Zoho Books Team

Taxes & compliance

Gain full insights into registration for GST in India: FAQs

Taxes & compliance

Get answers to the most common questions about GST in India

Taxes & compliance

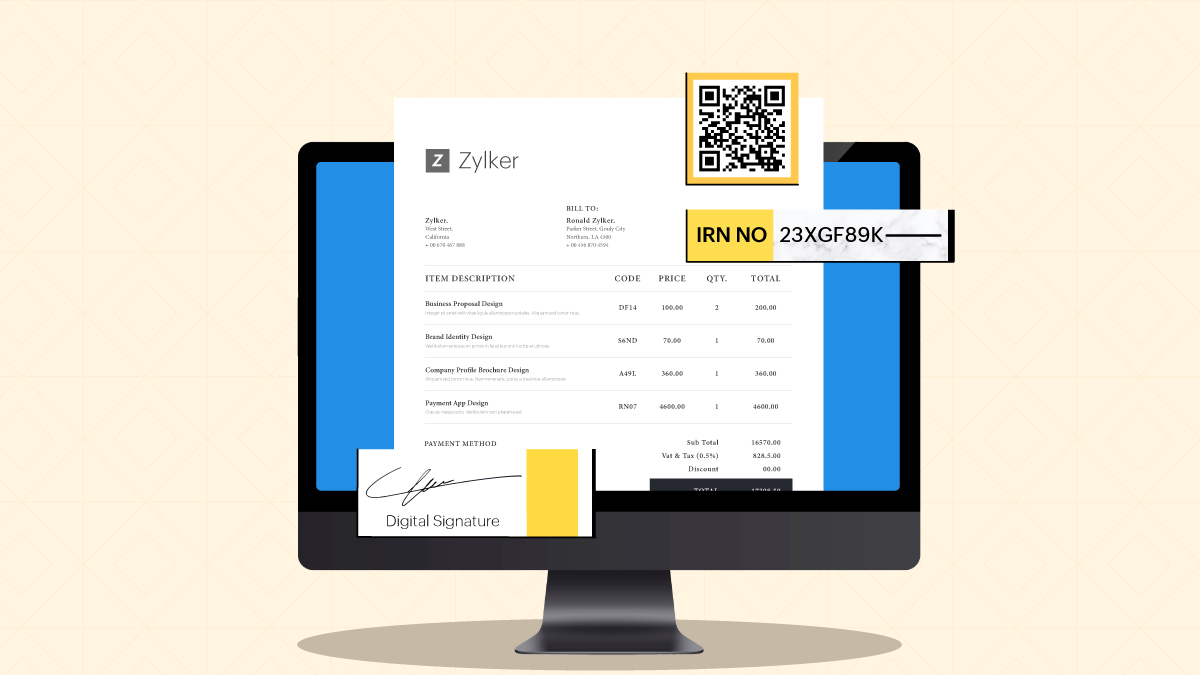

Streamline your transactions with these important e-invoicing features

Taxes & compliance

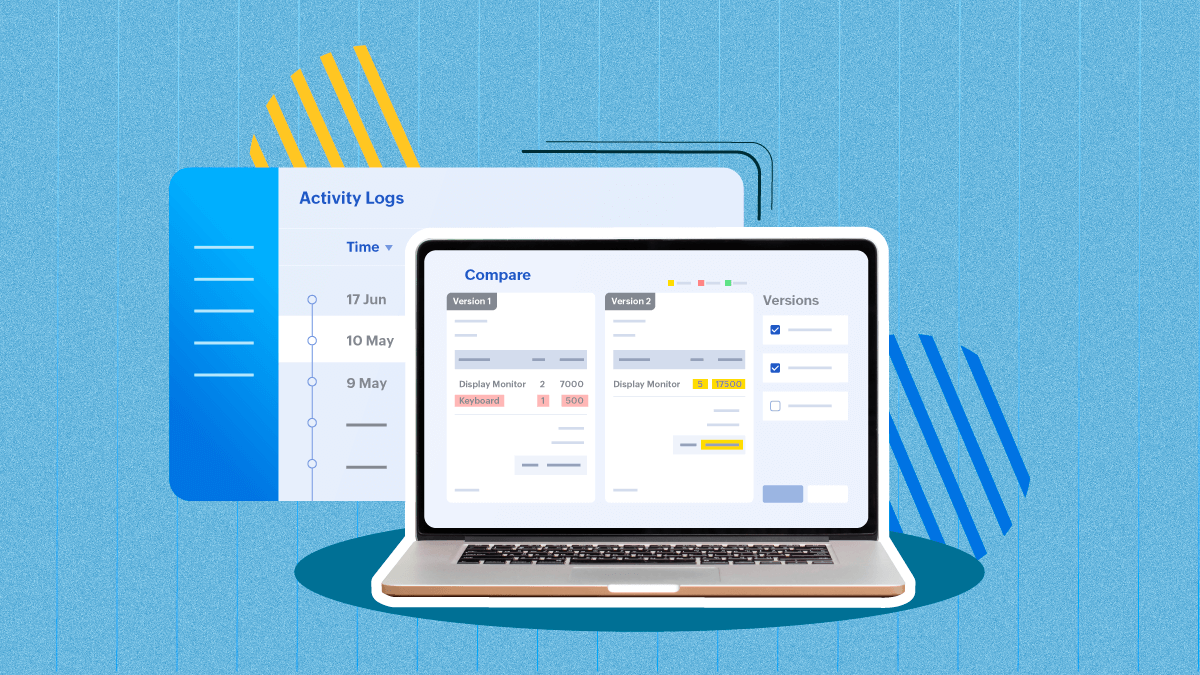

Staying audit ready: how to prepare your business for the audit trail mandate

Taxes & compliance

