Latest from us

Filter By

Clear filter

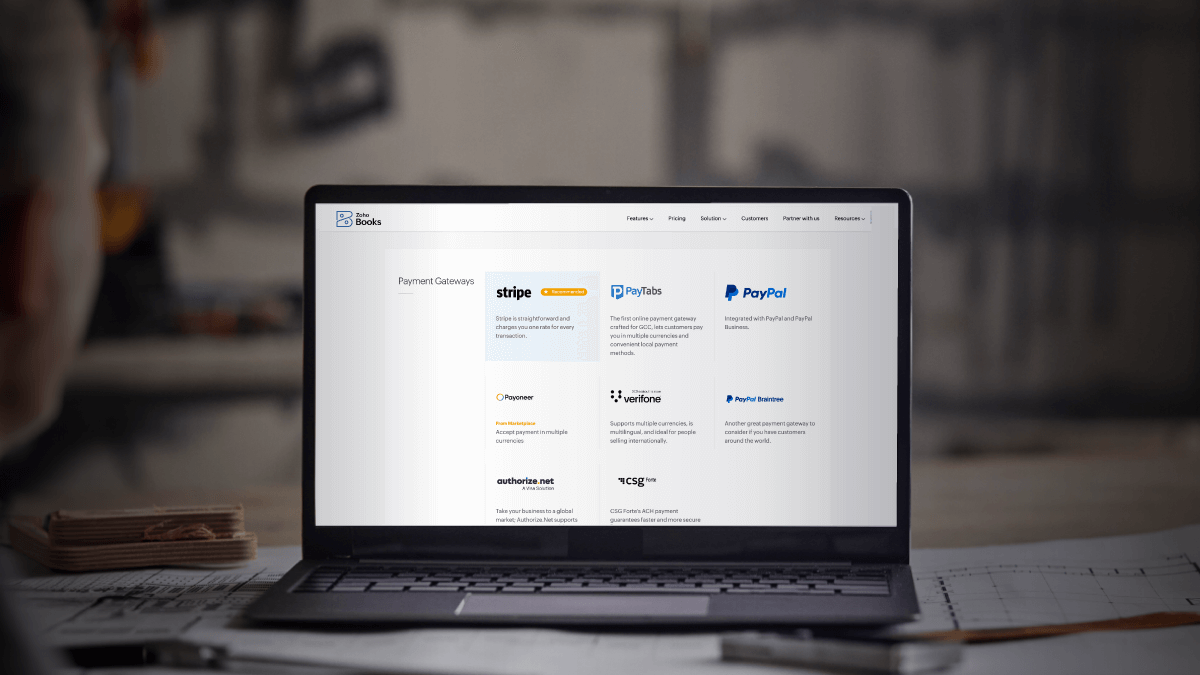

Banking & payments

Online Payment Gateway – Definition, Working & Benefits

Taxes & compliance

Small Business Taxes in Canada: A Complete Guide

Taxes & compliance