End-to-end tax compliance for limited companies

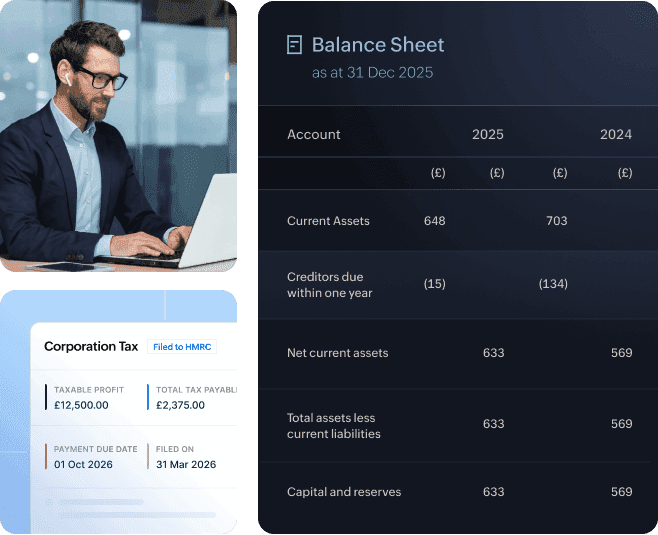

If you are a micro-entity limited company, your search for end-to-end tax compliance ends here. File FRS 105 final accounts reports to Companies House and submit CT600 (Corporation Tax) returns directly to HMRC.

*No credit card required

End of year relief with Zoho Books

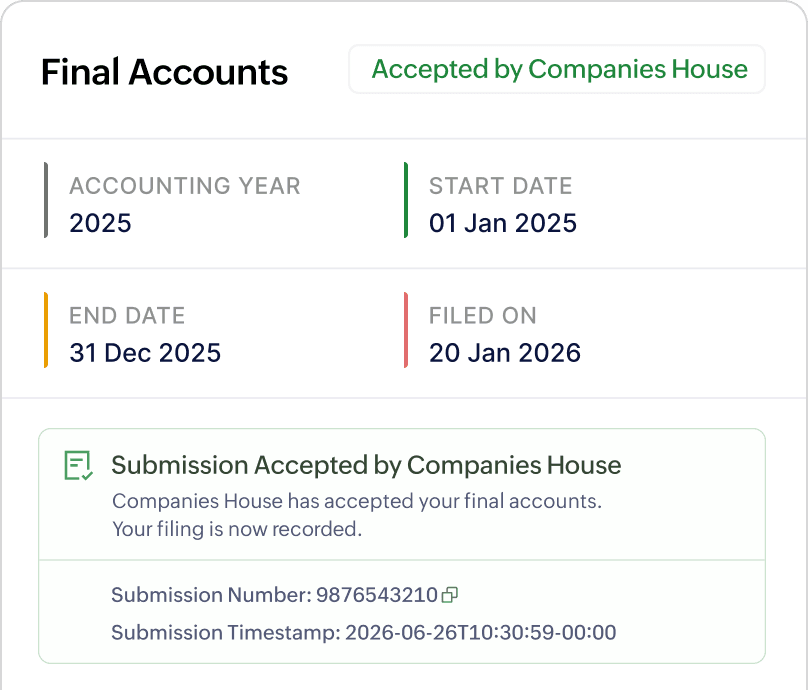

Final Accounts

Generate your Final Accounts report (FRS 105 micro-entity reports) directly from Zoho Books. You may then send the report directly to Companies House.

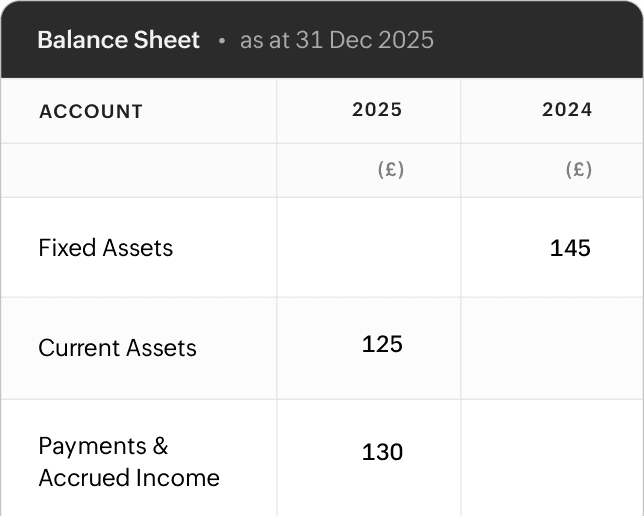

iXBRL Reports

The statutory annual accounts (including the balance sheet and profit & loss statement) and the corporation tax computations can be exported in iXBRL format with Zoho Books.

