.

- Payments can be made or collected among the various branches.

- The estimate created for a branch cannot be converted to an invoice for another branch. This applies to other transaction types as well.

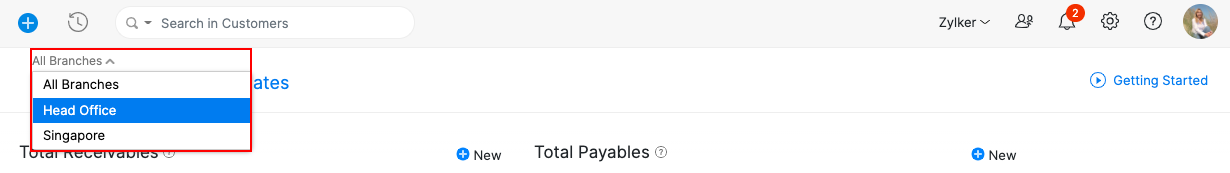

View Dashboard

When you associate branches with transactions, you can get an overview of each branch’s performance right from the dashboard. Here’s how:

- Go to your Zoho Books’ Dashboard.

- Click the All Branches dropdown in the top-left corner.

- Select the branch whose details you need to view.

Generate Reports

If you’ve associated transactions with branches, you will be able to generate reports for a particular branch or for all the branches collectively. This lets you view the profits, sales or the expenses of a particular branch.

Insight: If your Zoho Books organisation is integrated with Zoho Analytics, you will be able to sync the branch details as well and run advanced reports as per your requirements.

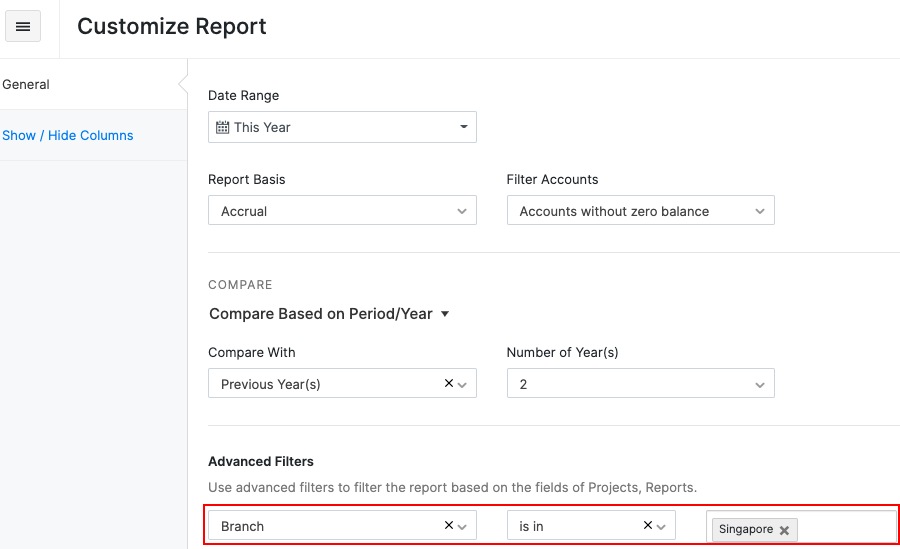

Run Reports for Specific Branches:

- Go to the Reports module in Zoho Books.

- Select a report for which you want to view the details. For example, the Profit and Loss report.

- Click the Customise Report option in the top.

- Go to the General tab and you will be able to find the Advanced Filters option.

- Select the parameter as Branch from the dropdown.

- Set the comparators and choose the branch or branches.

- Click Run Report.

Note: This option is not available for certain reports.

View Branch Details in Reports:

- Go to the Reports module in Zoho Books.

- Select a report for which you want to view the details in the report.

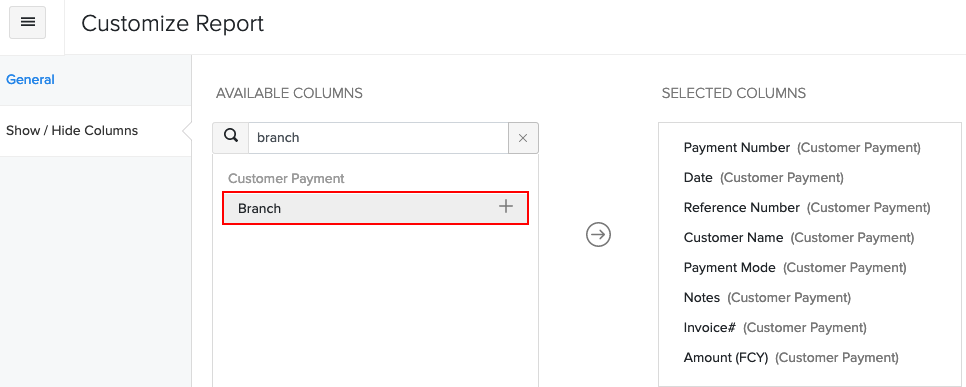

- Click the Customise Report option and go to the Show or Hide Columns tab.

