Taxes

Taxes are the mandatory charges imposed on individuals or businesses by the government to fund public services and infrastructure. In India, Goods and Services Tax (GST) is levied on the supply of goods and services. GST compliance is essential for businesses to operate legally, claim input tax credit, issue valid invoices, and avoid penalties. In Zoho Commerce, GST can be configured to create and apply the correct tax rates to your products.

Note: This document is applicable only for the India Edition of Zoho Commerce.

In this help document, you’ll learn how to configure:

GST Settings

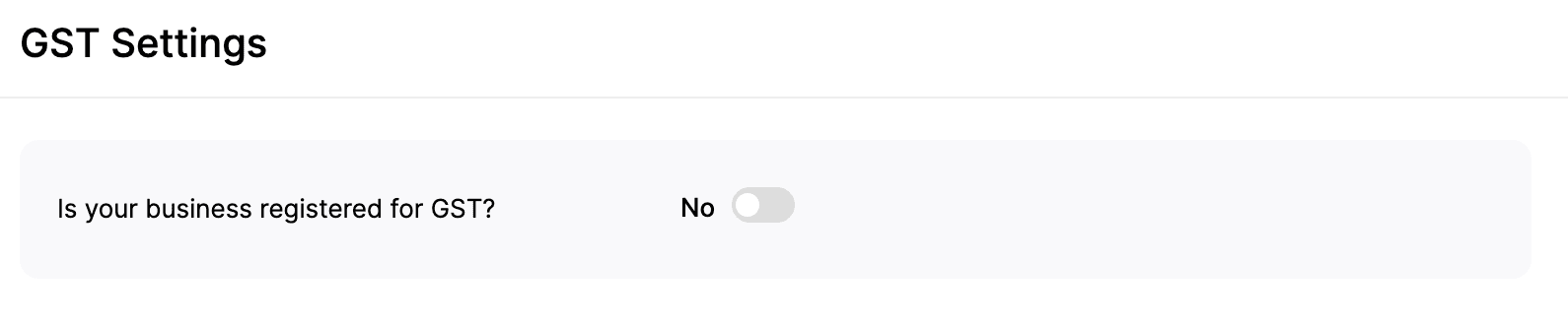

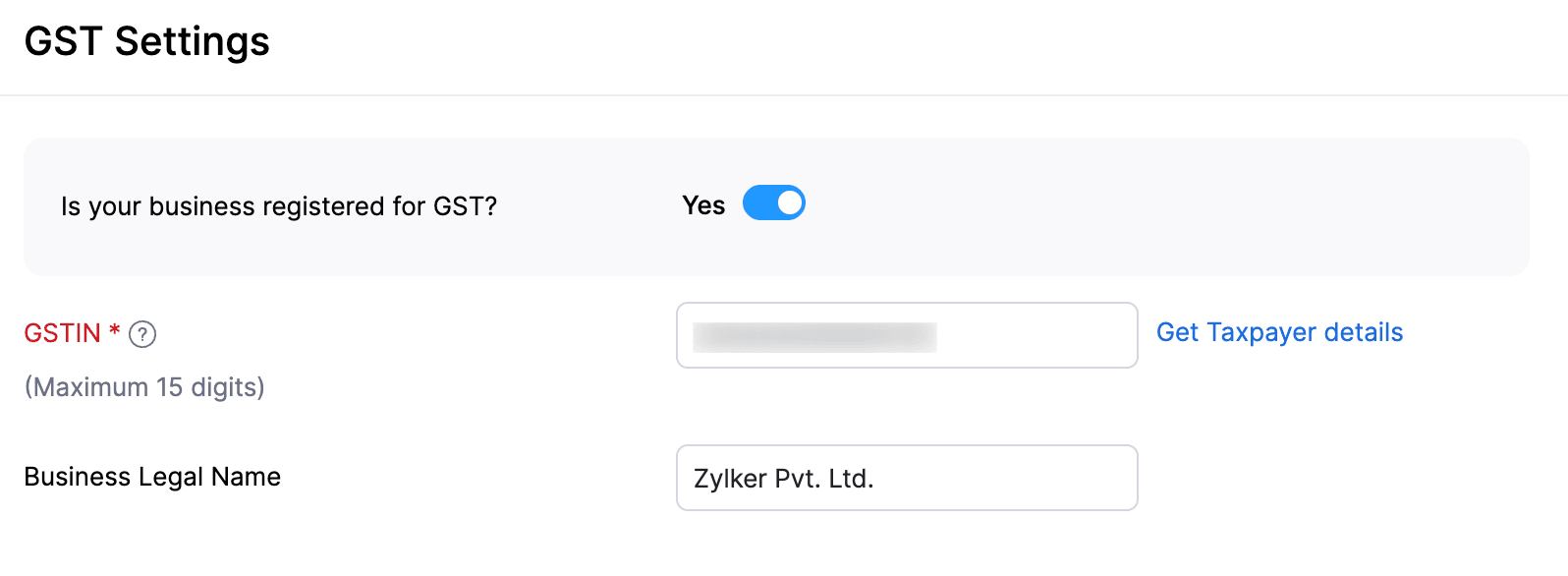

If you haven’t configured GST for your organization during the Quick Setup process, you can set it up anytime from the GST Settings tab. Here’s how:

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select GST Settings.

- Enable Is your business registered for GST?.

- Enter your GSTIN.

- Enter your Business Legal Name.

- Click Save.

