- HOME

- Payroll metrics

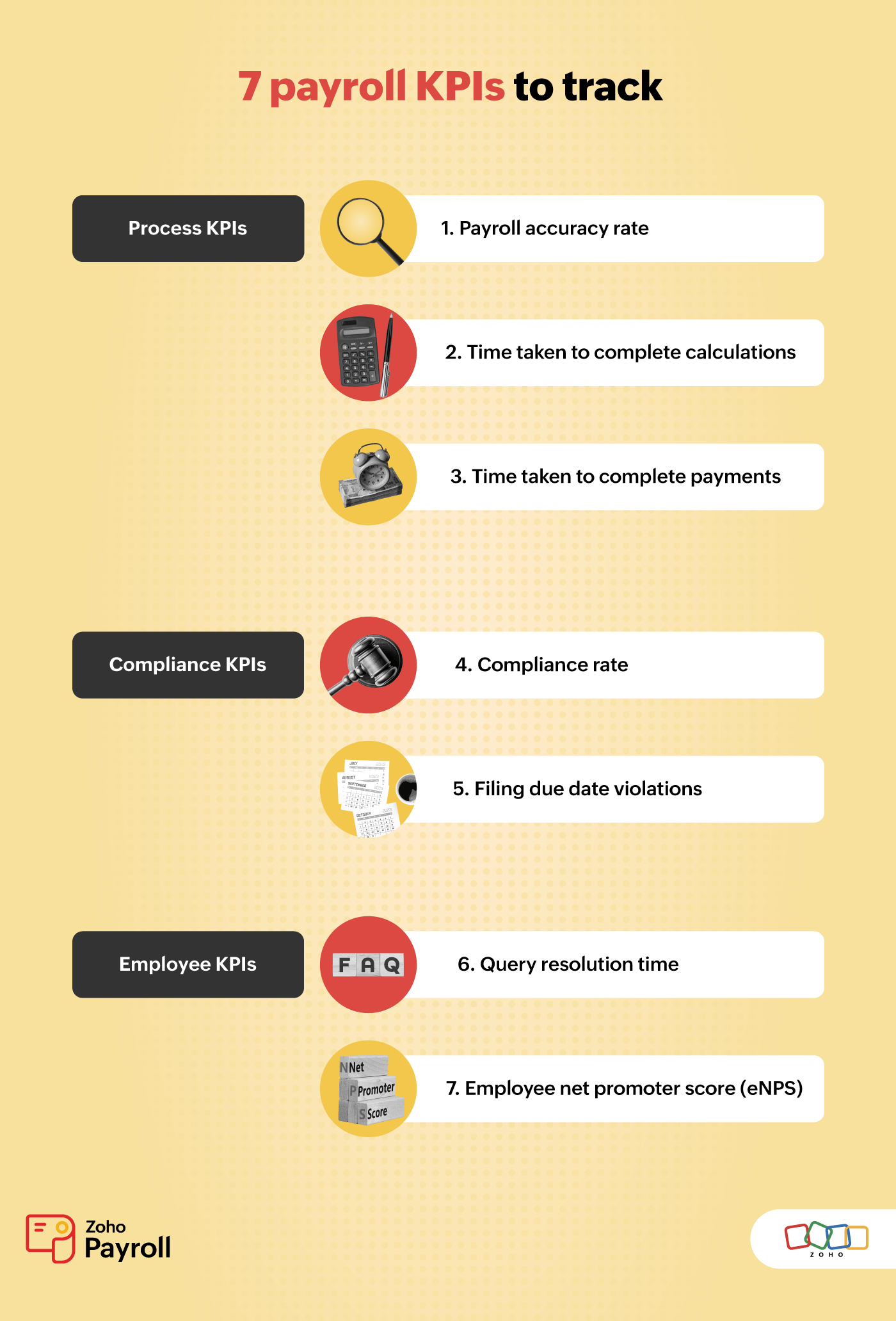

- Track the health of your payroll with these 7 KPIs

Track the health of your payroll with these 7 KPIs

Ask yourself this question: How does your payroll perform? Not simply regarding reports on payroll cost, overtime, or deductions, but rather how your payroll team functions and the impact payroll has on the employee experience. If you're unsure, then this article is for you.

