Challans

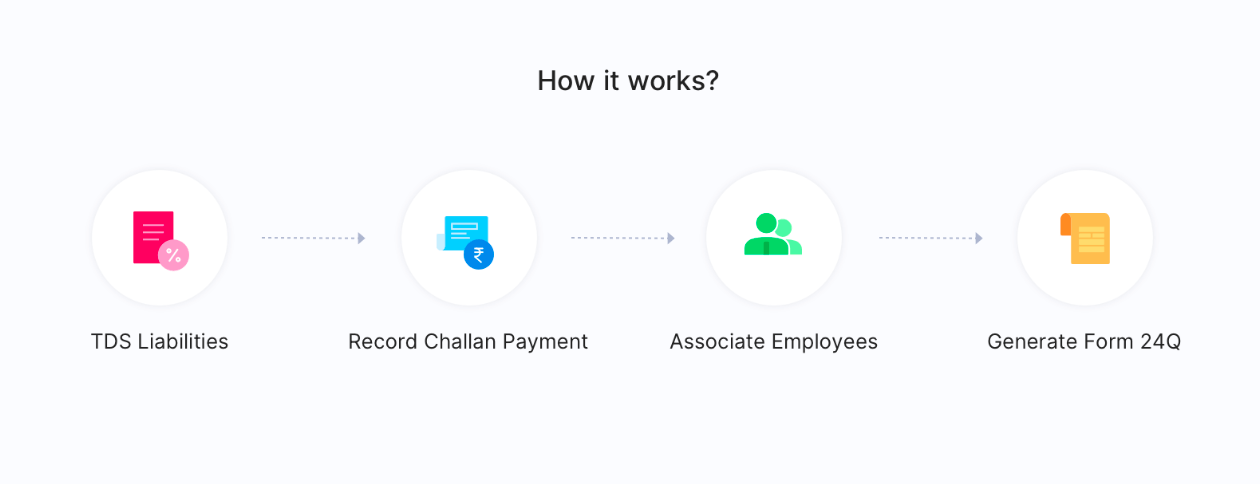

Recording challans for TDS Liabilities is crucial for businesses to ensure compliance with Indian tax laws. By following the steps outlined in this help document, you can easily record and associate challan payments with the TDS liabilities of your employees. Once you record the challan, you’ll be able to view them in the Form 24Q module in Zoho Payroll.