Once saved, your business’s GST details will be updated in your Zoho Commerce organization.

Tax Rates

Once you complete configuring GST Settings, the default GST tax rates are auto-populated in the Tax Rates tab. You can perform the following actions in Tax Rates:

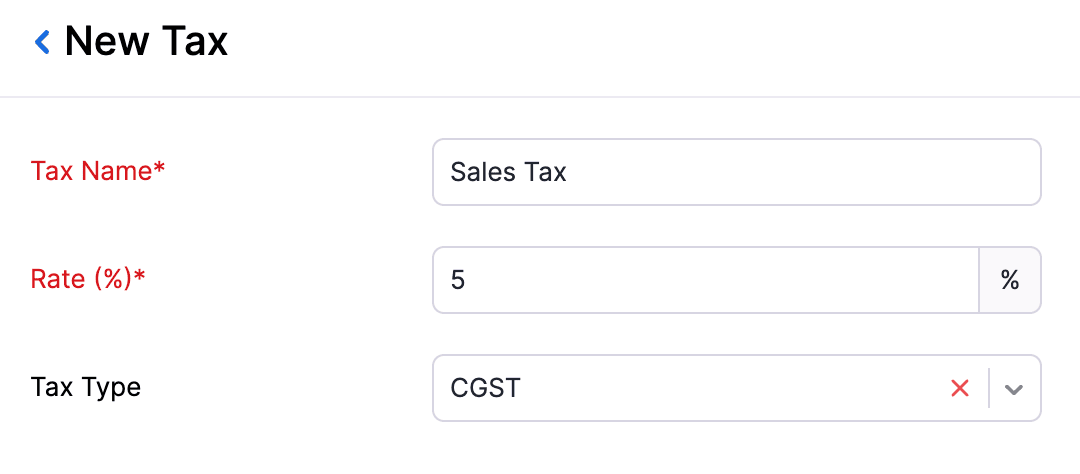

Add a New Tax Rate

To add a new tax rate in Zoho Commerce:

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select Tax Rates.

- Click + New Tax to add a new tax rate.

- Enter atheTax Name.

- Enter the relevant Rate (%).

- Select the relevant GST Tax Type.

- Click Save.

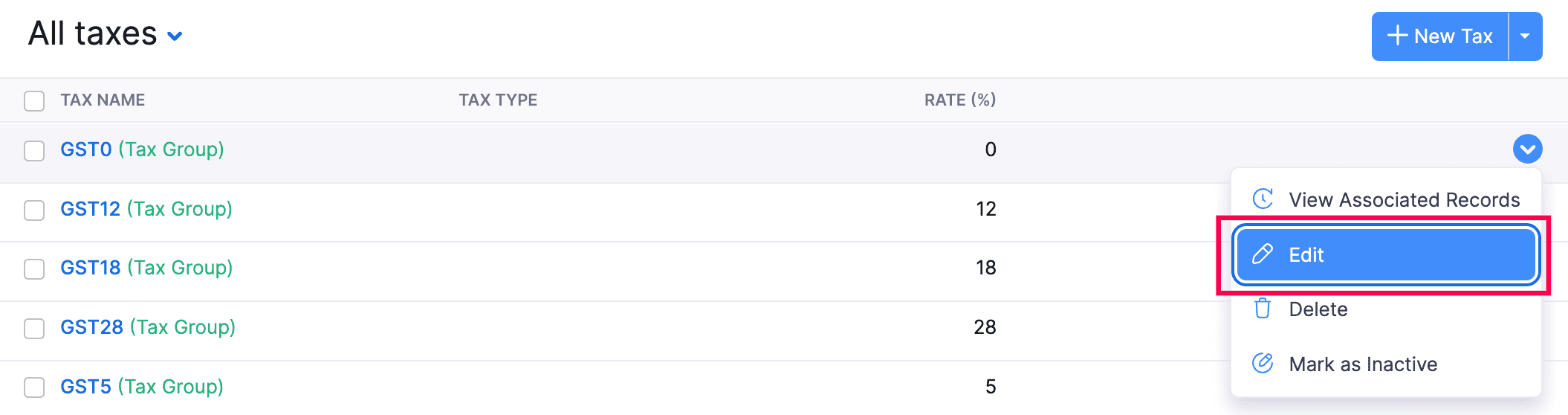

Edit a Tax Rate

To edit a tax rate

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select Tax Rates.

- Hover over the tax you wish to edit.

- Click the dropdown and select Edit.

- On the page that follows, make the necessary changes.

- If the tax you are editing has already been applied in some transactions, you will be prompted to confirm whether you want to update the new tax rate in those transactions as well.

- Click Confirm to proceed if the tax you are editing has already been applied in transactions.

- Click Save.