Payroll is a business-critical operation. It directly impacts employees. Such a crucial activity needs to be measured, analyzed, and improved consistently. Quantifying the results of your payroll gives you good visibility, tells you if you are equipped to scale the company, and indicates if your payroll operations are healthy.

Below are three categories of KPIs. Track them, improve them, and see payroll make a difference in your business operations.

Process KPIs

These KPIs are directly measured in the process during multiple milestones and tasks involved in completing payroll.

Payroll accuracy rate

Taxes, deductions, and net pays need to be calculated accurately. A single inaccurate calculation might seem harmless for an organization, but its highly impactful in an employee's livelihood and their financial plans. Their trust in the organization goes for a toss. The company may also face compliance-related fines or lawsuits.

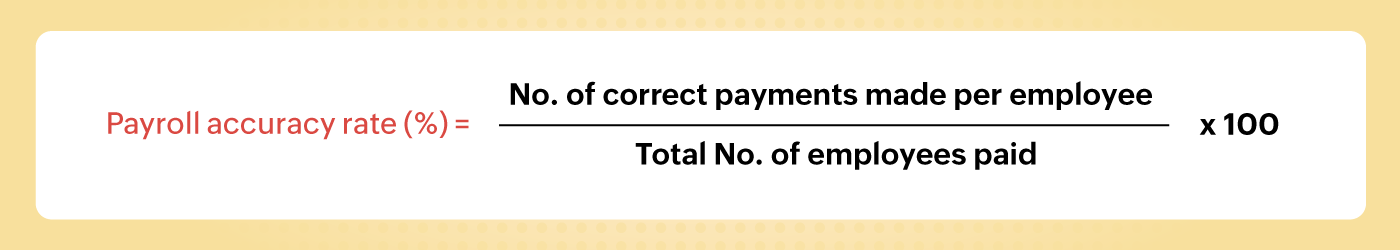

Calculate the payroll accuracy rate as the prime metric every time you run payroll. There should be no room for error.

A low payroll accuracy rate can mean lack of resources and training. It can also signal manual, error-prone practices and tools. Digitize all parts of your payroll and eliminate possible chances of error. Using payroll software like Zoho Payroll with automatic calculations is the best solution to reduce the probability of errors and have a high accuracy rate.

With Zoho Payroll, the training required to run payroll is also reduced. The software is designed in such a way that anyone, from beginners to payroll experts, can complete payroll easily.

Time taken to complete payroll calculations

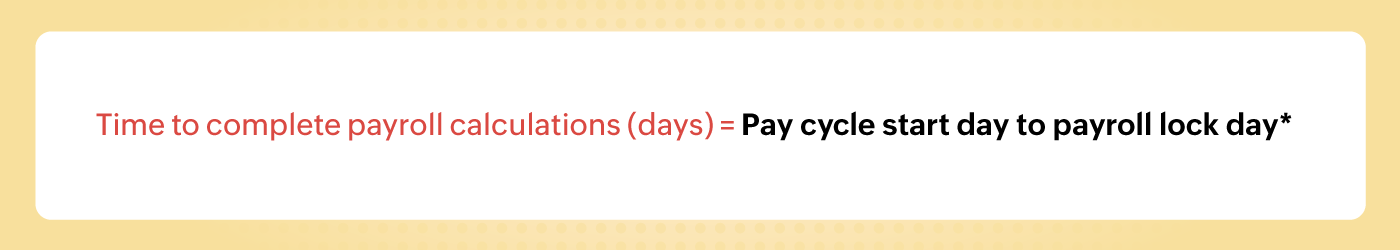

Completing a payroll calculation refers to accomplishing all the tasks in the payroll cycle before processing the final payments.