- Select the Branches column and click Run Report.

Generate GST Returns:

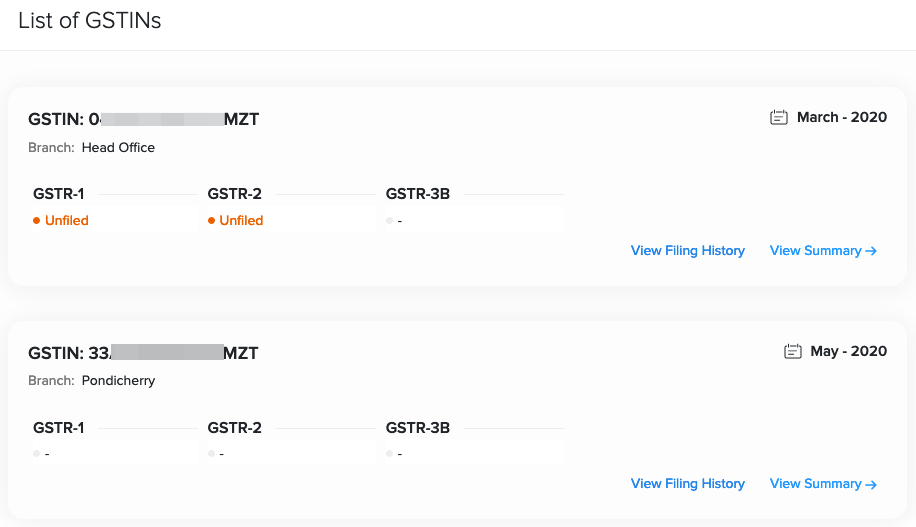

When you have multiple GSTINs, the returns will be generated for each GSTIN separately. A GSTIN dashboard will list all the GSTINs.

In case of GST returns and summaries, a new GST panel with the Branch and GSTIN will be displayed. Click View Summary to view all the returns associated with the GSTIN.

Alternatively, you can also filter the individual tax summaries available in the Reports module.

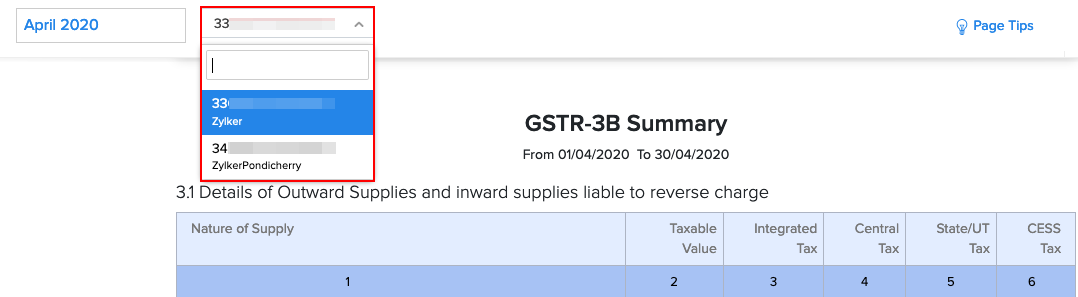

- Go to the Reports module.

- Select the GSTR-3B Summary (or any return) under Taxes.

- Choose the GSTIN from the drop-down to run the report.

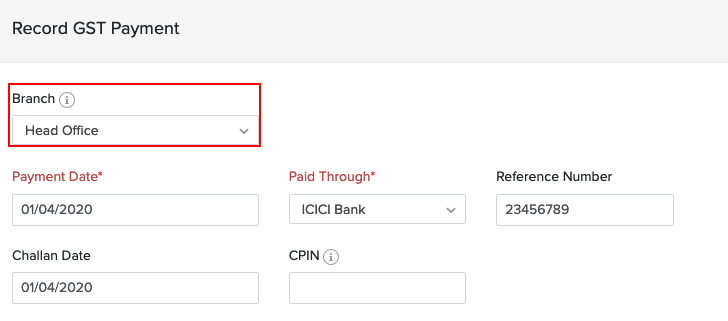

The GST payments you record/make and the returns you mark as filed will also contain your branch details.

Next >

Yes

Yes

Thank you for your feedback!

Thank you for your feedback!