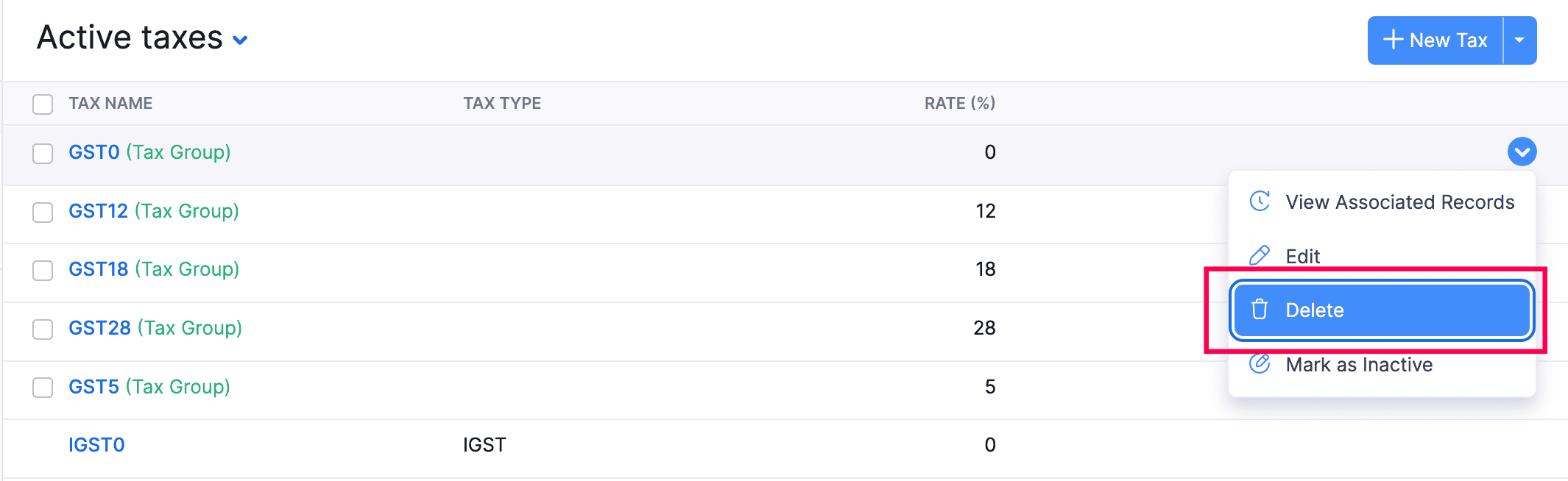

Delete a Tax Rate

To delete a tax rate:

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select Tax Rates.

- Hover over the tax you want to delete.

- Click the dropdown and select Delete.

- Click OK in the pop-up that appears.

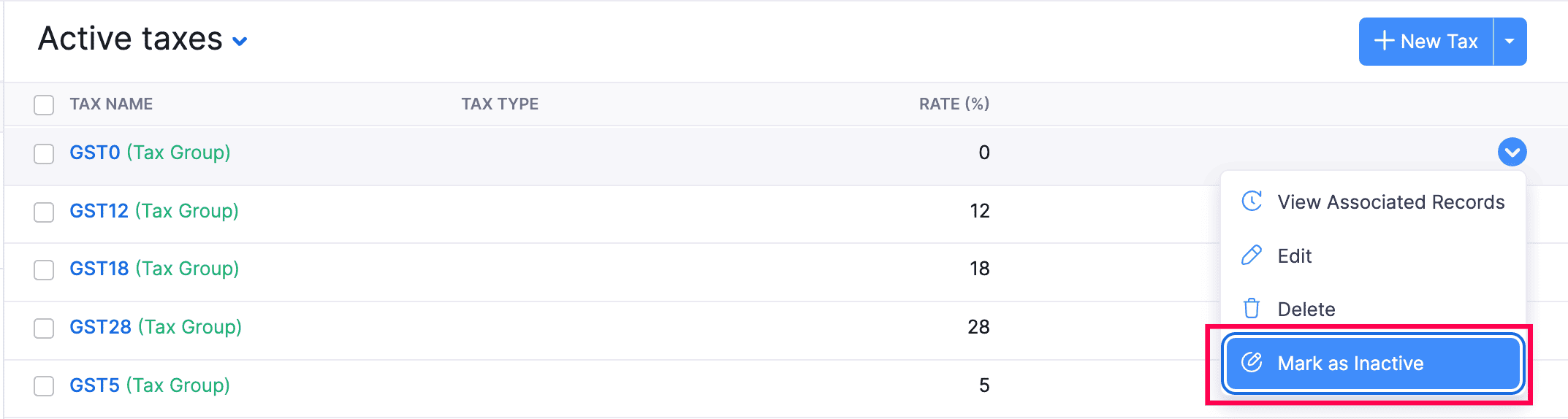

Mark a Tax Rate as Inactive

To mark a tax rate as inactive:

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select Tax Rates.

- Hover over the tax you want to mark as inactive.

- Click the dropdown and select Mark as Inactive.

Once a tax is marked as inactive, it will be excluded from future transactions.

