- HOME

- Taxes and compliance

- 4 ways Zoho Payroll simplifies LWF process

4 ways Zoho Payroll simplifies LWF process

For businesses in India, managing payroll is a challenging task because of the various moving parts involved. One crucial aspect of payroll is the need to stay compliant with statutory regulations. The complexity of staying compliant is magnified with vastly distinct and regionally intricate laws. The Labour Welfare Fund (LWF) is one such location-based payroll compliance. Its deduction cycle, deduction rates, and even the forms for compliance vary from one state to another.

To process LWF accurately, you need input from various teams, the proper deductions from your employees' salaries, and the ability to pull reports whenever required. Legacy payroll methods and spreadsheets do not have the capabilities to handle these. This is where modern payroll software comes into play. Software like Zoho Payroll comes with automatic LWF compliance and makes the right deductions across all the states. In this blog, we will learn how Zoho Payroll helps you implement a thorough LWF process.

What is Labour Welfare Fund?

The Labour Welfare Fund is a welfare scheme administered by the Ministry of Labour & Employment and managed by the state government authorities. It aims to improve labourer's working conditions and living standards by providing socio-economic benefits to eligible employees.

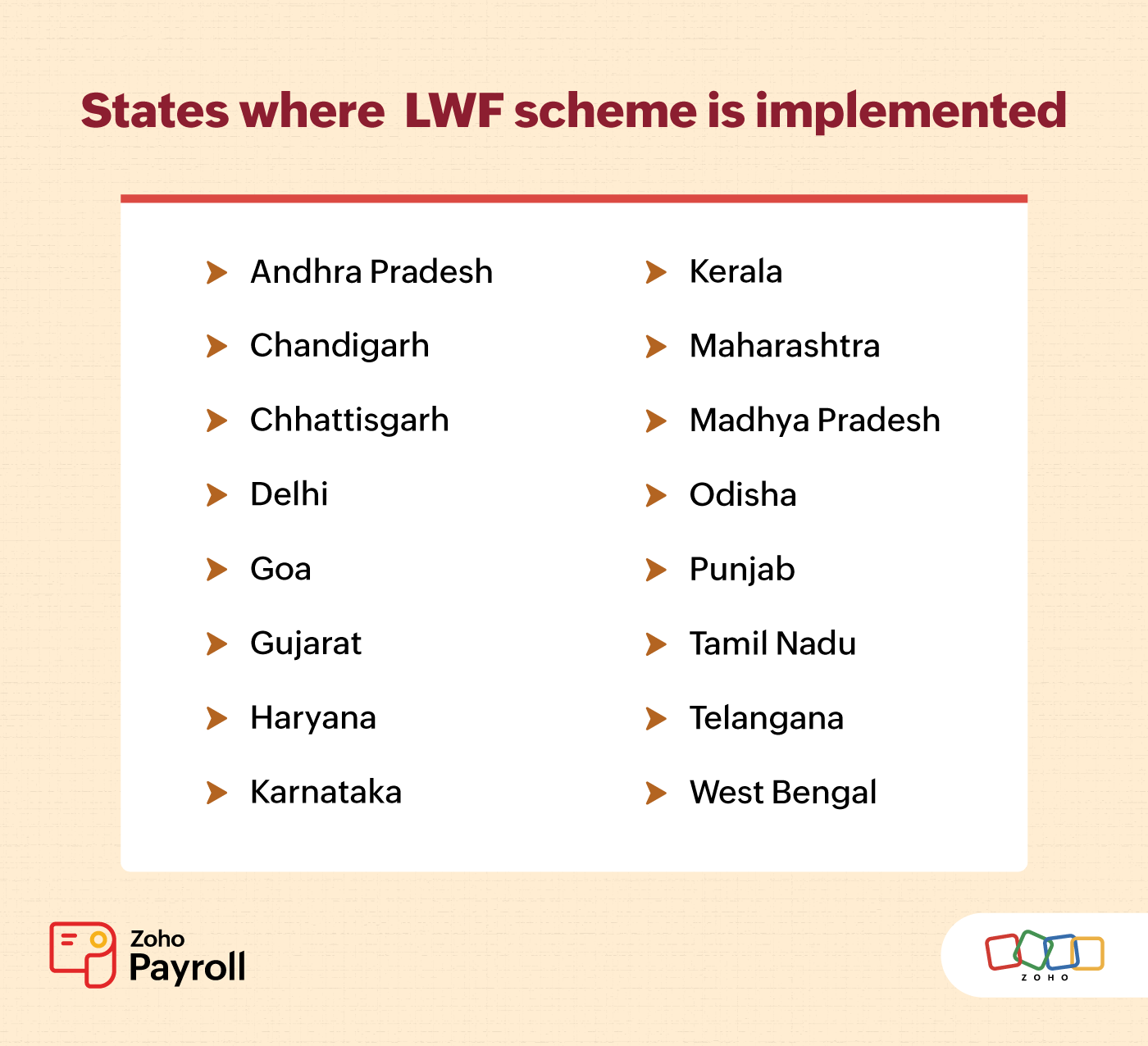

Employers and employees of registered organisations must contribute towards this fund. The LWF contribution rates and deduction frequency are decided by the respective state's commercial tax department. So far, 16 states have implemented this scheme.

If your organisation is based out of any of these states, you must:

Register your establishment under the scheme.

Deduct contributions from your employees' salaries at intervals mentioned in your specific state's Labour Welfare Fund Act.

Make payments before the due date.

Failing to comply with the above rules can incur hefty fines and loss of reputation for your company. We understand that it can be overwhelming for budding entrepreneurs to maintain a clean LWF record. That's why we built Zoho Payroll with automated LWF compliance.