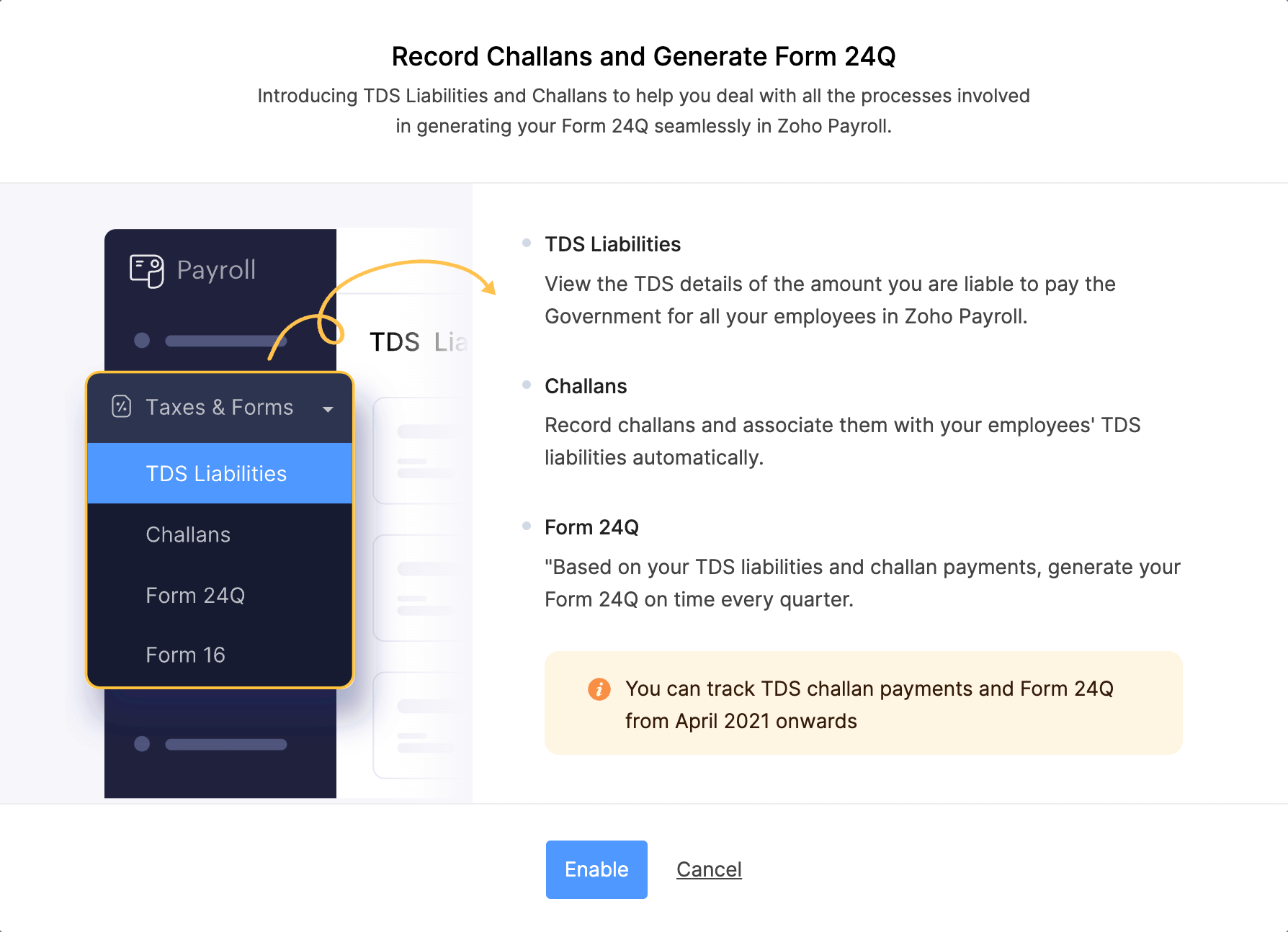

Enable Challans

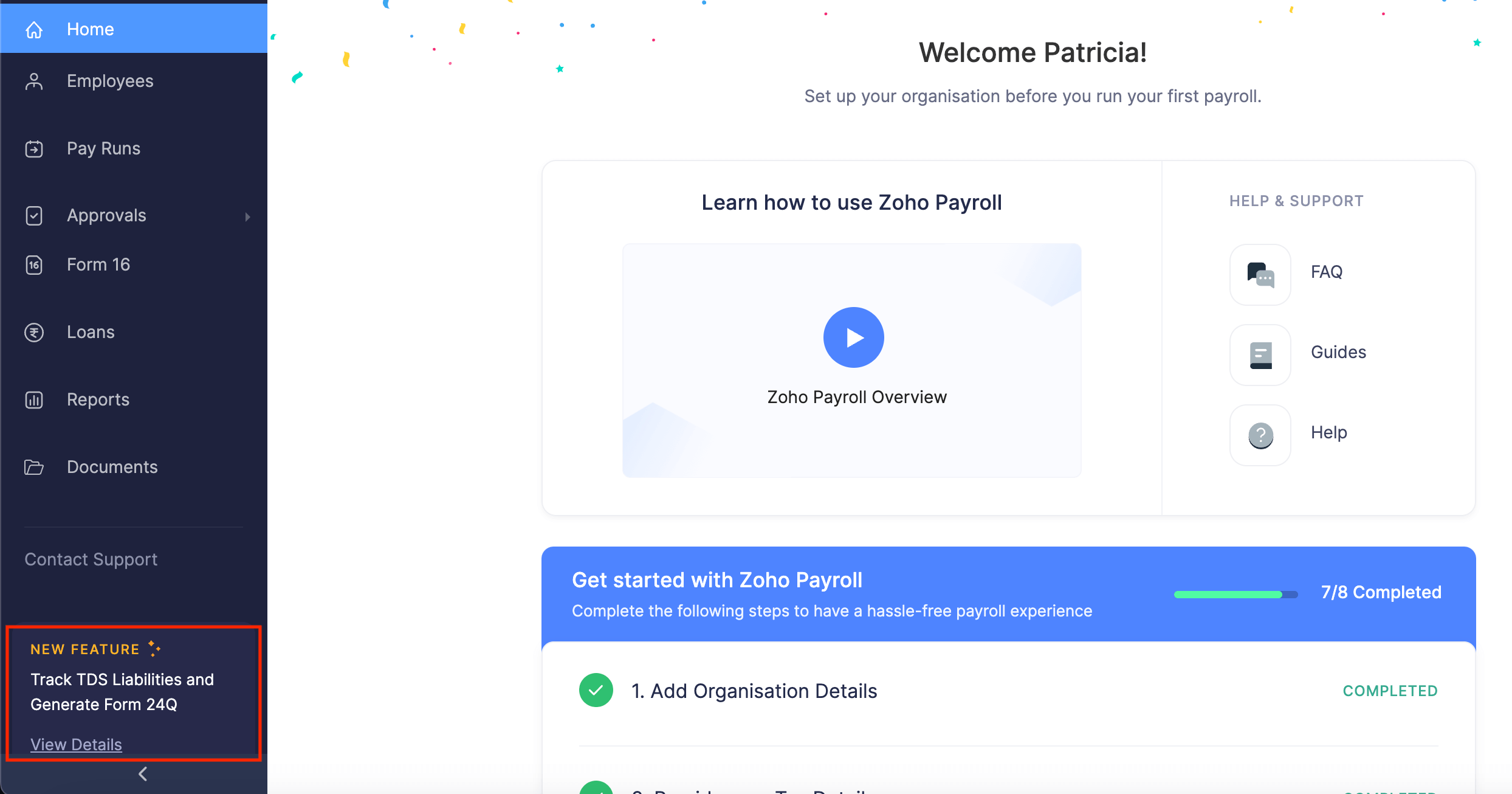

Pre-Requisite: You need to enable the feature first to view the TDS Liabilities, Challans and Form 24Q modules. Click View Details on the left sidebar and click Enable.