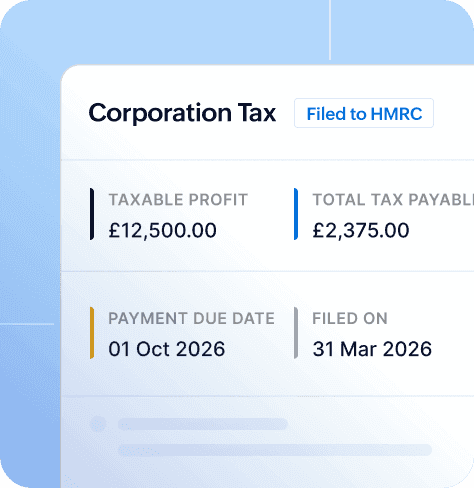

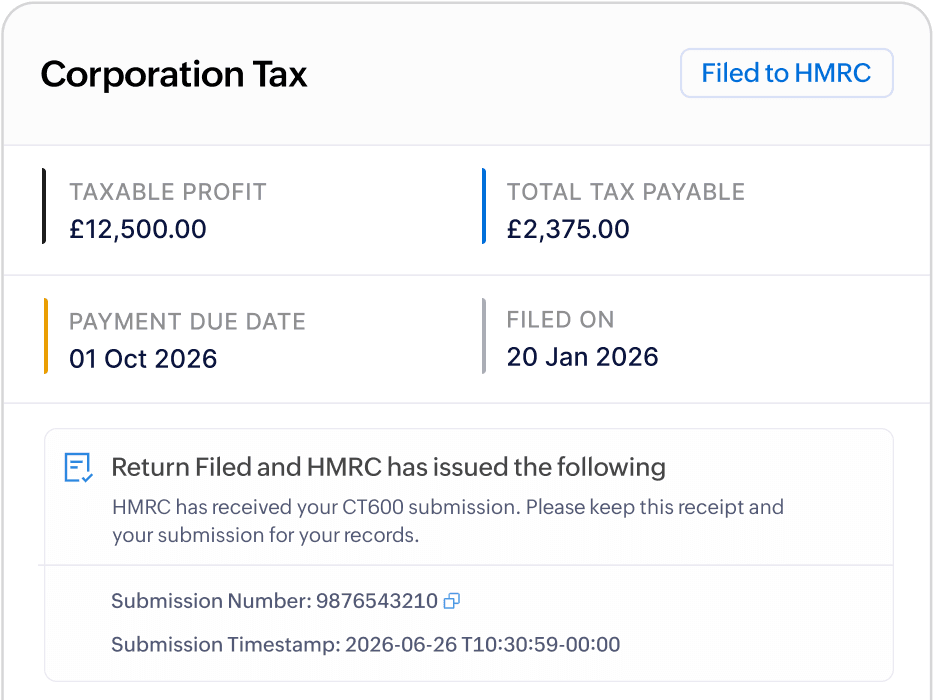

Corporation Tax

Filing Corporation Tax helps your business stay compliant with UK tax laws and avoid penalties. Submit your Corporation Tax (CT600) return to HMRC with details of your income, expenses, profits, and the tax you owe.

Effortless accounting for limited companies

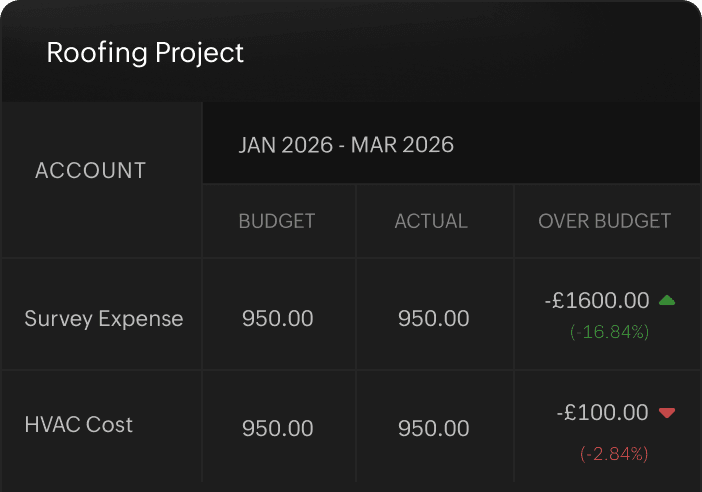

Budget planning

Set budgets for each project, monitor estimated and actual costs in real-time, identify areas of overspending proactively, and manage your expenses better.

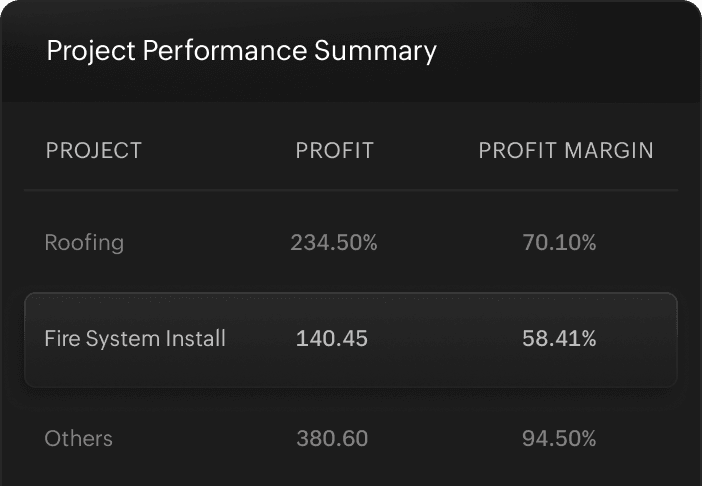

Project profitability

Log billable hours, track project costs, and identify profitable projects for your micro-entity business with Zoho Books to eliminate guesswork.

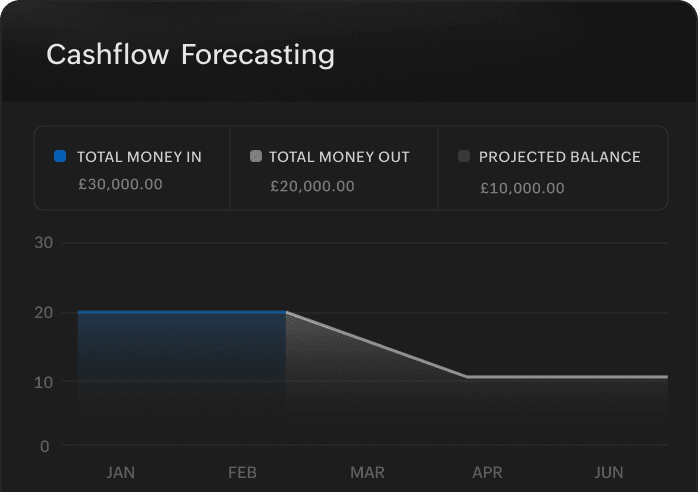

Powerful reports

Monitor project performance, navigate cash flow challenges amidst multiple stakeholders, and make informed decisions with 70+ powerful reports.