It involves collecting reimbursement claims, IT declarations, and POI documents from employees, as well as attendance data and additional earnings from HR teams. Any travel or business expense reimbursements also need to be collected from finance or travel desk teams. All data needs to be compiled and salaries have to be calculated.

Data from various sources needs to be verified, exported, imported, and added into your payroll on time. This in itself is a huge task for the payroll team to accomplish every month.

*Payroll lock day refers to the day on which the final payroll calculations are frozen and it's ready to be paid.

This KPI should be measured for every pay cycle.

Using pre-integrated payroll, HR, expense management, and accounting platforms decreases the time and efforts taken to compile various inputs and complete the calculation. Attendance data is synced automatically to Zoho Payroll from Zoho People, our HRMS. Business expense reimbursements are fetched from Zoho Expense. Payroll journal entries are automatically made in Zoho Books, our GST-compliant accounting software.

With Zoho Payroll, employees get a dedicated self-service portal to submit their reimbursements, IT declarations, and proofs of investments.

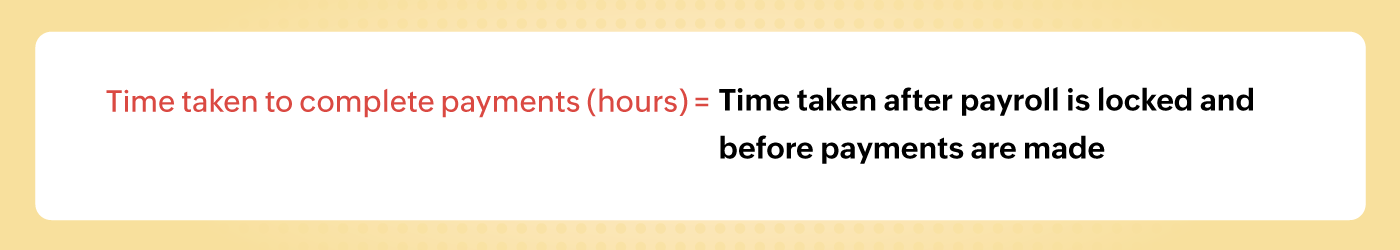

Time taken to complete payments

Timeliness and consistency are key when it comes to salary payments. Can your payroll team deliver salaries to employees on the same exact day each month? This is extremely important for employees.

One of the most critical tasks in payroll is making payments to employees. There are multiple modes to transfer salaries.

- A very small company with five employees can easily handle five different bank transactions or cheques processed by the business owner.

- When the count grows to 15 employees or more, separate transactions would be a complex affair. The solution could be compiling a bank advice in a specific format, uploading it to an online banking portal, and transferring salaries in one shot. This is the most common method of salary payment in India.

The above two are good solutions, but there is a more effective way. The direct deposit integrations in Zoho Payroll help you go a step further. If you have a corporate bank account with YES Bank, or HSBC, it can be integrated with Zoho Payroll. Salaries are instantly paid to employees within Zoho Payroll at the click of a button.