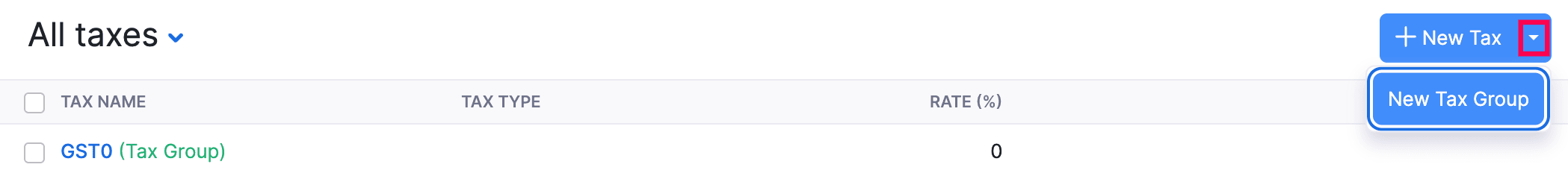

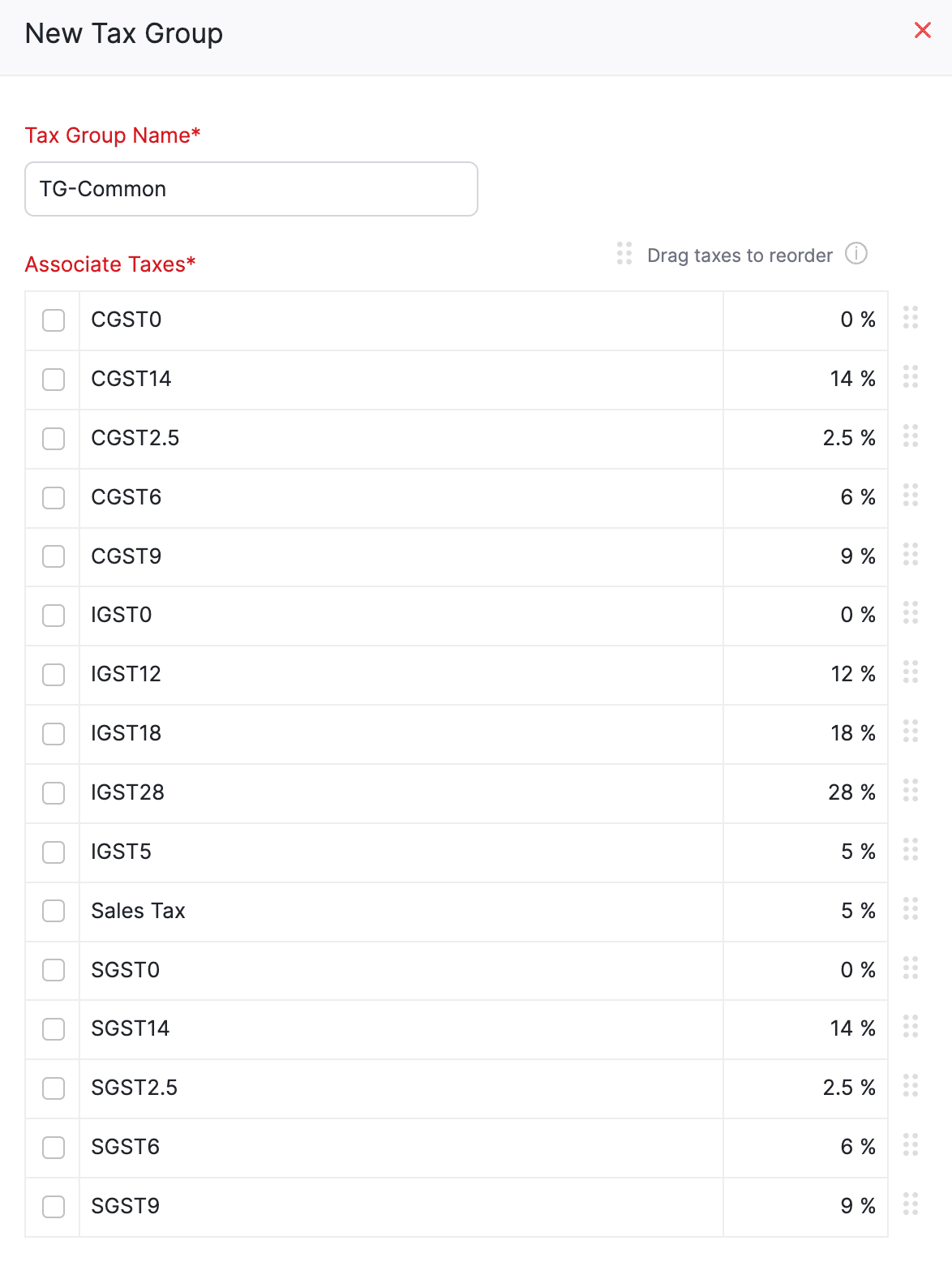

Add a New Tax Group

In India, grouping taxes is essential because of how the GST structure works. Taxes like CGST and SGST must be applied together for sales within the same state. Instead of adding them one by one each time, you can create a Tax Group to combine both, making billing easier and faster.

Scenario: Bailey Miles runs an online electronics store. For intrastate sales, she is required to apply both 9% CGST and 9% SGST. To avoid adding both taxes separately each time, she creates a Tax Group in Zoho Commerce. Now, she can simply select this group during billing, and both taxes are applied automatically.

To add a new tax group:

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select Tax Rates.

- Click the drop-down next to + New Tax in the top right corner.

- Select New Tax Group.

- Provide a Tax Group Name.

- Select the taxes to be clubbed together by clicking on the check box next to the desired taxes.

- Click Save to add a new tax group.

Tax Exemptions

Some goods and services under the GST regime are exempt from tax, and businesses dealing with these items will not be eligible to claim Input Tax Credit (ITC) on their sales. Here’s a list of all the items that are exempt from tax.

Scenario: Patricia Boyle runs an online store where she sells fresh fruits. As fresh fruits are exempt from GST, she doesn’t apply any tax on these items during checkout. Since her products fall under the tax-exempt category, she’s also not eligible to claim Input Tax Credit (ITC) on business expenses accrued on this account.