Year-round tax compliance

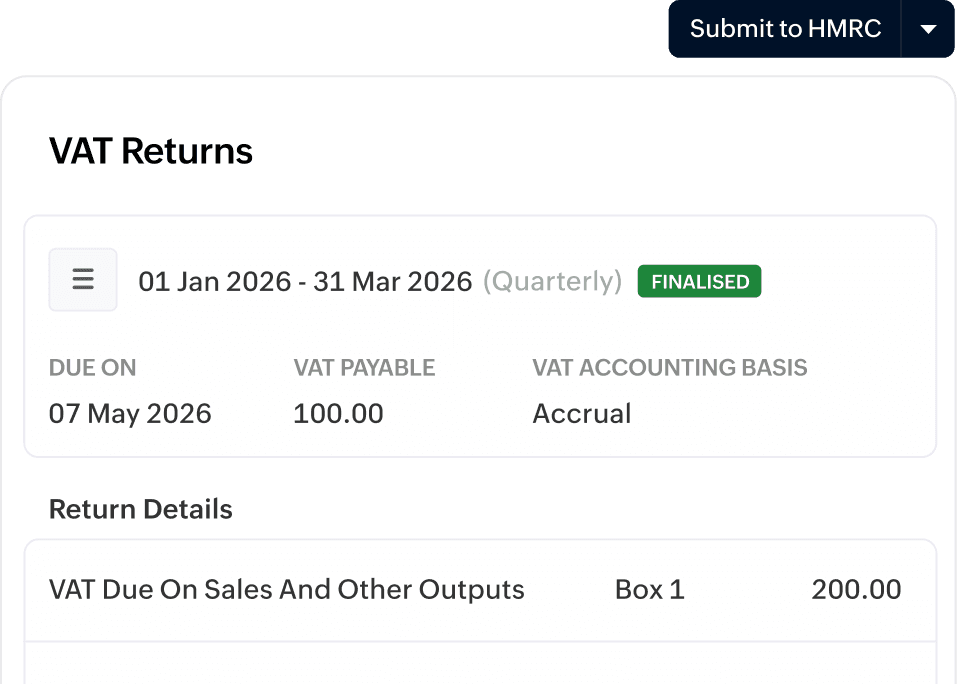

MTD for VAT

Make VAT compliance a breeze with Zoho Books. Our MTD-compliant accounting software generates your VAT returns based on your purchases and sales, allowing you to review, finalise and directly submit them to HMRC.

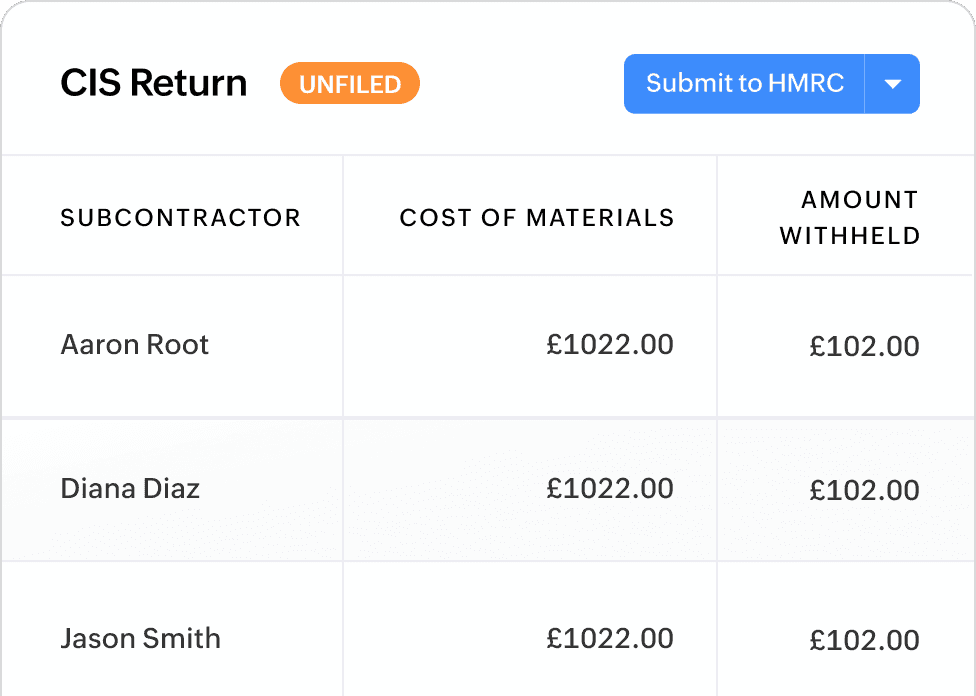

CIS Submissions

If you are in the construction industry, simplify CIS compliance with Zoho Books. Auto-calculate your contractor and subcontractor CIS deductions, generate insightful reports, and file CIS returns directly to HMRC.

And some more features for you...

