What is a credit note?

When the cost of goods or services supplied (or the tax amount levied on them) that is furnished in a tax invoice is higher than the actual chargeable rate, the supplier issues a credit note to the recipient. The credit note allows the supplier to credit the corresponding amount to the client’s account. For example, this could be done for a return of goods, where the value of the goods is credited back to the customer’s account.

When is a credit note issued under GST?

A credit note is issued when:

- The taxable value declared by the supplier in the tax invoice is more than the actual taxable value of the goods or services supplied. For example, if a product originally priced at Rs. 100 is incorrectly invoiced at Rs. 150, then a credit note of Rs. 50 will be issued by the vendor.

- The tax rate furnished in the tax invoice is more than the actual tax rate levied on the supply. For example, if a product categorised under the 12% GST slab is invoiced at 18%, then a credit note should be issued.

- The quantity of the supply received by the customer is less than the quantity declared in the tax invoice.

- The goods or services supplied are of inferior quality or are found unsatisfactory by the recipient, leading to a partial or complete reimbursement.

- The recipient returns the goods or services to the supplier.

- A registered person may issue a consolidated credit note for multiple invoices issued in throughout a financial year.

Note: When a credit note is issued, it must be accompanied by a supplementary invoice. A supplementary invoice is issued whenever there are errors in the original tax invoice.

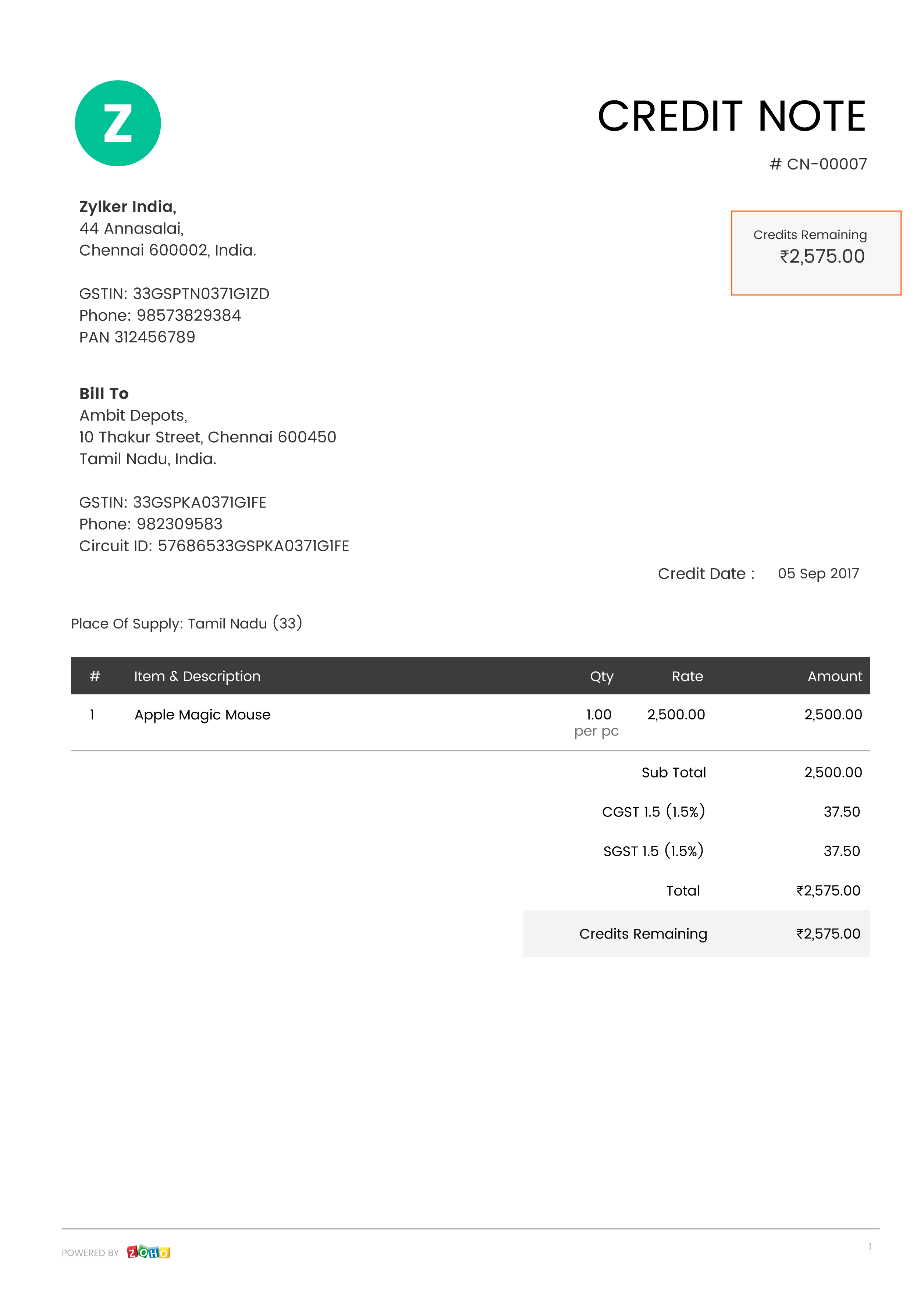

Format of a credit note in GST

Based on the rules prescribed by the Government, here is what a sample credit note will contain under the GST regime:

- The words Revised Invoice should appear if applicable.

- Name, address, and GSTIN of the supplier.

- Nature of the document (Credit note, in this case), unique serial number (containing only letters and/or numbers), and date of issue.

- Name and address of the recipient. If the recipient is registered for GST, the note must include their GSTIN/UIN.

- The customer’s state and state code, if they are not registered under GST.

- Serial number and date of the corresponding tax invoice or bill of supply (whichever one was originally issued).

- Value of the taxable goods and services involved in the sales transaction.

- Tax rate and the amount of tax to be debited to the recipient.

- Signature or digital signature of the authorised supplier.

Tax liability

The tax liability of the supplier is reduced if the credit note matches with the following:

- the recipient’s tax return that has the corresponding reduction in the claim for input tax credit for the same tax period or any tax period that follows

- duplication of claims for reduction in output tax liability

When the supplier’s claim for reduction in output tax liability matches with the corresponding reduction in the claim for input tax credit made by the recipient, the government will accept the claim and inform the supplier.

The supplier cannot claim reduction in tax liability with credit notes, if the tax and interest applied on the transactions have been transferred to another person.

Procedure

When the supplier files their returns for the month, they should mention details of any credit notes issued during the month. Their tax liability will be adjusted accordingly. It should be noted that the supplier will not be allowed reduction in output tax liability for a transaction, if the tax and interest of that transaction is passed on to another registered person.

Time limit

The supplier should declare the details of the credit note in their tax returns for the month in which the credit note was issued.

The credit note details should be furnished either by the September following the financial year in which the sales transaction occurred, or by the date of filing of the relevant GSTR-9 annual return, whichever is earlier.

Maintaining records

All information and records related to a credit note must be preserved and accessible both physically and digitally until their expiry, which is 72 months from the date of providing the relevant annual returns.