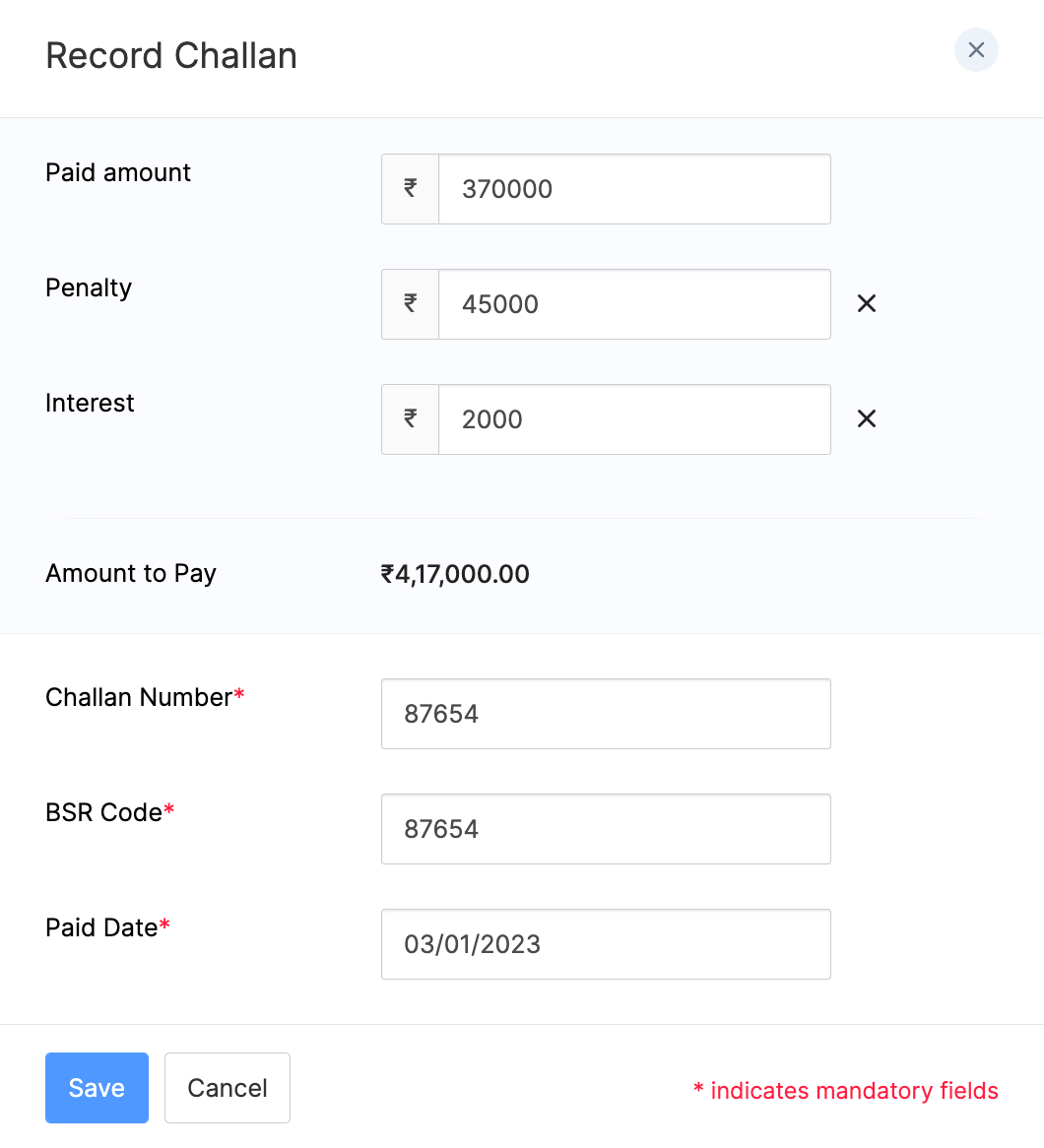

Record Challan

Insight: If you wish to record a challan for liabilities of two or more months, you can use the above method. However, if you wish to record a challan for the liability of a particular month, it is recommended that you do it in the TDS Liability module.

Once you’ve viewed the TDS Liabilities, you can record the challan for it. Here’s how:

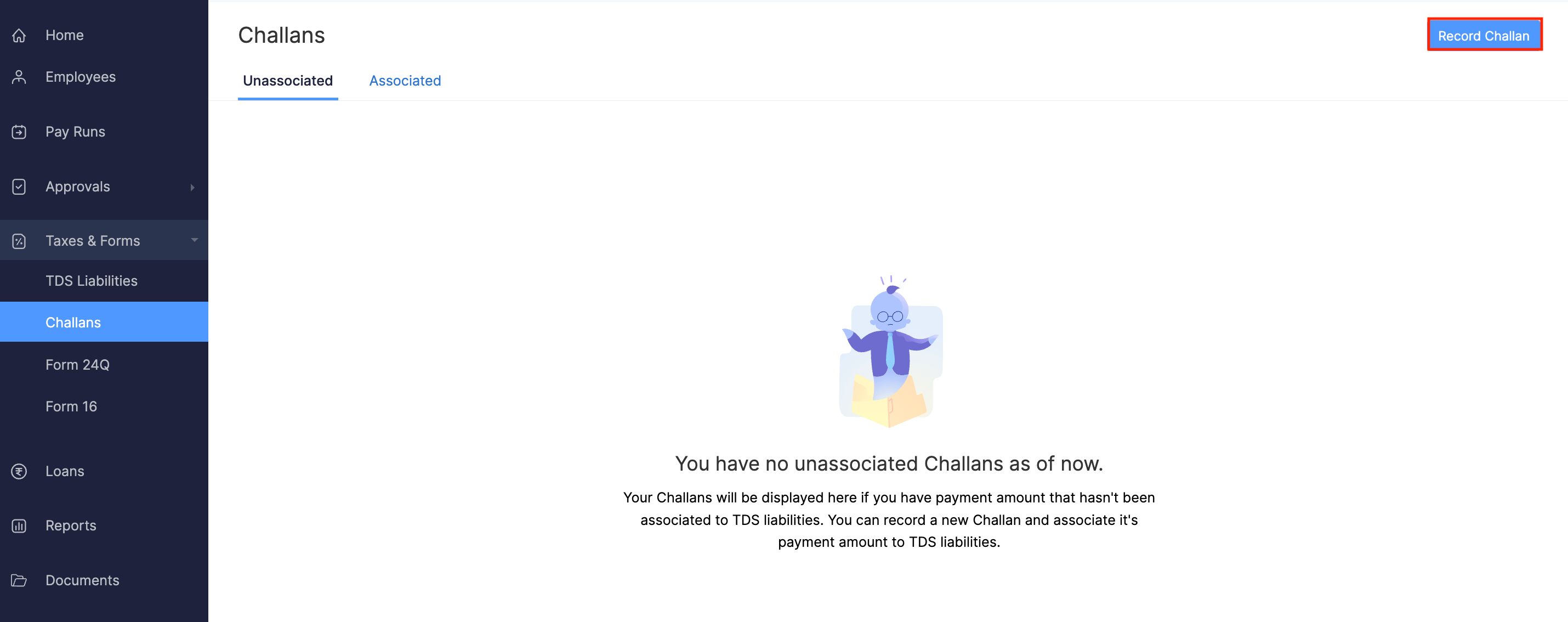

- Go to Taxes and Forms on the left sidebar and click Challans.

