- HOME

- Expense Management

- Operating expenses: Get everything you need for building a better cash flow

Operating expenses: Get everything you need for building a better cash flow

Operational expenses (OpEx) is one of the key financial metrics used to determine the profitability of a business. From a startup to a large enterprise, understanding operating expenses is vital for the financial health of an organization.

According to an S&P Global market intelligence report, in Q4 2023, US investment-grade companies' median operating expense ratio (Opex-to-Revenue) jumped to 83.7%, up from 82.2% in Q3. The IT sector was able to reduce its OpEx ratio by cutting expenses by 14.5%. However, most other sectors, including energy and consumer discretionary, saw notable increases in operating costs.

In this article, you'll get an idea of what operating expenses are, how you can differentiate them from capital expenses and expenses involved in the cost of goods sold, and the best practices to manage and optimize them.

What are operating expenses?

Operating expenses, in simple terms, can be defined as the ongoing day-to-day recurring expenses to run the operational activities of your business. These expenses include employee salaries, office building rents, marketing and sales expenses, office supplies, employee travel and expense (T&E), insurance, employee welfare, software licensing and renewals, administrative expenses, and the like. Managing these expenses effectively enables companies to optimize their operations, enhance profit margins, and foster long-term, sustainable growth.

To get a further understanding of the types of expense categories and the ways to manage them, check out our blog 10 esssential business expense categories.

OpEx vs. CapEx vs. COGS

Capital expenditure, referred to as CapEx, is completely different than OpEx. CapEx are generally long-term expenditures such as land, building, machinery, IPs, and trademarks. It is calculated in the assets column of the balance sheet, while OpEx comes under the P&L statement.

Cost of goods sold (COGS) are the expenses that are directly involved in the production of goods or services that the organization operates in. These expenses largely consist of direct labor involved in production, materials bought for production, and taxes involved in production. Balancing COGS and OpEx is essential for driving long-term growth and profitability.

The common ambiguity that arises is how you classify your payroll expenses into OpEx and COGS. Salaries that are paid for factory laborers and employees who are directly responsible for manufacturing goods and services come under COGS. All other employees, be it the finance teams, accountants, marketing, and sales, will fall under OpEx.

