- HOME

- Category: Taxes & compliance

Discover more

Filter By

Clear filter

Taxes & compliance

Top questions about GST refunds answered: FAQs

Taxes & compliance

GST Payment Categories and Procedures: FAQs

Taxes & compliance

Exemptions under GST in India: FAQs

Taxes & compliance

Get answers to your top questions about GSTR 9: FAQs

Taxes & compliance

Complete details about filing returns under GST in India: FAQs

Taxes & compliance

Value of supply under GST: FAQs

Taxes & compliance

Gain full insights into registration for GST in India: FAQs

Taxes & compliance

Get answers to the most common questions about GST in India

Taxes & compliance

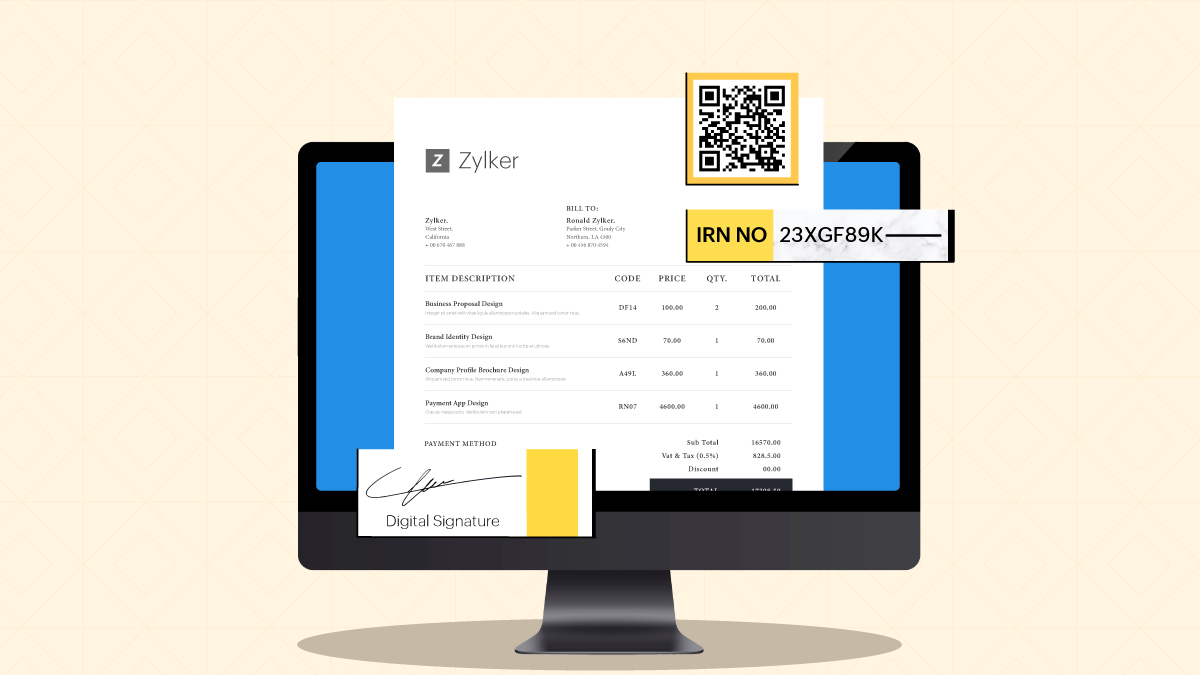