- Click Record Challan in the top right corner.

- Enter the amount you’ve paid.

- Click + Add Interest if you’ve failed to deduct TDS for this liability or to pay whole or part of the tax to the Government after deducting, if any.

- Click + Add Penalties for any delay in TDS Return filing.

- Enter the Challan Number, BSR Code (Branch Code) of the challan and the date on which you paid the amount.

- Click Save.

A challan will now be created for the TDS liability and you can view the details in the Unassociated tab.

Import TDS Liabilities of Employees

You can import the TDS liability details of employees, such as the Employee Number, Liability Period, and TDS amount. To import:

- Go to Taxes and Forms on the left sidebar and click Challans.

- Switch to the Unassociated tab.

- Click View Details.

- Click Import Data.

- Upload the CSV, TSV, or XLS file and click Next.

- Map the Zoho Payroll fields with Import Fields and click Import.

The TDS liabilities will be imported into Zoho Payroll. You can then associate the TDS Liabilities to the challans.

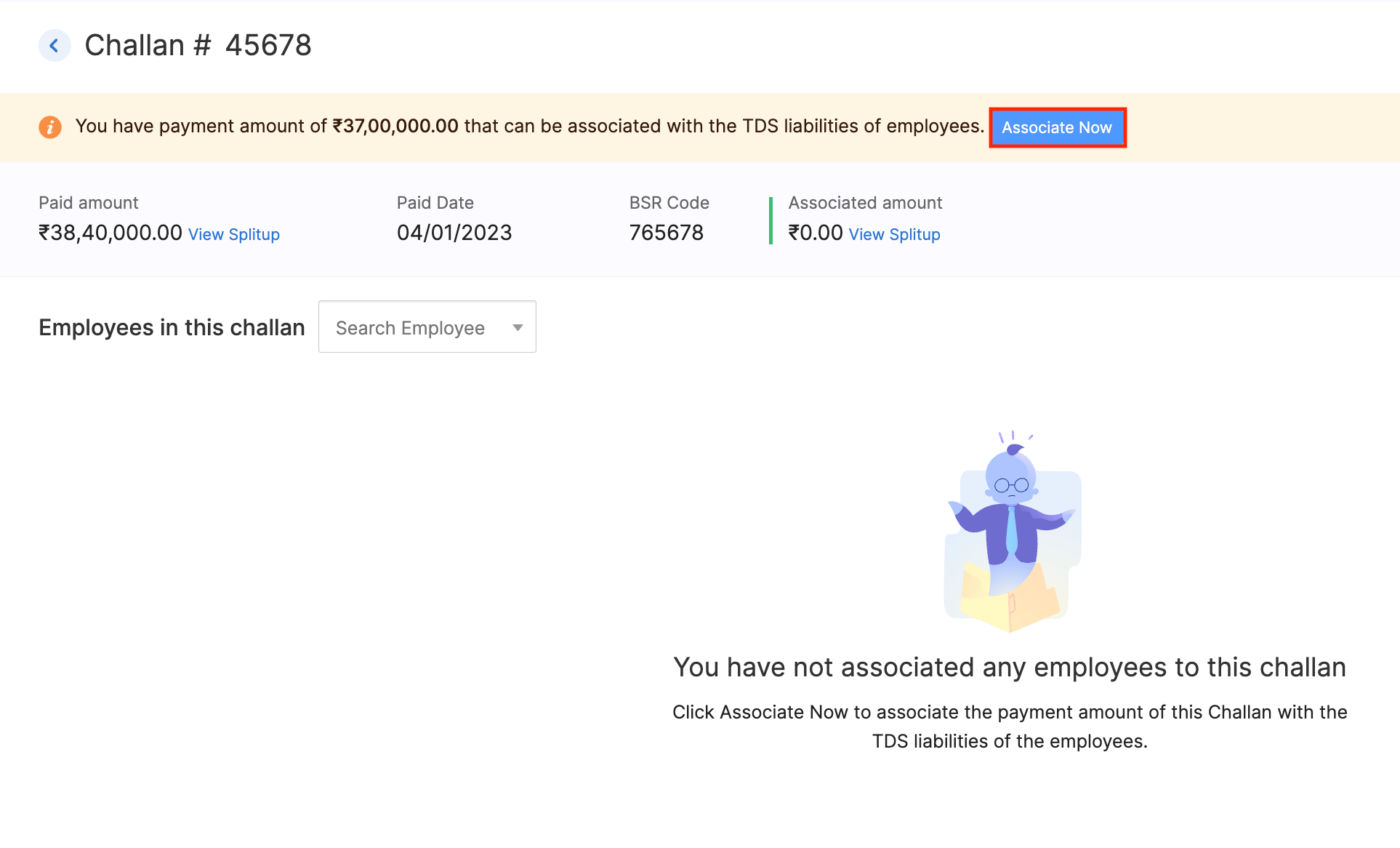

Associate Employees to Challan