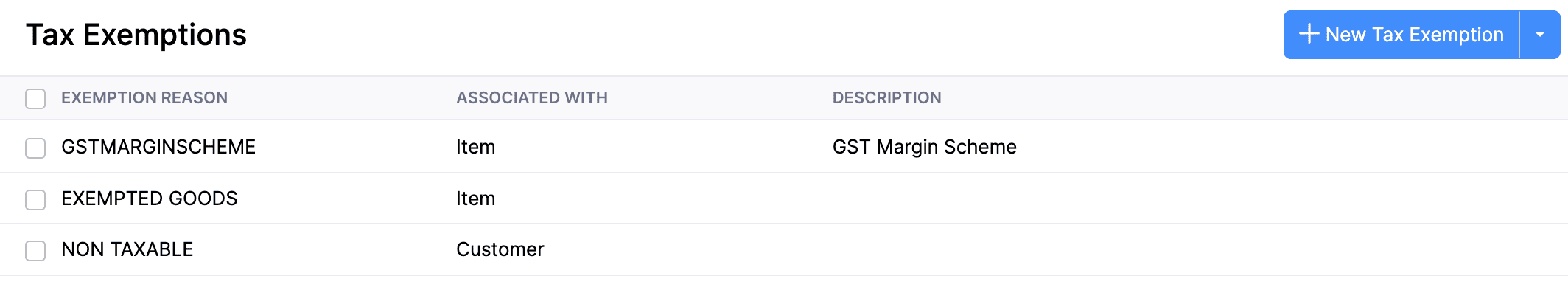

Create Tax Exemptions

You can create tax exemptions in Zoho Commerce to ensure such items are excluded. Here’s how:

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select Tax Exemptions.

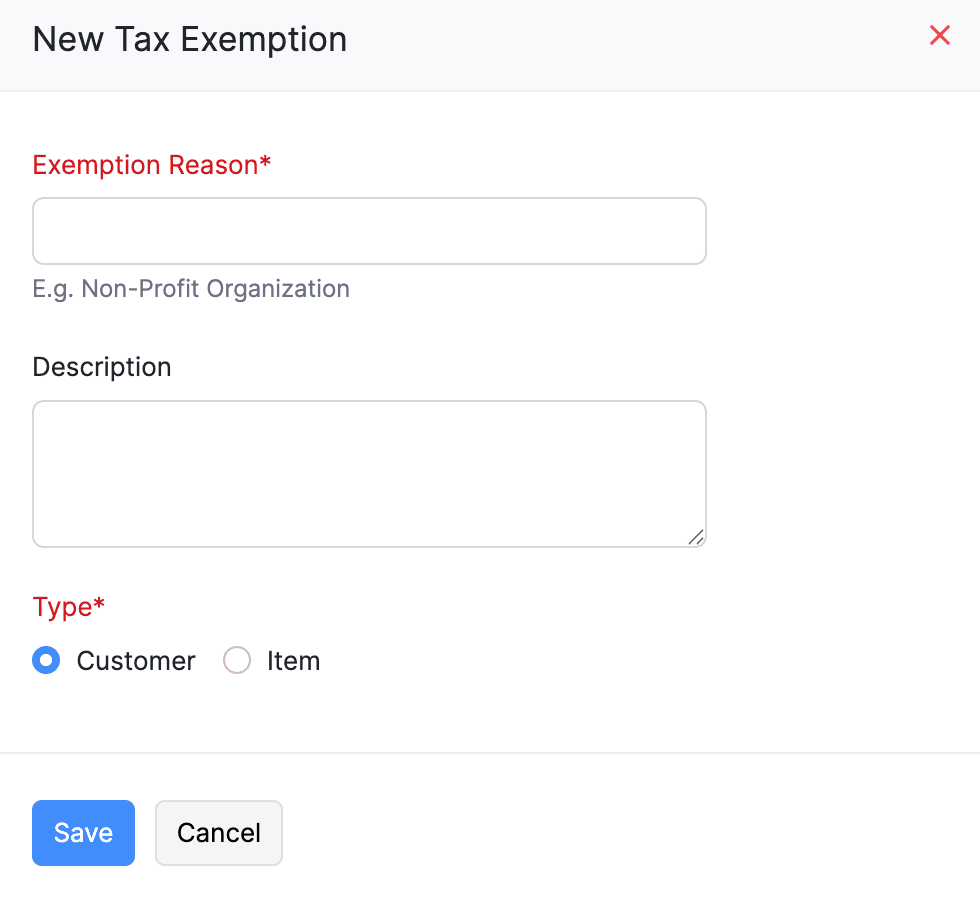

- Click + New Tax Exemption in the top right corner.

- Enter the Exemption Reason, provide a Description, and select the Type.

- Click Save.