Streamline your transactions with these important e-invoicing features

Taxes & compliance

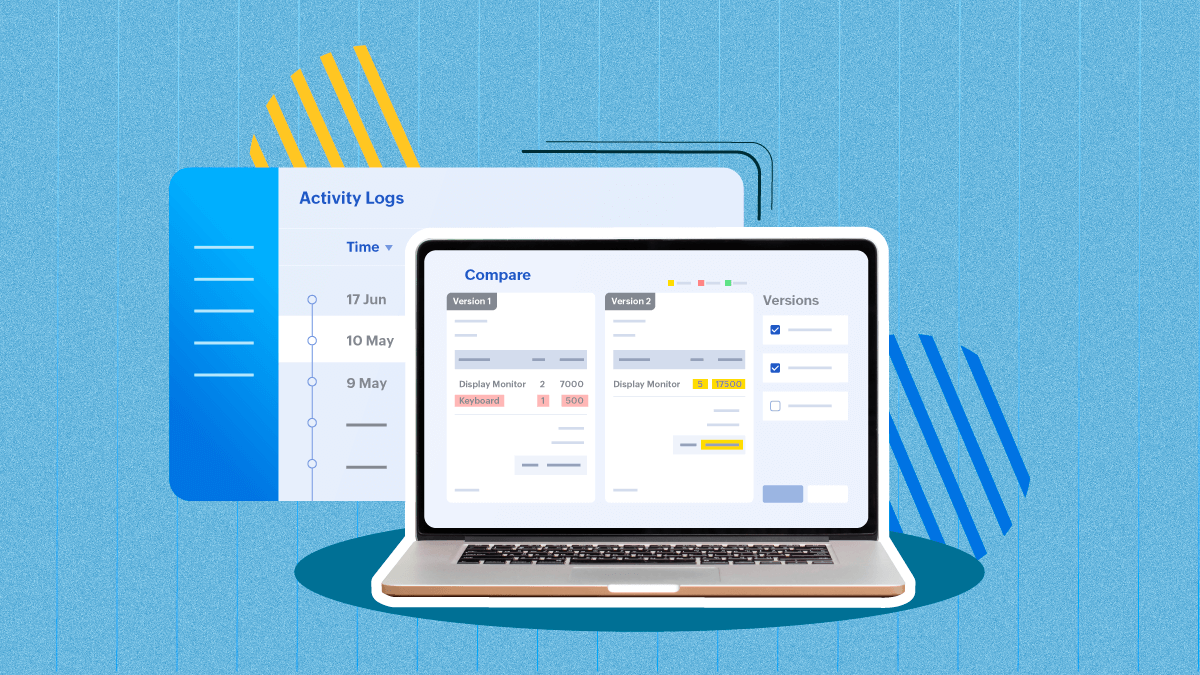

Staying audit ready: how to prepare your business for the audit trail mandate

Taxes & compliance

Basics of Invoice Furnishing Facility (IFF) in GST

Taxes & compliance

E-Invoicing in India Simplified: Understanding the Process and Benefits

Taxes & compliance

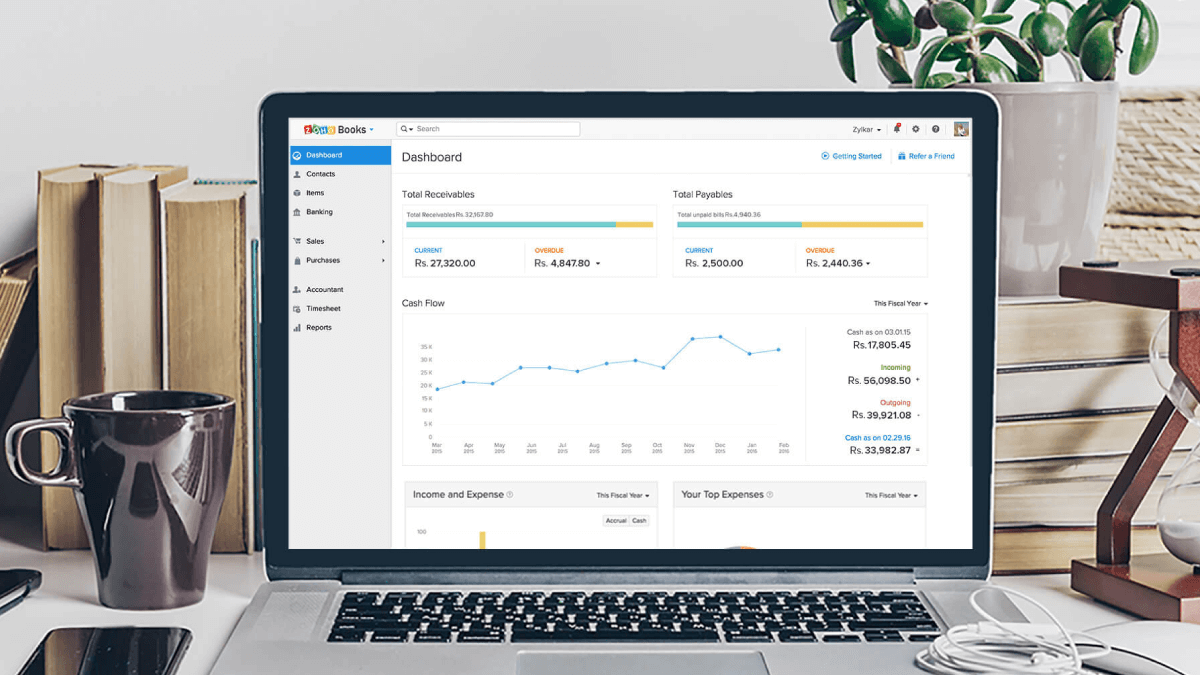

Zoho Books is the best tool for GST compliance, and here's why

Taxes & compliance

Quarterly Return Filing & Monthly Payment of Taxes (QRMP) Scheme under GST

Taxes & compliance

Composition scheme - A way to comply with GST if your business sells goods without invoices

Taxes & compliance