Once you’ve recorded a challan, you can associate the pending liabilities of employees to the challan of any given period.

Insight: Click View Split Up next to the Paid Amount to view a breakdown of the challan.

To associate employees:

- Go to Taxes and Forms on the left sidebar and click Challans.

- Switch to the Unassociated tab.

- Click View Details.

- Click Associate Now.

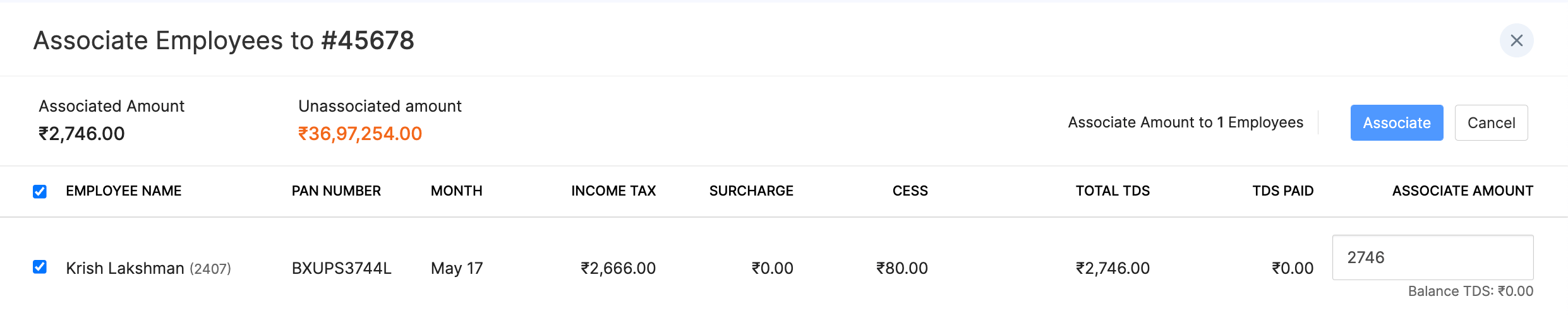

- Select an employee and enter the amount you want to associate. You can view the balance TDS under this field under the amount you enter.

- Click Associate.

You’ve now associated the challan payment amount to the TDS liability of the employee. If you’ve associated the full amount to the TDS liabilities, you can view the challan in the Associated tab. If you’ve partially associated the amount to the TDS liabilities, you’ll be able to view the challan in the Unassociated tab.

Insight: Click View Split Up next to the Paid Amount to view a breakdown of the challan.

You can filter the employees associated to the challan based on period and work location.

Note: If you want to delete the pay run after recording the challan, you’ll first have to delete the associated challan from the pay run.