Basics of Invoice Furnishing Facility (IFF) in GST

Banking & payments

Managing Customer Payments with UPI and Zoho Books

Taxes & compliance

E-Invoicing in India Simplified: Understanding the Process and Benefits

Banking & payments

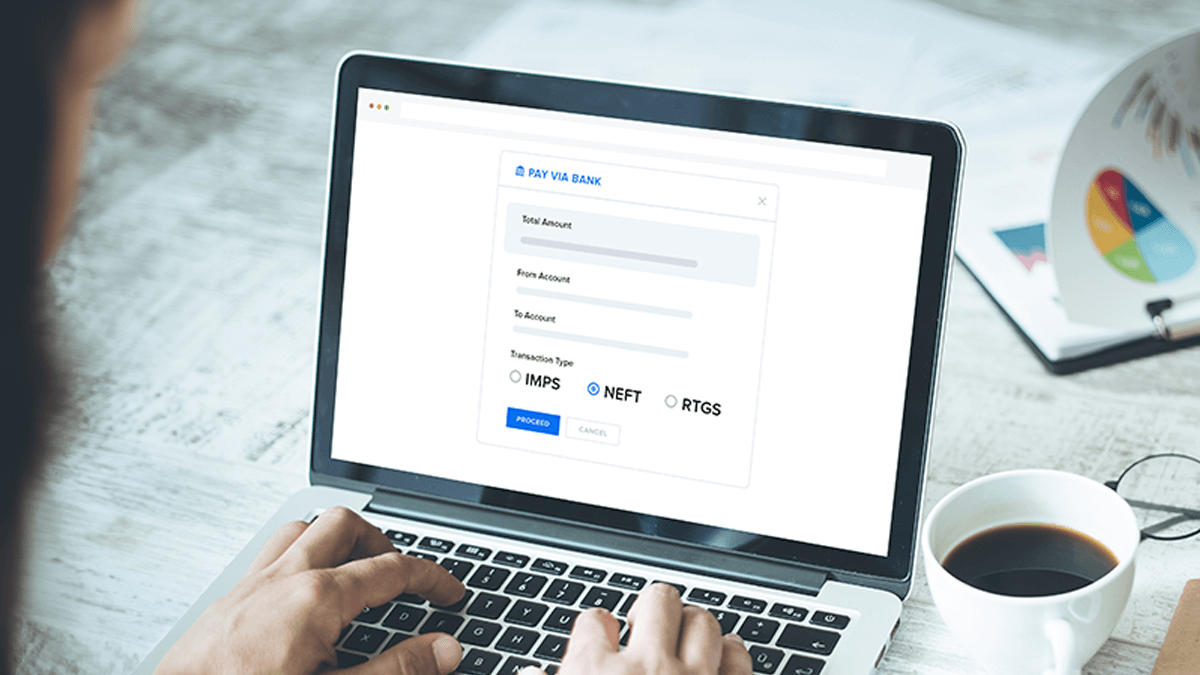

Benefits of making NEFT, RTGS, and IMPS payments with Zoho Books

Taxes & compliance

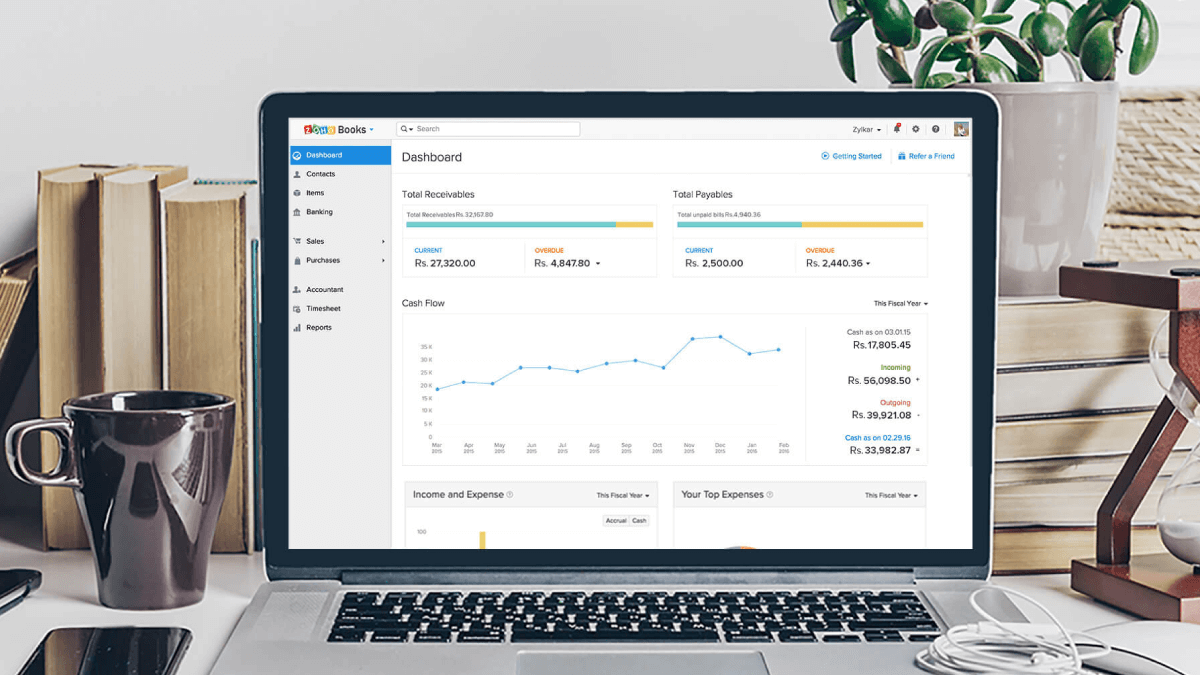

Zoho Books is the best tool for GST compliance, and here's why

Taxes & compliance

Quarterly Return Filing & Monthly Payment of Taxes (QRMP) Scheme under GST

Taxes & compliance

Composition scheme - A way to comply with GST if your business sells goods without invoices

Taxes & compliance

Impact of GST on Ecommerce Operators and Suppliers

Taxes & compliance

Transitional Provisions for CENVAT Credits in GST

Taxes & compliance

How is Goods and Services Tax different from Value Added Tax?

Taxes & compliance

All you need to know about GST terms - Glossary

Taxes & compliance