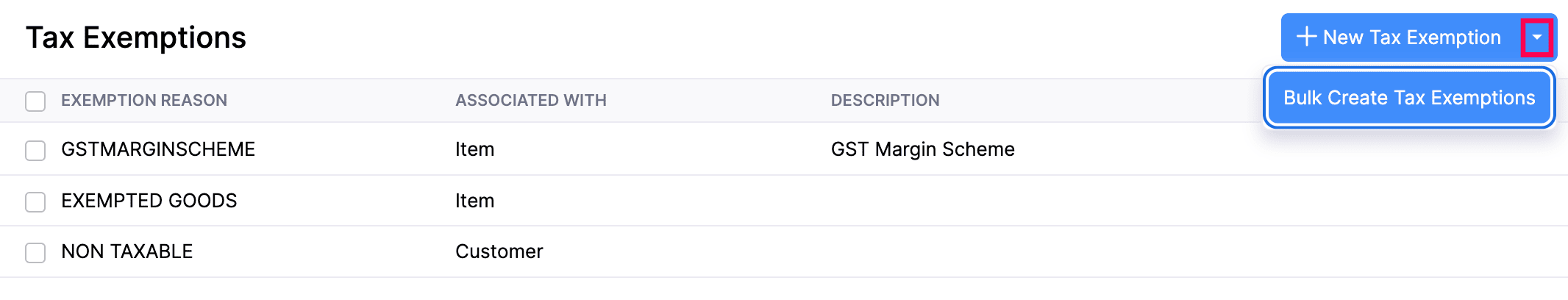

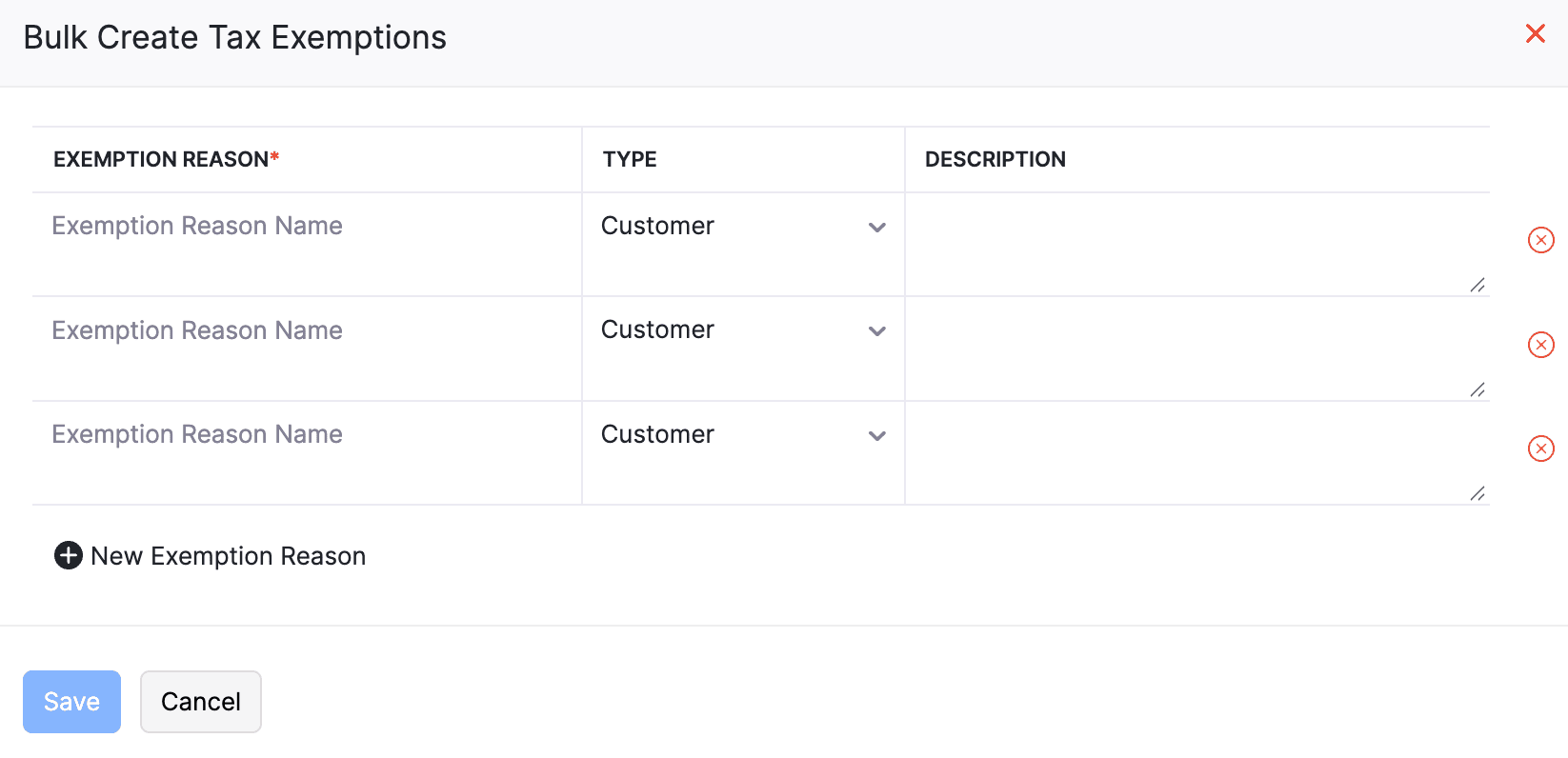

Bulk Create Tax Exemptions

You can also bulk create tax exemptions to simplify the process of creating multiple exemption reasons at once. Here’s how:

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select Tax Exemptions.

- Click the drop-down next to + New Tax Exemption in the top right corner.

- Select Bulk Create Tax Exemptions.

- Enter Exemption Reason, provide a Description, and choose the appropriate Type for each exemption.

- Click Save to add all the tax exemptions at once.