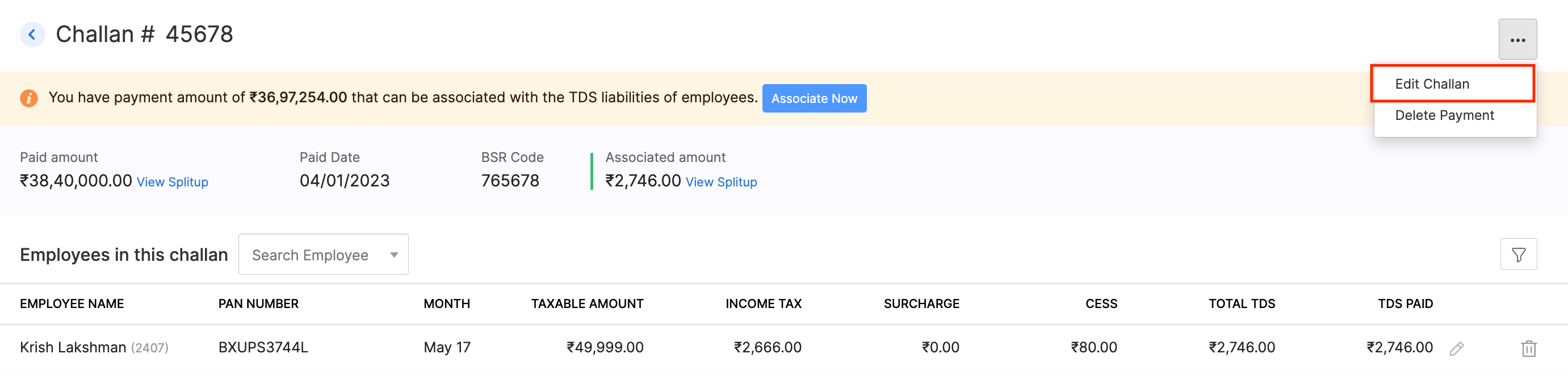

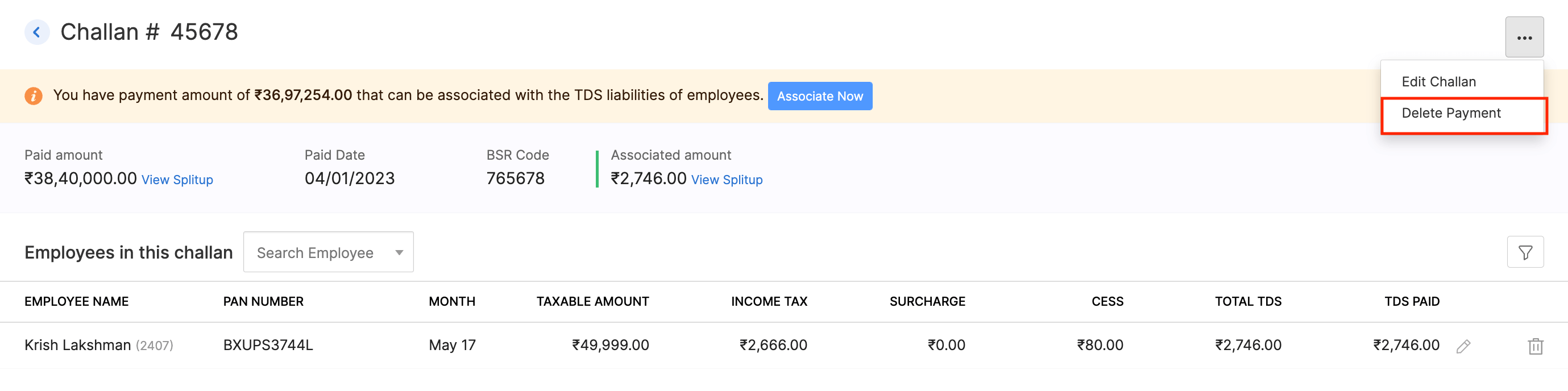

Edit Challan

If you want to make changes to a challan you’ve recorded, you can edit the challan. You can edit challans that have been associated to TDS Liabilities and the ones that have not been unassociated. Here’s how.

- Go to Taxes and Forms on the left sidebar and click Challans.

- Switch to the Unassociated or Associated tab.

- Click the More icon in the top right corner and click Edit Challan**.**

Pro-Tip: To edit the TDS Paid for an employee, you can click the Edit icon next to the employee details. However, if you wish to unassociate the employee from the challan, click the Delete icon next to the employee.

- Make the necessary changes and click Save.

Delete Challan

You can delete a challan if needed. Here’s how:

- Go to Taxes and Forms on the left sidebar and click Challans.

- Switch to the Unassociated or Associated tab.

- Click the More icon in the top right corner and click Delete Payment.

- Click Delete.

Warning: Deleting a challan that has been associated to multiple TDS liabilities will remove it for all months, not just one.

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!

Zoho Payroll's support is always there to lend a hand. A well-deserved five-star rating!