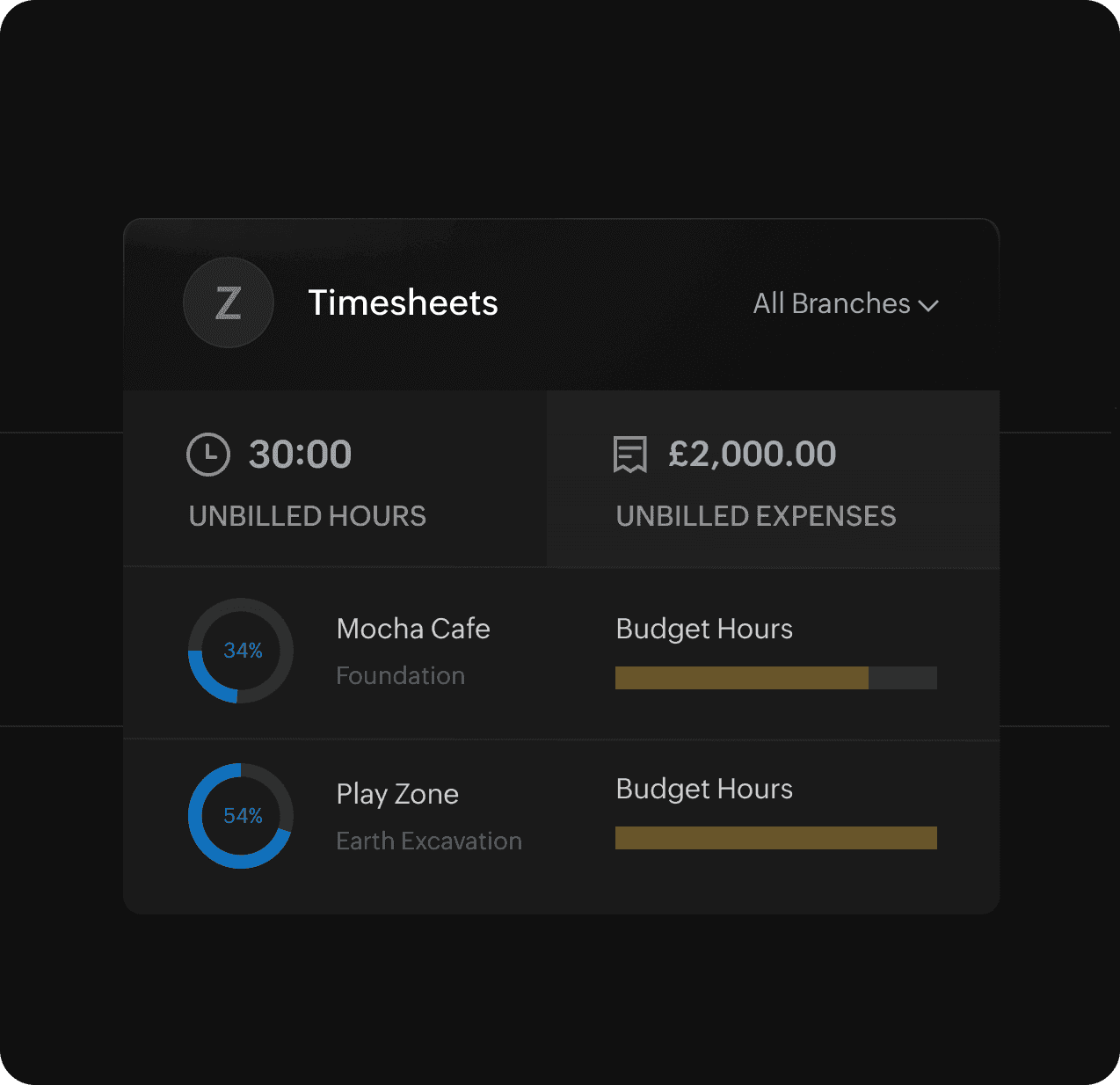

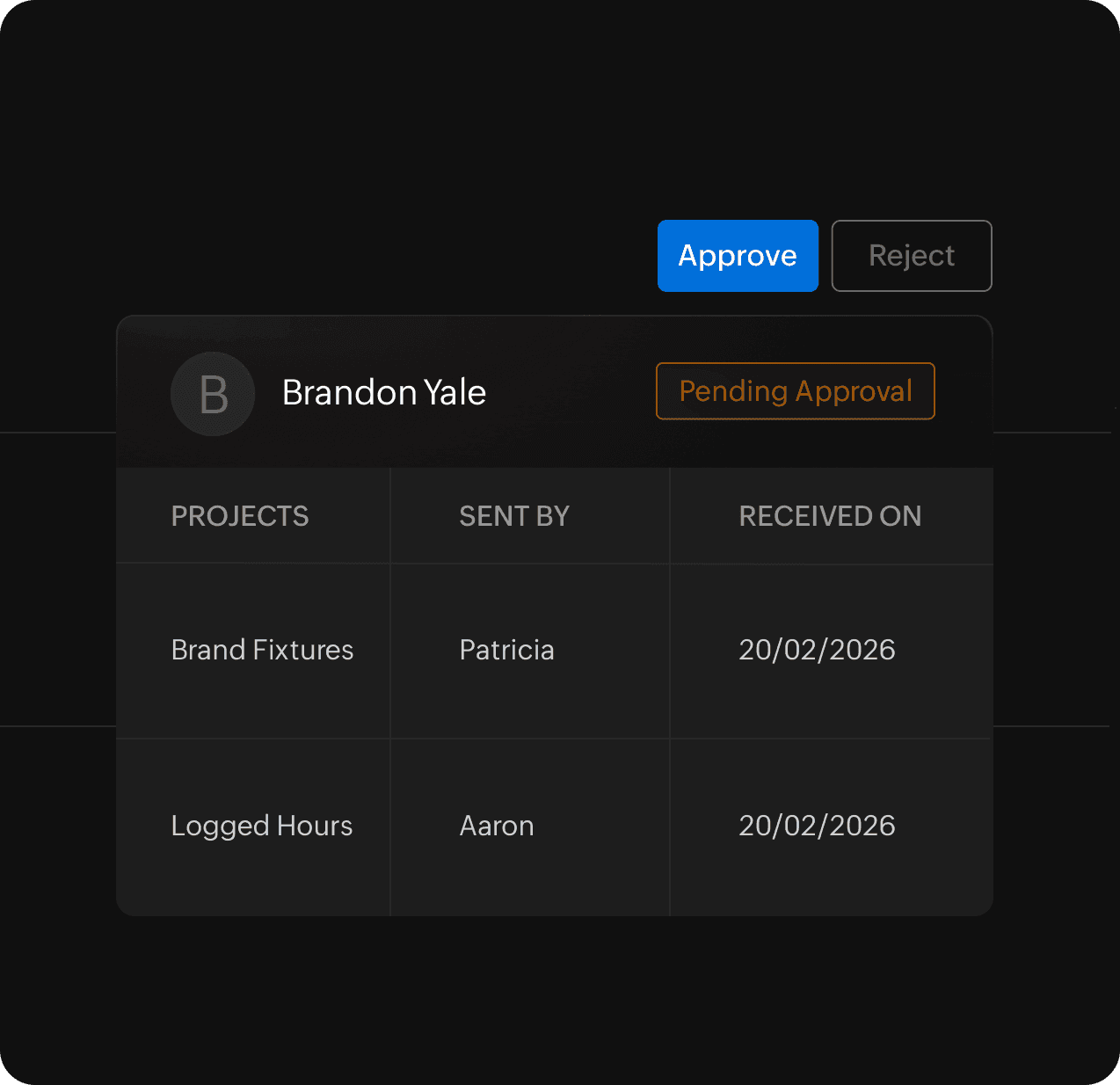

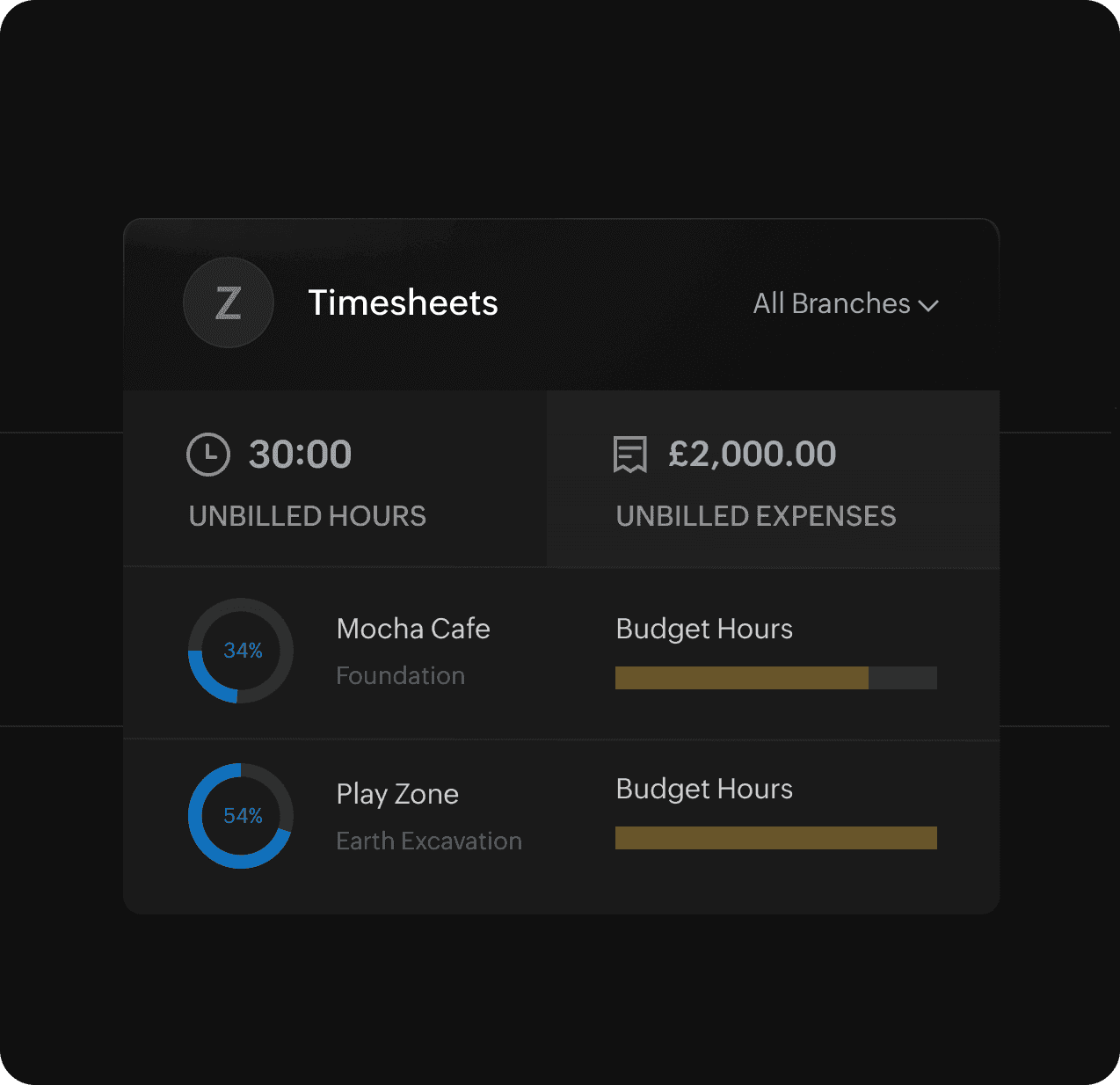