Compliance KPIs

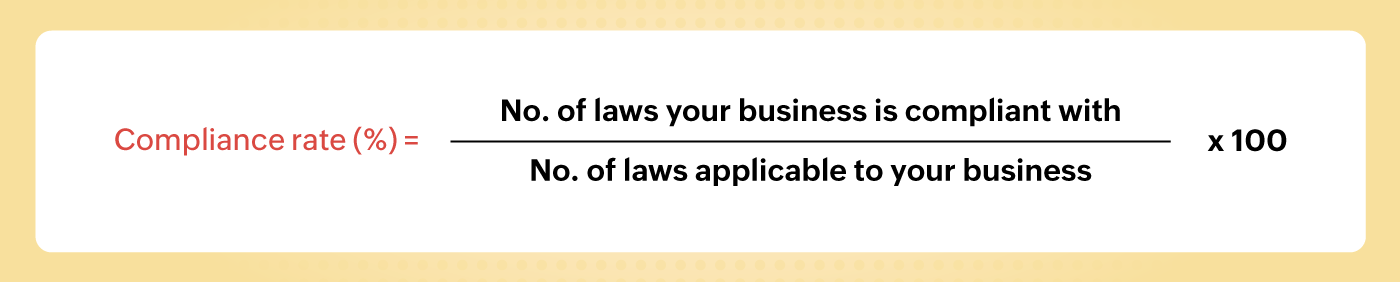

Compliance rate

Compliance is an ever-changing and ever-challenging part of payroll. India has 40 central labour-related acts and the Income Tax Act. Along with these, individual states and union territories also have their own laws. Compliance has a huge impact on employee salaries.

Accurate taxes and deductions need to be calculated to keep the business on legal footing. Business owners and payroll teams need to identify the laws that apply to their business, decode them, and operate payroll accordingly.

Tip: If you are a business operating in India, we have compiled an ebook, Comprehensive guide on payroll compliance in India, with all the regulations and applicability.

Documents also need to be generated and distributed on time. Payslips and TDS worksheets are to be mandatorily distributed to employees. The last day to produce the signed Form-16 is June 15th of every assessment year.

When the employee count grows, compliance gets increasingly harder. In Zoho Payroll, we've simplified compliance to make it easy on businesses. Any updates to payroll statutes are immediately implemented in Zoho Payroll, keeping you compliant. You can focus on other aspects of payroll and HR knowing that compliance is automated.

Filing due date violations

Operating in compliance with rules and acts like Income Tax, ESI, EPF, LWF, and PT also requires you to file returns on time. Every law has its own frequency and deadline for filing. Missing filing date deadlines brings fines and penalties to the business.

Late filing fees for TDS is ₹200 for each delayed day. Let's say you miss the filing date by a quarter. Assuming there are 90 days in a quarter, the penalty amounts to ₹18,000. Similarly, late fees penalties are framed for all labour laws too.

Set reminders for filing dates and always be on time. Delays in preparing the reports for filing can also cause teams to miss filing deadlines. Zoho Payroll generates pre-formatted reports for return filing, namely Form 24Q, EPF-ECR, and ESIC. Download the reports, upload to the online portals, and you're ready to file returns.

Employee KPIs

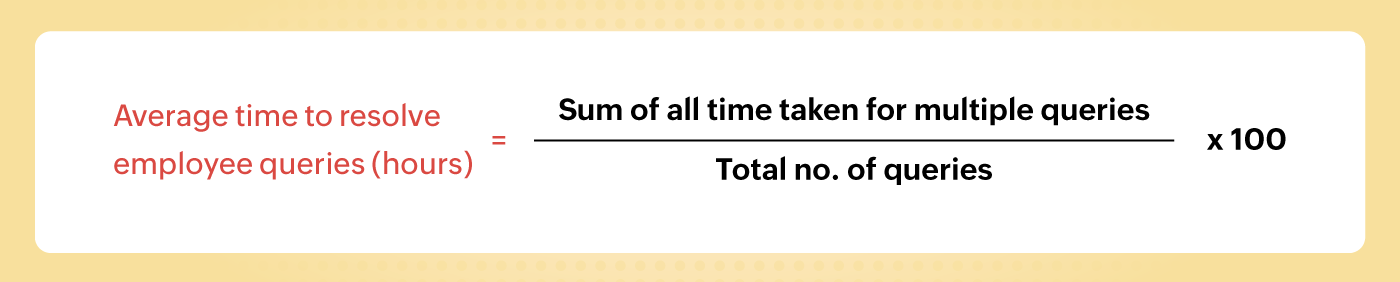

Query resolution time

Employees are not experts on payroll but they hold the highest stakes. They may have many questions about their salary structure, submitting documents, reducing their taxes, and much more. It's the duty of the employer and the payroll team to help employees with necessary information whenever needed.

Resolving employees' queries quickly puts them in a better position to make important financial decisions. Giving payroll or financial-related help is the best way to earn an employee's trust. Quick resolution times also make the payroll process faster and easier.

