E-invoicing under GST is a cinch with Zoho Books

The latest announcement from CBIC requires businesses with a turnover of ₹5 crore and above to mandatorily generate e-invoices starting 1 August, 2023. You will need software that will make this transition smoother. Zoho Books is e-invoicing compliant and designed to adapt to GST requirements.

How Zoho Books simplifies e-invoicing

A quick and easy solution

Zoho is a recognized GST Suvidha Provider, which means your invoices can be directly uploaded to the IRP without relying on another GSP.

Smart validation

Zoho Books preemptively validates your data to identify violations, incorrect data entry, and missing mandatory fields.

Recurring e-invoices

Set your e-invoices on recurring mode so you can auto charge your customers, upload it to the IRP, and send them to your customers automatically.

Multiple GSTINs

Get complete visibility on the transactions happening across all your branches with multiple GSTIN support from Zoho Books.

REST APIs

Connect to the IRP and push directly with powerful REST APIs

A unified compliance solution

Compliance is a top priority for any business. Zoho Books ensures that your business stays compliant by acting as a single window of communication with the GST Network.

IRP

With Zoho Books, you can directly upload your invoices to the IRP. All your invoices will then be validated and signed in the portal.

GST portal

The invoice details from the IRP will be synced to the GST portal and the details will be auto populated in GST ANX-1 and GST ANX-2.

Read more about the new GST returnsE-way bill portal

With Zoho Books, all you have to do is register Zoho Corporation as your GSP and start generating e-way bills

Learn more about e-way billsStart e-invoicing with five easy steps

- Register your business in the e-invoice portal. (If you've already connected with e-Way Bill system then you can start uploading e-Invoices directly)

- Create API credentials for GST Suvidha Provider(GSP) for Zoho Corporation

- Enter your portal credentials in Zoho Books

- Upload your invoices to the IRP.