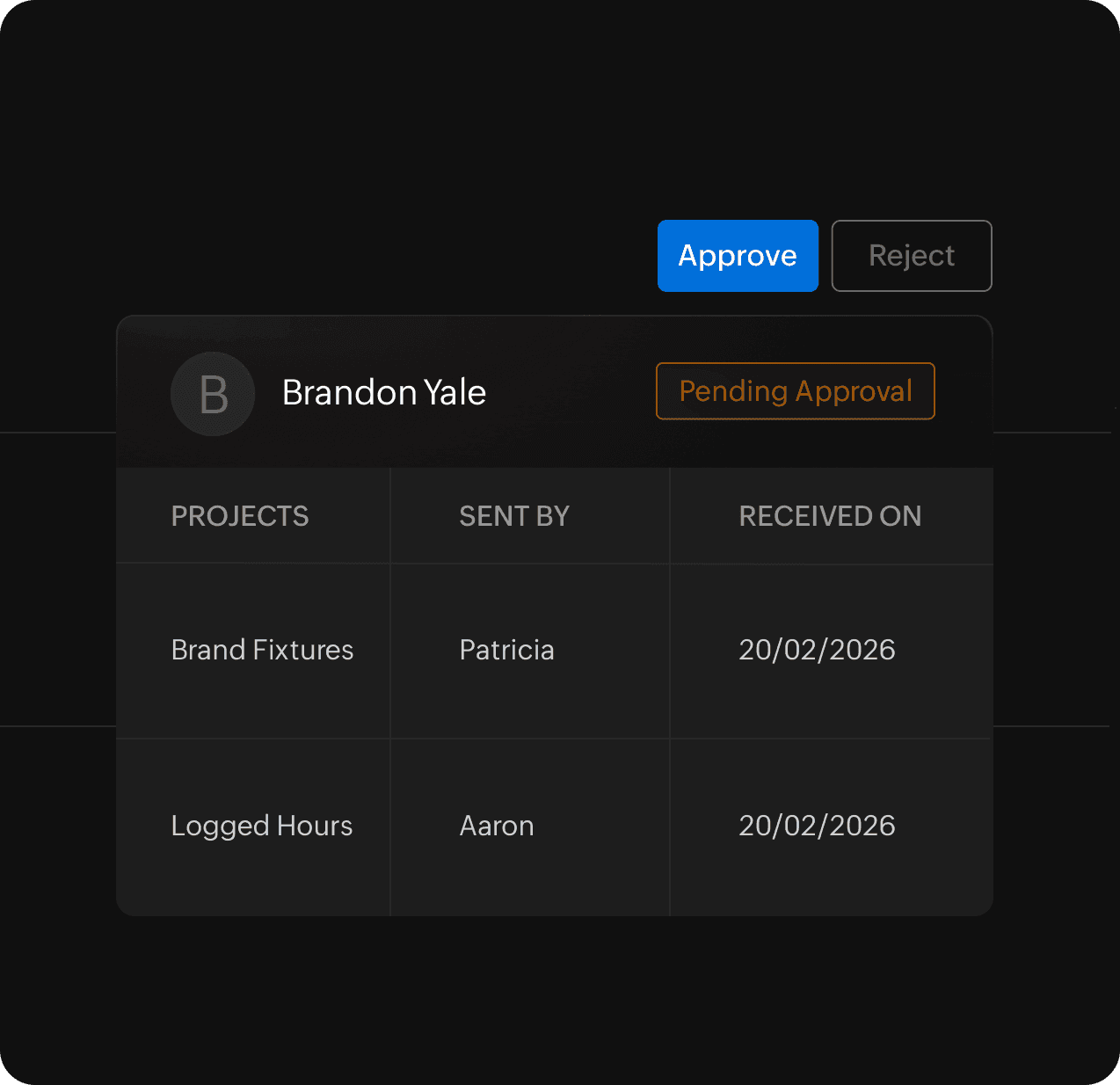

Smart timesheets

Easily track and approve timesheets, compare budgeted versus actual hours, and maximize billable time with Zoho Books. Gain insights into your team's time investments and optimize project workflows.