Select a time period like two weeks or a month, and find out the approximate time (in hours) taken to resolve each query.

If your payroll team struggles with handling too many queries, create knowledge base articles, FAQs, and make the resources easily accessible to employees. Create SLAs and track queries through a service desk. You can also go a step further and segment the count of queries from basic to advanced. This gives an idea of how well your employees are educated and aware of their salaries and taxes.

To solve queries quickly, it's important to make yourself accessible too. The Contact Payroll Admin feature in Zoho Payroll's self-service portal is a great way to make it easy for employees to know where to ask questions. They can type in their questions and hit send. An email gets delivered directly to a designated payroll admin's inbox.

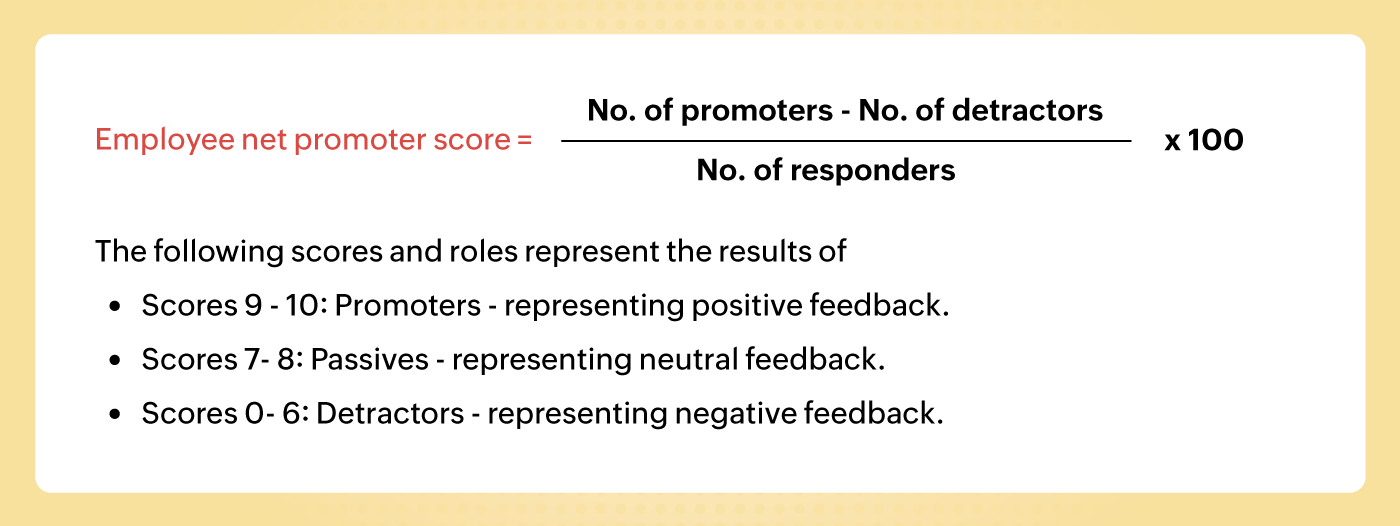

Employee net promoter score (eNPS)

The net promoter score (NPS) is a scoring method developed by Bain & Company to gauge the loyalty of customers. The same method can also be applied to employees to measure the impact of payroll at the workplace.

Send a survey to your employees saying "On a scale of 1-10, how do you feel about the payroll, compensation, and benefits process at [XYZ Company]?".

An eNPS score of 100 signals all employees are promoters, and -100 signals that all are detractors. A low eNPS score is a signal for less-informed or dissatisfied employees. Send follow-up survey questions, narrow down further, and identify specific issues and communication gaps. Keep improving your eNPS scores for payroll and compensation. You can run eNPS surveys and other surveys with Zoho People.

There you go!

These are seven KPIs you can track to assess the health of your payroll. Track them, improve your payroll process, and make a difference in your employee experience.