What is a Tax Invoice?

A Tax Invoice is a list of goods or services that must be issued for every taxable supply, containing the item or service descriptions, quantities, date of shipment, mode of transport, prices and discounts, if any. It also includes the total value and the tax charged on the supply.

Why is a Tax Invoice required?

A Tax Invoice is required to provide confirmation or evidence that a supply of goods or services took place. It is also necessary so that the recipient is eligible to claim ITC.

When is a tax invoice issued?

A Tax Invoice is issued by a registered dealer before or during the supply of taxable goods or services. It is mandatory for claiming input tax credit.

Number of tax invoice copies to be issued

For the supply of goods, the following copies are required:

- The original invoice is issued to the recipient, and is marked as “Original for recipient”.

- A duplicate copy is issued to the transporter of goods, and is marked as “Duplicate for transporter”. This duplicate needs to be shown by the transporters whenever they’re asked for evidence, unless the supplier has obtained an invoice reference number. (The supplier can obtain an invoice reference number by uploading their tax invoice in the GST portal. It is valid for 30 days from the date of upload.)

- A triplicate copy is retained by the supplier for their own use, and is marked as ‘Triplicate for supplier’.

For the supply of services, the following copies are required:

- The original invoice is issued to the recipient, and is marked as ‘Original for recipient’.

- A duplicate copy is retained by the supplier for their own use, and is marked as ‘Duplicate for supplier’.

Time limit for issuing tax invoices

Supply of goods

If the supply involves the transfer of finished goods from one place to another, then the invoice must be issued at or before the time of transfer. So if a dealer is purchasing pens from a supplier, the supplier needs to issue an invoice at or before the time the pens leave the warehouse. If the supply does not involve the transfer of finished goods, the supplier can issue the invoice when the goods are delivered to the recipient. If a dealer is purchasing a custom partition wall for his/her office that will be completely assembled on-site, the invoice must be issued at the time the completed wall is made available at the recipient’s office.

Supply of services

In most cases, the tax invoice must be issued within 30 days from the date of supply. If the supplier is a bank or an insurer, then the invoice must be issued within 45 days from the date of supply.