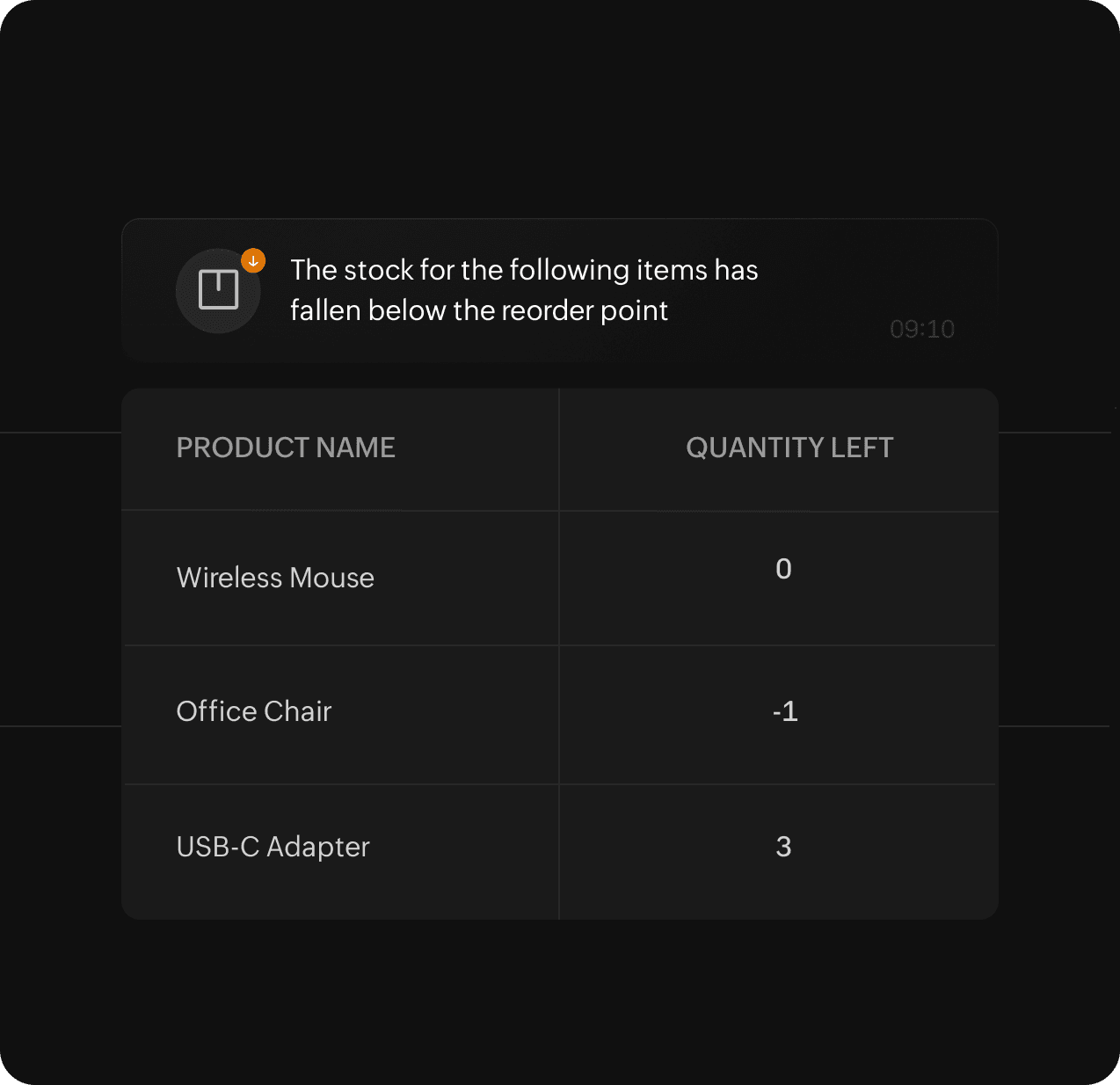

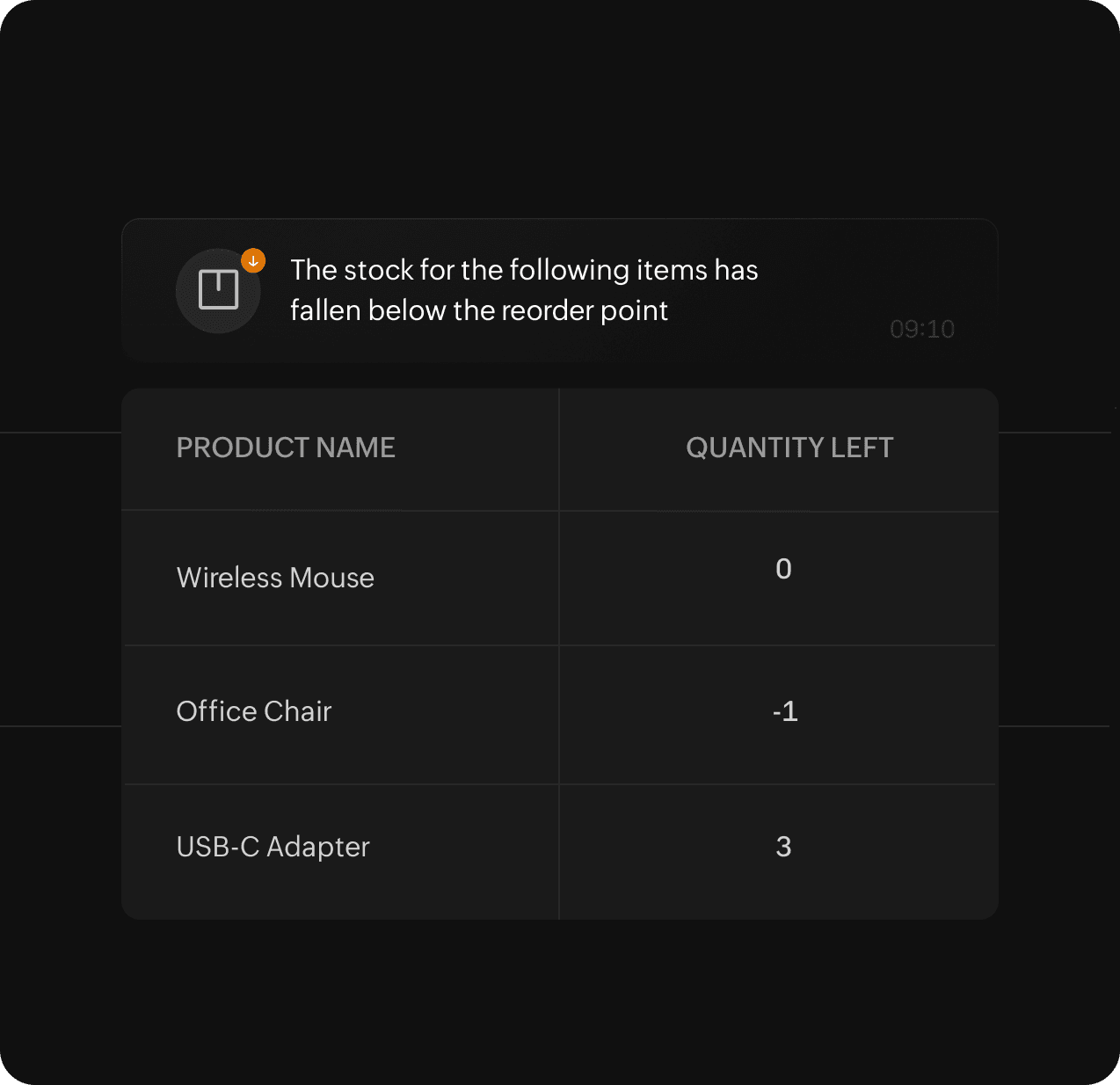

Real-time inventory tracking

Avoid project delays by ensuring continuous stock availability with real-time inventory tracking to know what is in stock and what is not. Set reorder points and automate the ordering process to maintain adequate stock in your warehouses.

Dedicated customer portal

Set up a dedicated space for your customers to view and manage all their transactions from a single portal. Zoho Books allows them to accept quotes and make payments for your invoice.