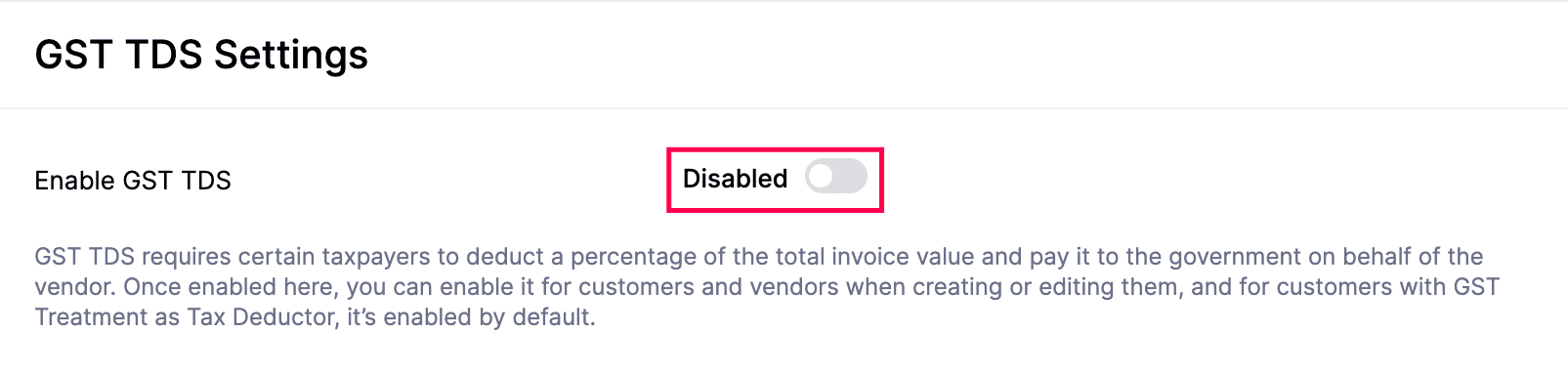

GST TDS Settings

GST TDS (Tax Deducted at Source under Goods and Services Tax) is a provision in Indian GST law where the recipient of goods or services is required to deduct a fixed percentage from the payment made to the supplier and deposit it with the tax authorities. This applies only when the value of supply under a single contract exceeds ₹2.5 lakh. The applicable GST TDS rate is 2%, which is split as:

- 1% CGST + 1% SGST for intra-state transactions

- 2% IGST for inter-state transactions

Scenario: A public sector organization hires a vendor for providing goods valued at ₹2,50,000. According to GST TDS regulations, the organization deducts 2% GST TDS, which amounts to ₹5,000. As a result, the vendor receives a net payment of ₹2,45,000 after TDS.

Enable GST TDS Settings

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select GST TDS Settings.

- Enable GST TDS toggle.

- Select for whom you want to configure withholding VAT in the Enable GST TDS For field. You can choose Customers, Vendors, or both.

- Click Save.

The GST TDS taxes will now be automatically populated in your organization.

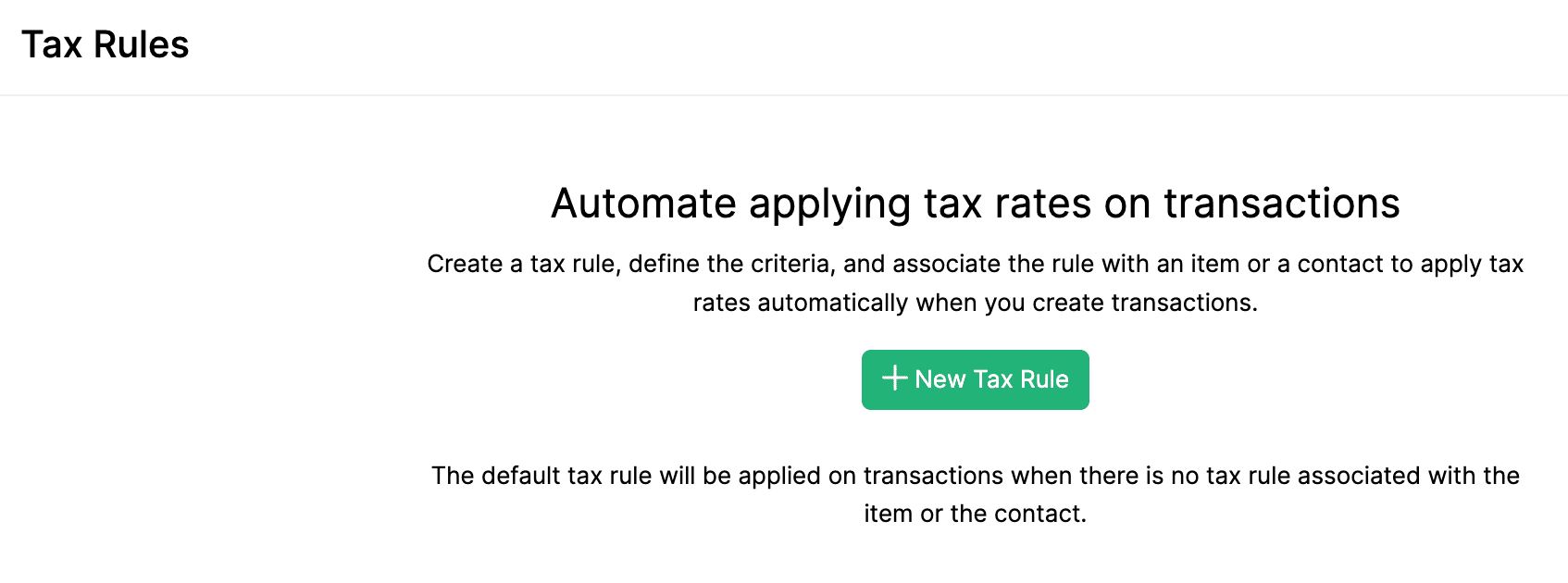

Tax Rules

Tax Rules allows you to automate tax application to transactions by defining specific criteria. In Zoho Commerce, you can configure tax rules to apply a standard tax rate across all products sold within a specific country.