Streamline the LWF process with Zoho Payroll

Automatic LWF configuration

Many businesses have branches in different states. Since LWF is a state-specific statutory, the deduction rules vary with each state. Luckily, you don't have to burn the midnight oil trying to understand them all; payroll software will configure things for you.

Sign up for the software, enter your company's address details, and let Zoho Payroll set up your organisation's LWF cycle. Voila! Within a few clicks you have implemented the LWF scheme and have taken the first step towards payroll compliance.

Accurate LWF deductions

The deduction cycle can be monthly, half-yearly, or yearly depending on your state. Remembering these due dates can be exhausting, but payroll management systems are built to help you with such repetitive tasks.

You can say goodbye to reminder notes and manual work, because Zoho Payroll is engineered to deduct accurate contributions from your employees' salaries before processing pay runs.

Insightful reports

To stay on top of your business accounting, you must create reports of your payroll and deduction summaries. These come in handy when you have to file returns or when the authorities ask for them. Payroll software generates automated deduction summary reports and real-time payroll cost summary graphs to help you stay in compliance.

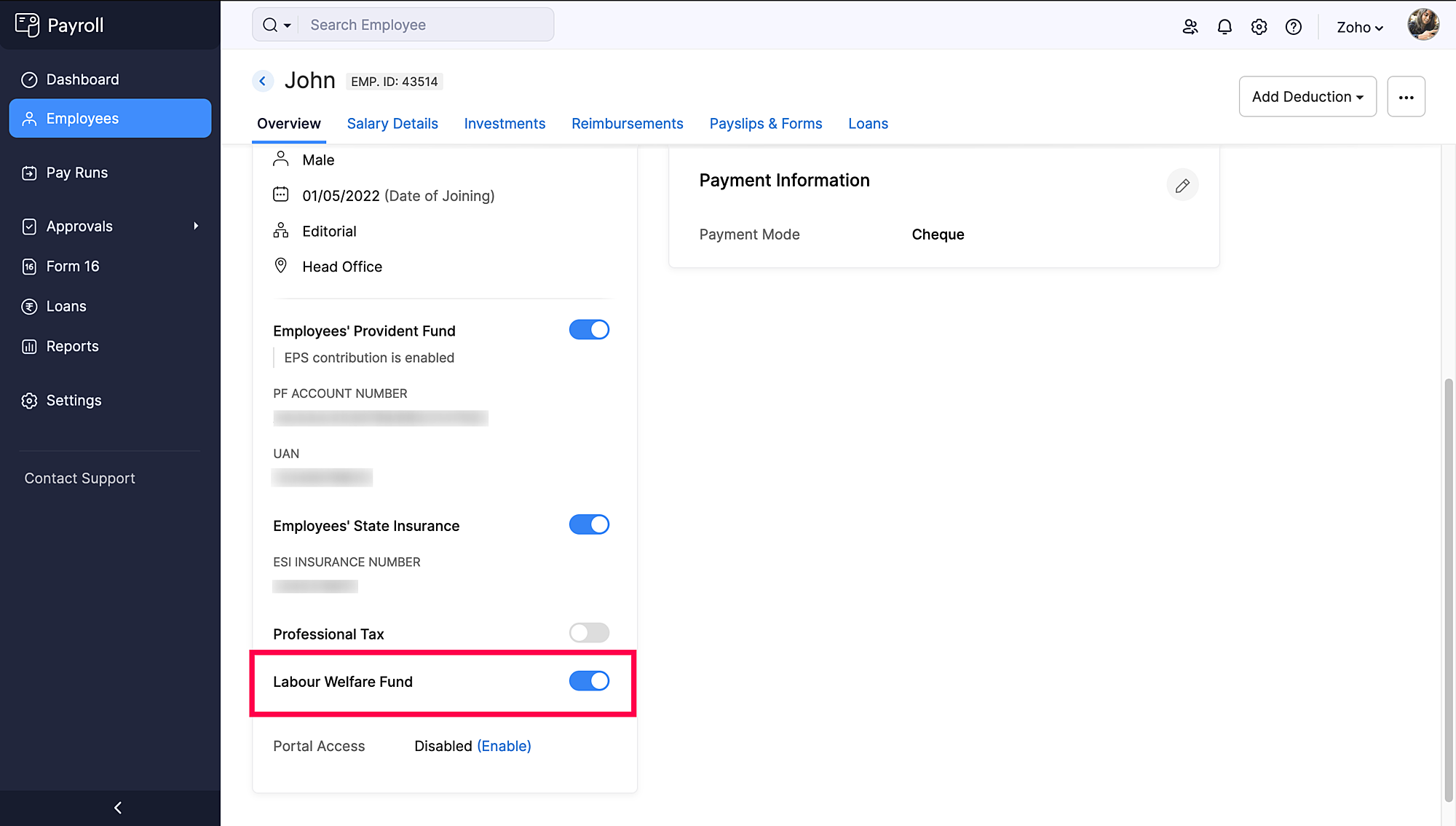

Employee level customisation

Eligibility to contribute and to avail benefits depend on an employee's salary and their designation. For instance, in Tamil Nadu, all employees who earn less than ₹15,000 per month and are not working in a managerial or supervisor capacity are eligible and must contribute towards the fund. It becomes crucial to implement the scheme across your whole organisation and enable deductions at the employee level.

Zoho Payroll has the capabilities to help you achieve exactly that. Go to the employees module to enable or disable contributions with a single click.

The way forward

Staying compliant with the laws of the land is certainly not rocket science. The process of payroll can be simple and you can be confident while making statutory deductions if you have the right tools from the start. Take Zoho Payroll for a spin today and see it for yourself!