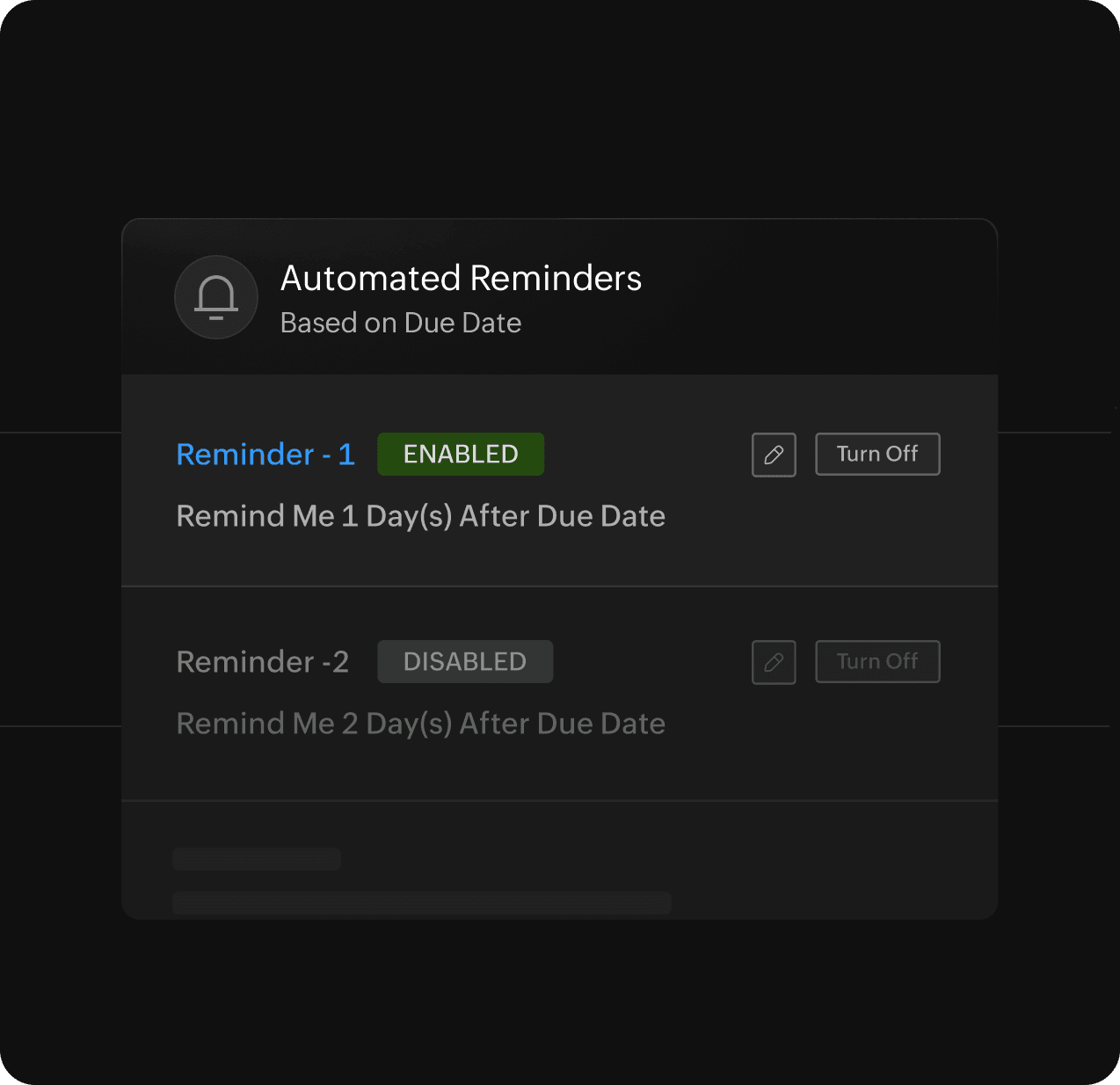

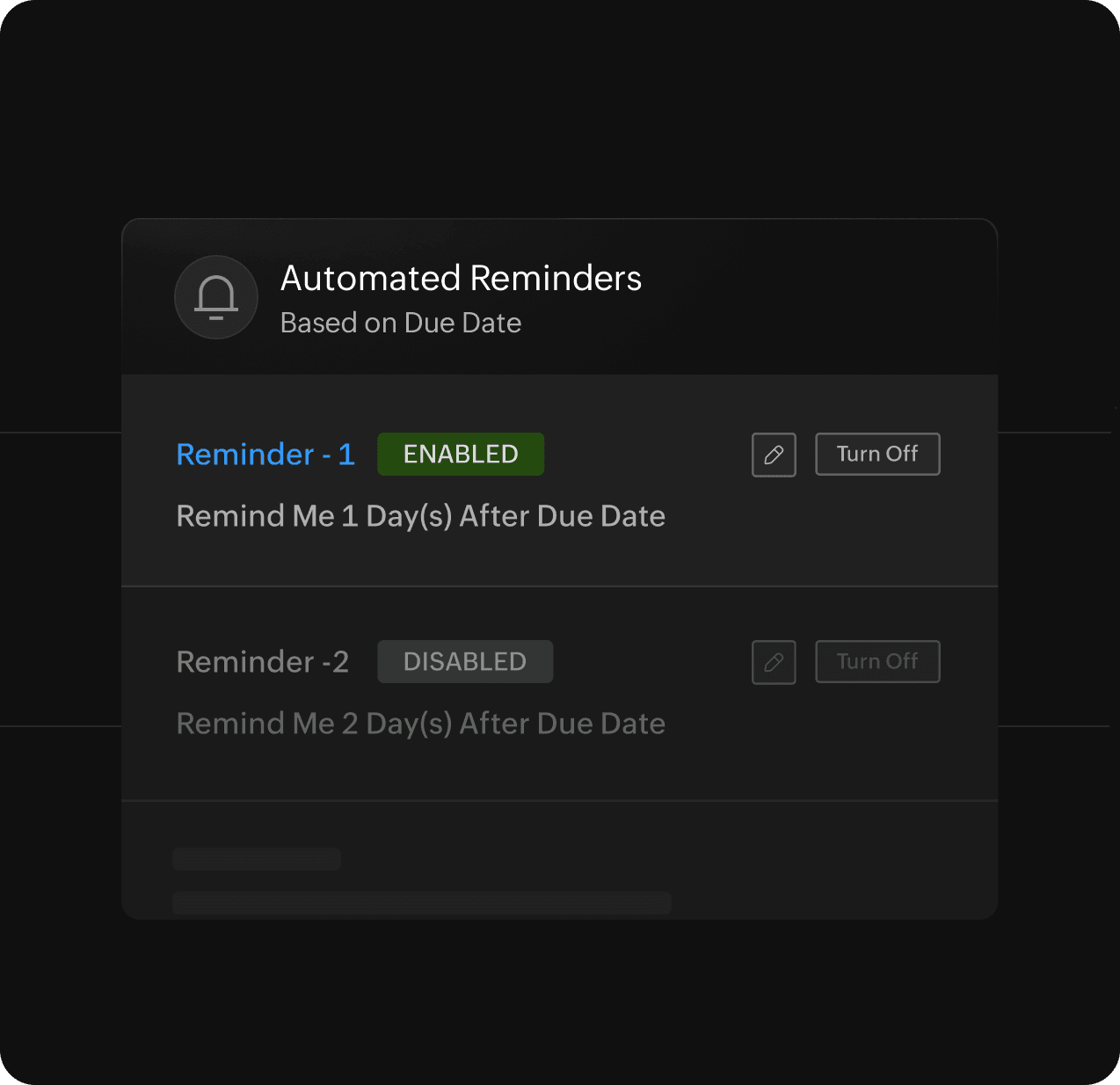

Automated payment reminders

Stay on top of business critical timelines by leveraging Zoho Books' automation capabilities. Set up automated email alerts for contract renewal dates, project completion dates, or payment due dates.