Scenario: Brandon Tyler owns a computer store and wants to apply a standard 18% tax rate to all computer parts and peripherals sold across India. Instead of manually entering the tax rate for each transaction, he creates a Tax Rule in Zoho Commerce. This rule automatically applies the 18% GST to every applicable transaction.

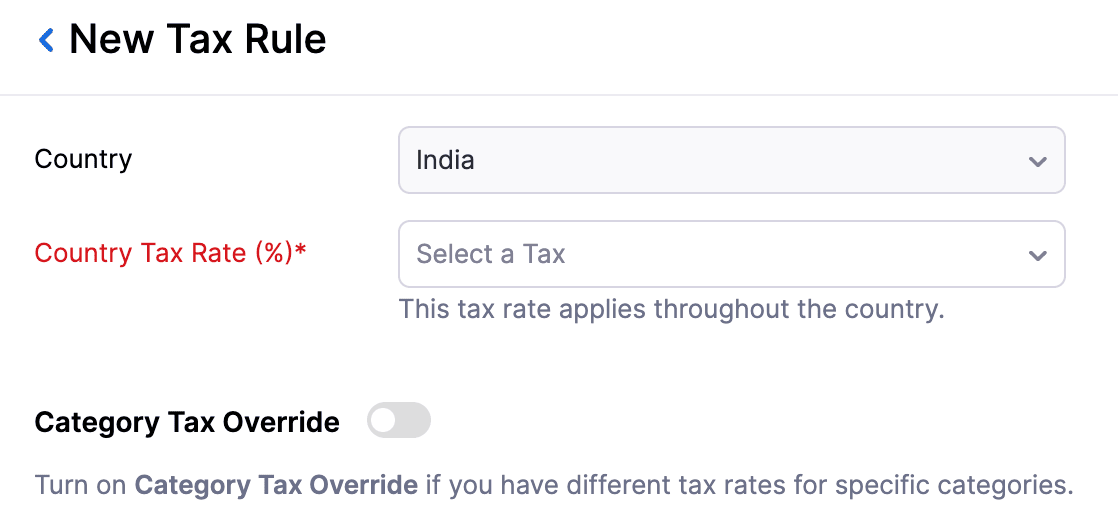

Add a Tax Rule

To add a tax rule:

- Log in to your Zoho Commerce organization.

- Click Settings in the top right corner.

- Navigate to Taxes under Taxes & Compliance.

- Select Tax Rules.

- Click + New Tax Rule.

- Select the Country where the tax rule will be applied.

- Select the standard Country Tax Rate (%). This is applicable throughout the selected country.

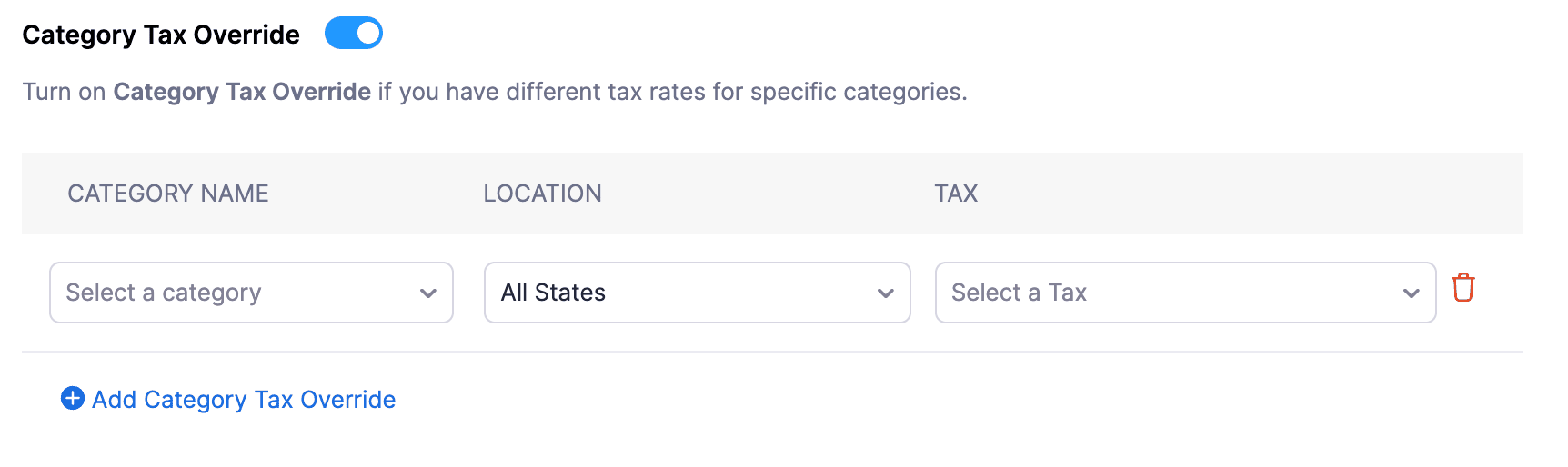

- Enable the Category Tax Override option if certain product categories are subject to different tax rates.

- Select the Category Name for which the custom tax applies.

- Select the Location where this category-specific tax rule should be active.

- Enter the applicable Tax.

- Click Save.

Once saved, the tax rule will be applied automatically for the category and location you have selected.