Format of tax invoice

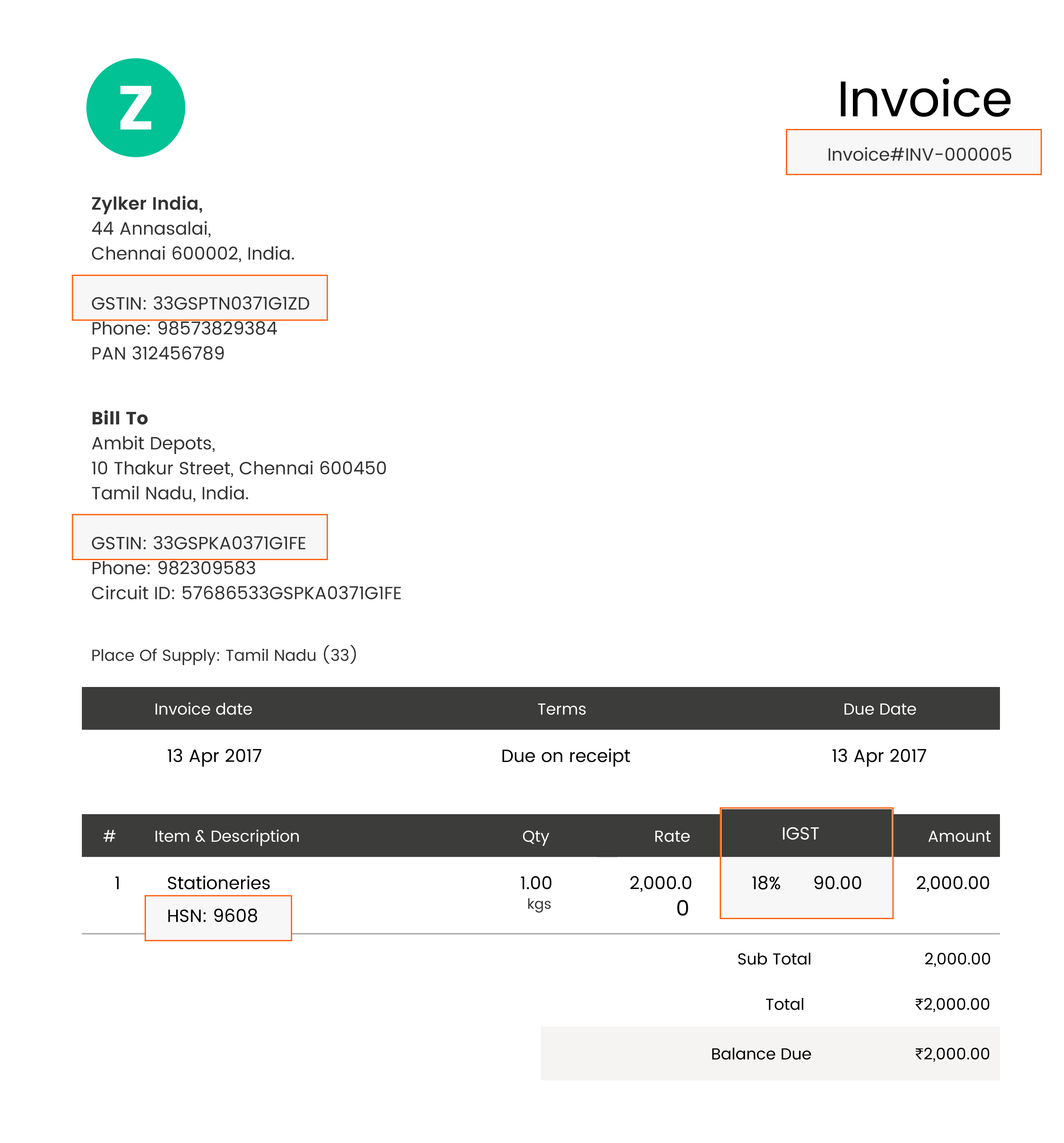

Based on the rules prescribed by the Government, here is what a sample tax invoice will look like in the GST regime:

- Invoice type: This indicates if the issued document is a tax invoice, debit note, credit note, or revised invoice.

- Name, address and GSTIN of the supplier and the recipient

- Invoice serial number: This unique invoice serial number must be part of a consecutive series, and it should contain only letters, numerals and/or the special characters - and /.

- Date of issue

- Name and address of the recipient, along with destination address, state and state code if recipient is un-registered, and value of supply if more than Rs. 50,000.

- Destination state as well as address of delivery if they are different

- HSN or SAC code: If you’re supplying goods, you must include the HSN code unless your annual turnover is less than Rs. 1.5 crores. If you’re supplying services, you must include the SAC code.

- UIN: This ID is assigned to agencies of the United Nations, and consulates or embassies of foreign countries.

- Description and quantity of goods or services

- Total value and taxable value of goods, services or both

- The CGST, SGST, and IGST tax rates and corresponding tax amounts in separate columns

- Reverse charge statement: The invoice must state whether reverse charge is applicable to the transaction or not.

- Signature: The invoice should be signed by an authorised personnel in either physical or digital form.

Revising an already-issued tax invoice

Once an invoice is issued, it cannot be modified. If there are changes to be made in the taxable value or amount of the product, one of the following is to be issued:

- Supplementary invoice/Debit note - If there is an increase in the price of an already supplied item, then the supplier needs to issue a debit note to the recipient. The debit note needs to be issued within 30 days of making such a price revision.

- Credit note - Similarly, if there is a decrease in the price, the supplier must issue a credit note needs to the recipient. The credit note must be issued on or before 30th September of the next financial year, or before the filing of the annual GST return, whichever is earlier.

The format of these documents is exactly the same as that of a tax invoice. The only difference is that it needs to be explicitly specified at the top whether the document is an invoice, a debit note, or a credit note.

Revised Invoice

Invoices that are issued after the date GST came into effect, but before the date that the certificate of registration was issued, require a revised invoice. This is to be issued within one month after the date of the certificate of registration.

Contents of tax invoices for special cases

When the supplier is an office under a banking company, or a financial company:

- The name, address and GSTIN of the Input Service Distributor and recipient.

- A unique serial number formed by using alphabets, numbers and the special characters - and /.

- Date of issue

- The total amount of credit forwarded

- Physical or digital signature of the Input Service Distributor

When the supplier is an insurer, banking company, financial institution or non-banking financial company, or passenger transporter:

The tax invoice must contain all information mentioned in a general tax invoice, and

- May or may not contain a serial number

- May or may not contain the address of the recipient

When the supplier is a Goods Transporter Agency (GTA):

The invoice must contain all of the contents of a general tax invoice as well as the following details:

- Name of the supplier and receiver

- Registration number of the transporting vehicle

- Details including gross weight of goods

- Starting and destination details

- GSTIN of candidate who is accountable to pay tax