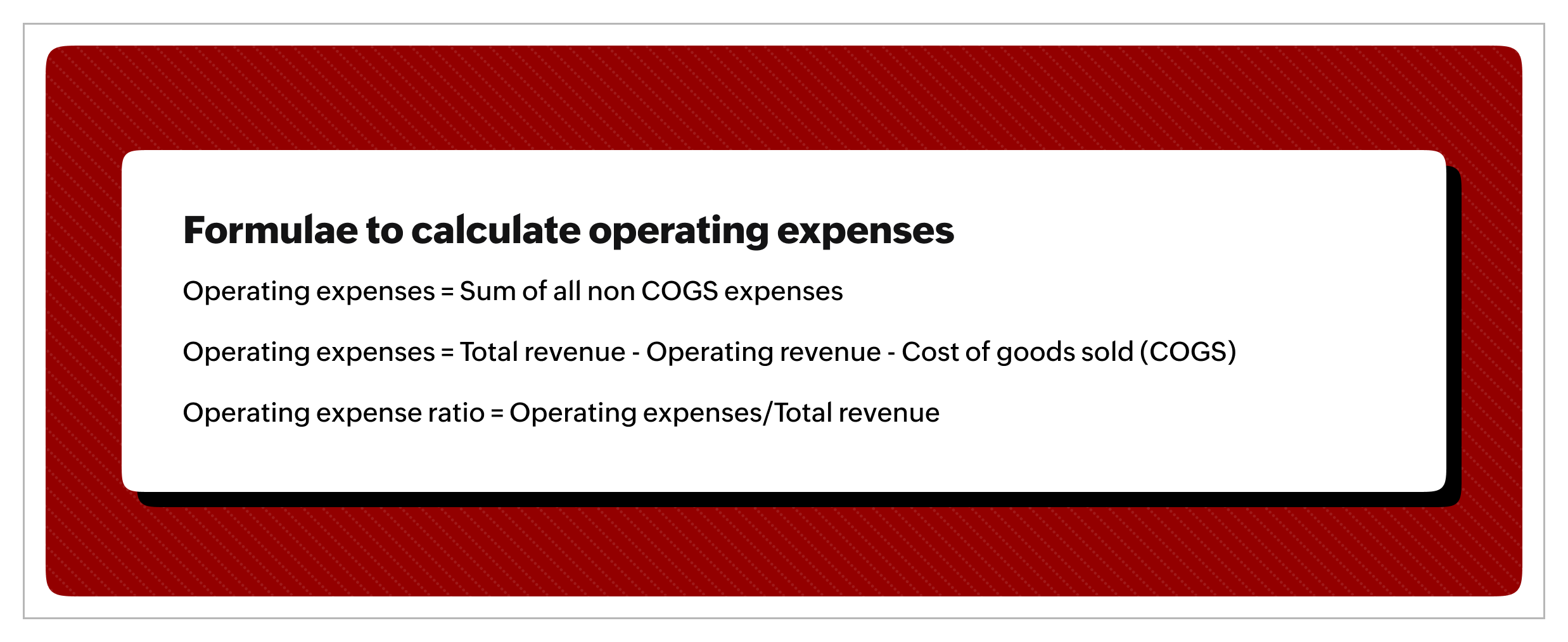

Formulae to calculate operating expenses

The simplest way to calculate operating expenses is to identify and sum up all expenses that are not a part of COGS.

Operating expenses = Sum of all non COGS expenses

On the other hand, certain finance professionals compute it with revenue, COGS, and operating income.

Operating expenses = Total revenue - Operating revenue - Cost of goods sold (COGS)

Defining operating expense ratio and what is considered a good OpEx

The operating expense ratio can be calculated with the formula below:

Operating expense ratio = Operating expenses/Total revenue

A company operating at a lower ratio is generally considered to have a stronger operational efficiency, while a high ratio often points to potential inefficiencies or poor cost management within a business. However, companies that have just started recently and are making strategic investments in growth or operational upgrades are expected to drive future revenue and profitability.

So it is ideal to analyze the operating expense ratio based on these factors; based on the industry that your business operates, historical data, and the company's strategy.

How to optimize operating expenses without hurting growth

Before you start to control overheads, it is essential to identify the key activities and areas of spend, which are crucial for business operations. Eliminating waste—not costs—is the mantra businesses need to imbibe to maintain momentum without stalling growth.

Here are some effective strategies to manage operating expenses (Opex).

Evaluate the impact of current spending

Get a complete overview and insights on each segment of spend that is not part of the COGS; when you have all the information and data available, the easier it is to measure and optimize it.

Tax deductions under the IRS

For a business operating in the US, the Internal Revenue Service (IRS) provides provisions to write off taxes. Check out our blog post on how to maximize your business tax deductions for a comprehensive overview.

Micro budgeting

Create, allocate, and track budgets at department levels and even for smaller projects, frequent travelers, office supplies, field sales teams, and on other heavy OpEx which occurs across all departments to ensure all spends are under control.

Restructure spending with real-time insights

With analytics and insights based on previous months and quarters, a regular review and reallocation of spends will help increase ROI, therefore resulting in a better bottom line. For example, optimizing customer acquisition costs can significantly reduce the cost per lead, resulting in increased profits and revenue.

Drive operational excellence via employee development

Push employees to choose more cost-effective choices; enforce policies that nudge employees to choose cost-friendly options. With an expense management solution like Zoho Expense, you can enforce foolproof travel policies, nudging employees to choose cost-friendly tickets and hotel booking options.

Implementing the right tech system

Building resilient financial models while streamlining overheads and spending needs to be a primary focus for businesses eyeing long-term efficiency. Embracing technology that offers real-time tracking and integrates smoothly with your existing tech stack is key. An expense management solution provides end-to-end visibility into departmental expenses, empowering smarter, data-driven cost optimization.

Importance of travel & expense management and OpEx

A company's employee travel and expense (T&E) is a significant component of operational expenses, especially when it is a sales and operations-driven business with client-facing teams traveling frequently. T&E spending directly impacts profitability, cash flow, and budget planning. Poorly managed T&E can lead to overspending and compliance issues. With the right system and policies in place, companies can monitor spending in real time, make informed decisions, and open doors for new opportunities for cost optimization, making T&E a critical area of focus within OpEx.

How can Zoho Expense help you optimize T&E

With Zoho Expense's end-to-end expense management software, you can automate all employee business spending. Enforce policies, budgets, and set up approvals for higher-value OpEx to identify leaks and maintain financial health.

Zoho Expense uses AI-powered autoscan to capture all information from your physical and digital receipts. It lets you connect corporate cards and reconcile all your transactions in real time, and also integrates with all leading accounting and ERP platforms, ensuring that all expenses are accounted for.

- Neil Varshiney

A focussed marketer and seasoned Fintech writer helping finance professionals and business owners to find and help them evaluate the right tech stack to run their operations effectively.