- Get validated,signed e-invoices with IRN

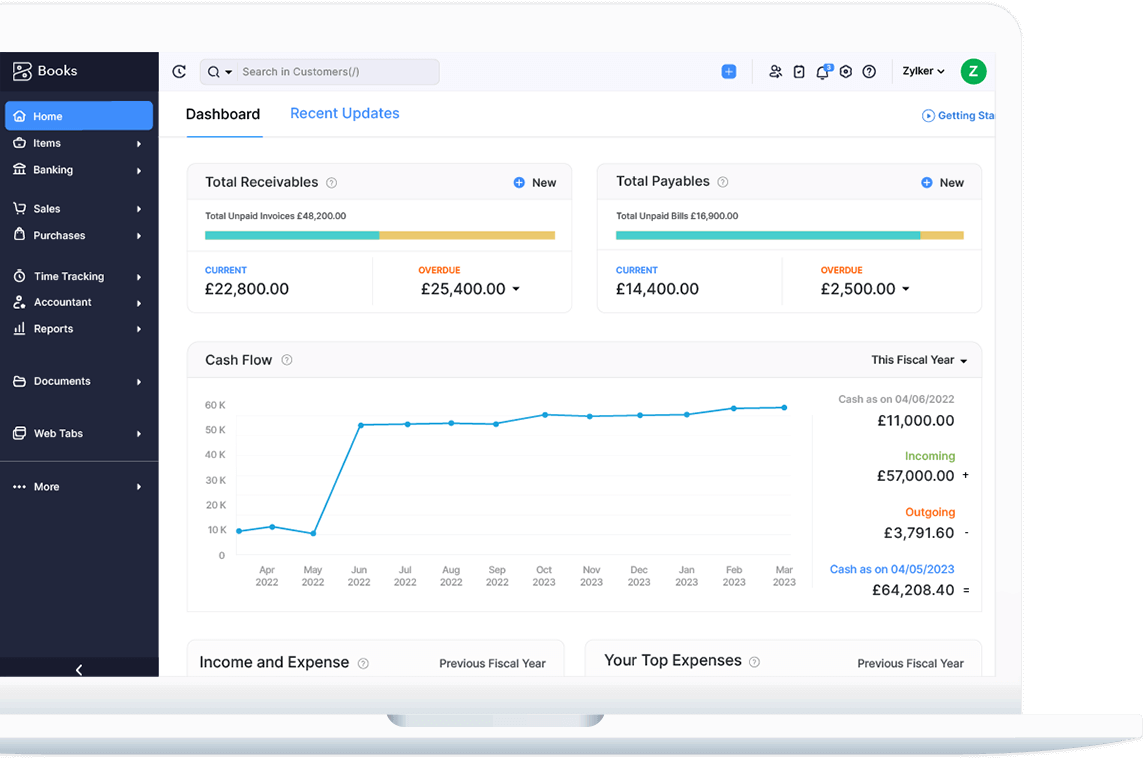

A complete accounting application

Apart from making e-invoicing hassle-free, Zoho Books takes care of core accounting for your business.

- Go from quotes to invoices and payments in a few clicks

- Record expenses, create vendor bills, and stay on top of your payables

- Ensure error-free transactions with transaction approval

- Get automatic bank feeds and reconcile accounts with minimal effort

- Create 70+ financial reports and understand your business finances better

Our resources on e-invoicing

What is e-invoicing?

Guide

E-invoicing workflow in India

INFOGRAPHIC

Why you should use Zoho for e-invoicing?

BLOG

How's e-invoicing system better than the current one?

INFOGRAPHICFrequently Asked Questions

-

When will the new e-invoice mandate be implemented?

Starting 1 August 2023, e-invoicing is mandatory for businesses doing B2B and B2G transactions, whose turnovers are more than ₹5 crore.

-

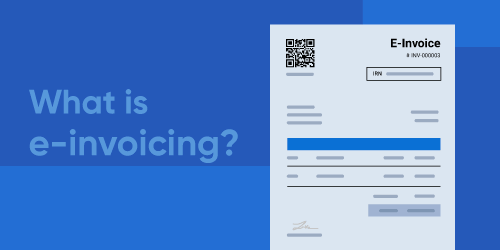

What does an e-invoice look like?

There are two e-invoice templates released by the GST portal. However, you can use any template provided by invoicing software that follows the prescribed e-invoice schema, standard, and format. So you can still customize the templates to reflect your brand, add your logo, choose a colour scheme, and personalize your invoices.

-

How does e-invoicing benefit businesses?

- E-invoicing helps you with data reconciliation and accuracy during manual data entry.

- It allows interoperability across businesses.

- You can track the e-invoices in real-time.

- The e-invoice details will be auto-populated on tax return forms and e-way bills, making the tax return process easy.

- All transaction details will be available online at all times. This would eliminate the need for frequent audits and surveys. Differences in data can be caught by comparing input credit and output tax.

- This initiative will also build efficiency within the tax administration by helping identify fake invoices.

-

What is a GSP?

GSP stands for GST Suvidha Provider. GSPs are government authorized web platforms that help taxpayers comply with the GST laws. It is like a gateway that provides access for ASPs (Application Service Providers) to the GST Portal. The safest way to access the GST portal is through a GSP which is also an ASP authorized by the government.

-

What happens after the e-invoice is uploaded to the IRP?

Based on the latest updates on the proposed system, the IRP will be validating and digitally signing the e-invoice. It will then generate a unique Invoice Reference Number (IRN) and a QR code before returning the e-invoice to the creator.

-

Can a taxpayer sign an e-invoice?

Yes, the e-invoice schema has a field for accepting digital signature. So, if a signed e-invoice is sent to the Invoice Registration Portal (IRP), it will be accepted.

-

Is e-invoicing available in all plans of Zoho Books?

E-invoicing is available in all the paid plans of Zoho Books, starting from the Standard plan.