- HOME

- Multichannel Selling

- Best multichannel eCommerce platforms, marketplaces and channels

Best multichannel eCommerce platforms, marketplaces and channels

The best multichannel eCommerce platforms depend on product category fit and operational needs. Amazon dominates with 310 million customers (electronics, home goods), eBay serves 134 million buyers (collectibles, refurbished items), Etsy reaches 96 million shoppers (handmade, vintage items), and Walmart Marketplace offers 120 million monthly visits (household essentials).

Consider this: You run a home decor business, making $500,000 annually. You're evaluating 15 sales channels. But spreading across all 15 isn't ideal for good business performance. The real question isn't "Should I be everywhere?" it's "Which two to three channels match my products and capabilities?"

What are the best multichannel eCommerce marketplaces?

Top 7 multichannel eCommerce marketplaces

Amazon: 310M customers, 8–20% fees, electronics and standardized products

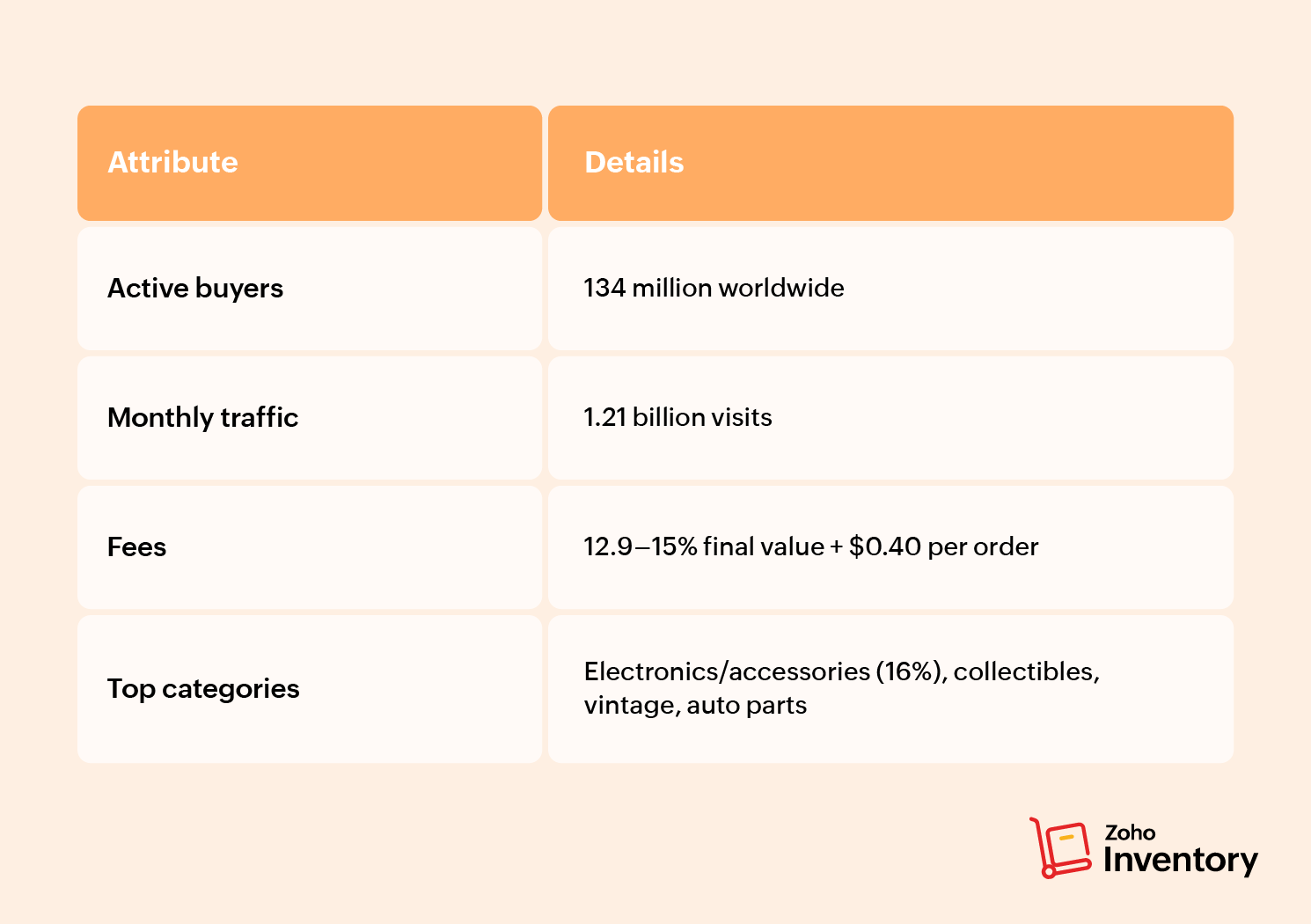

eBay: 134M buyers, 12.9–15% fees, collectibles and refurbished items

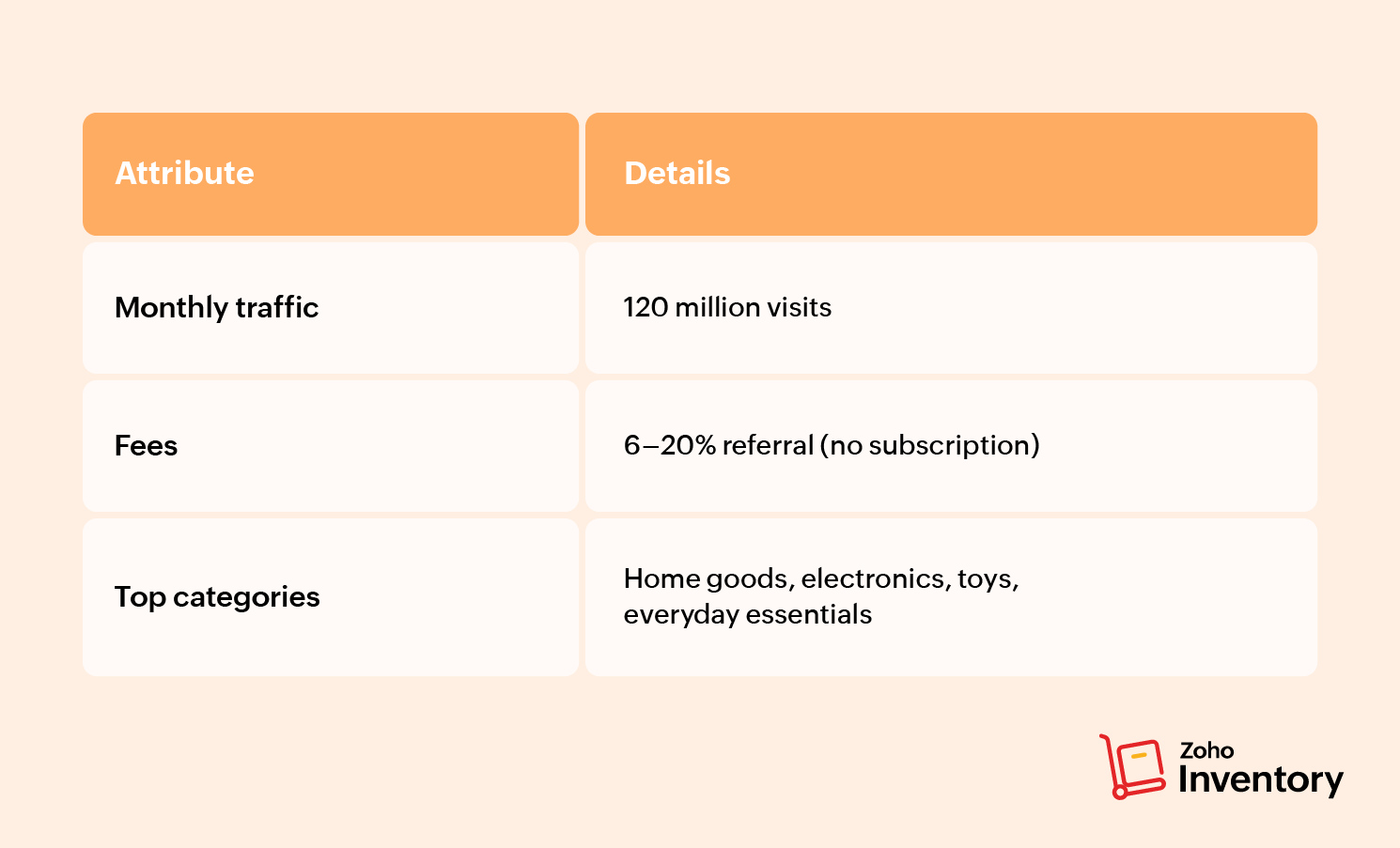

Walmart marketplace: 120M monthly visits, 6–20% fees, household essentials

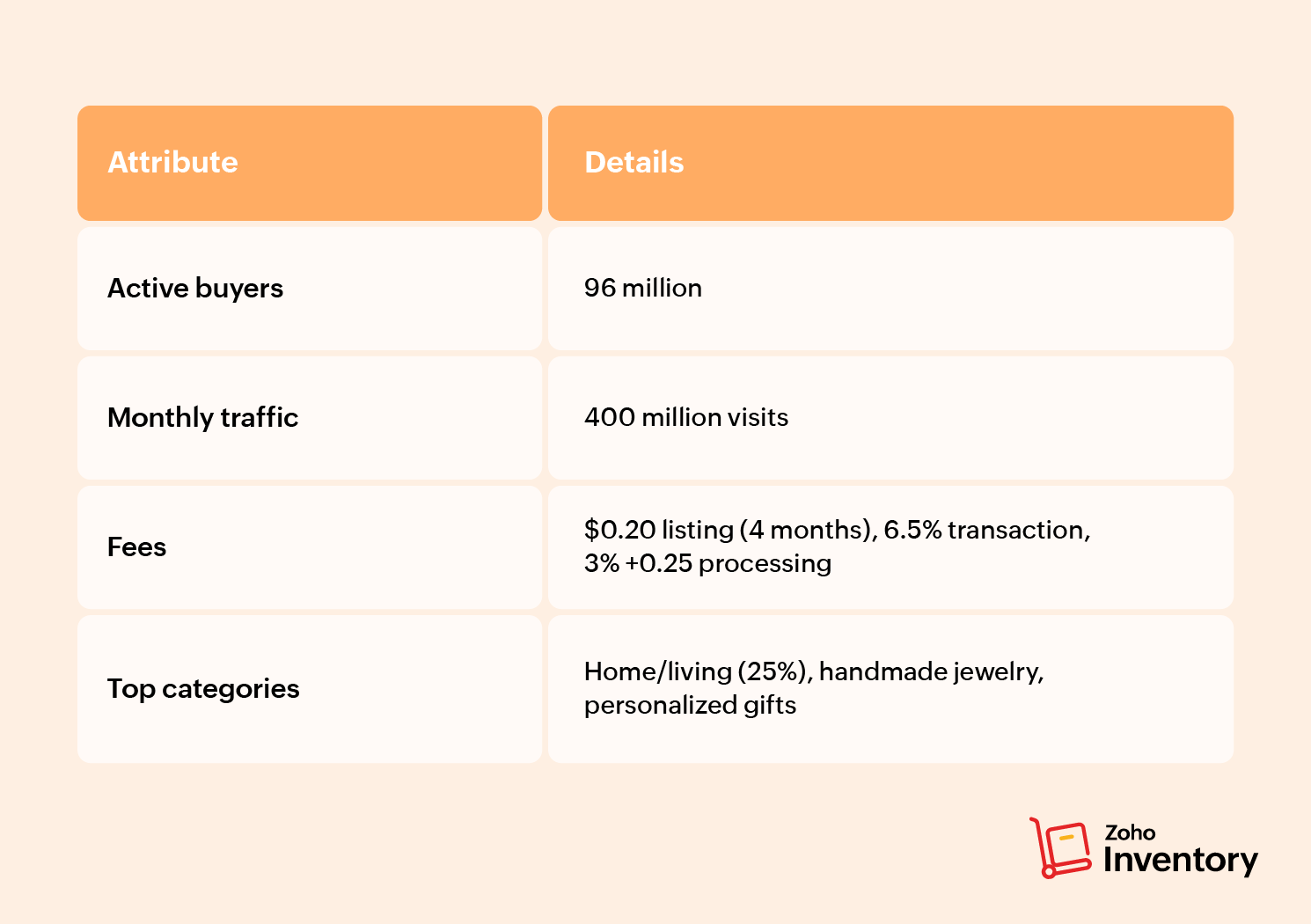

Etsy: 96M shoppers, 6.5% fees, handmade and vintage only

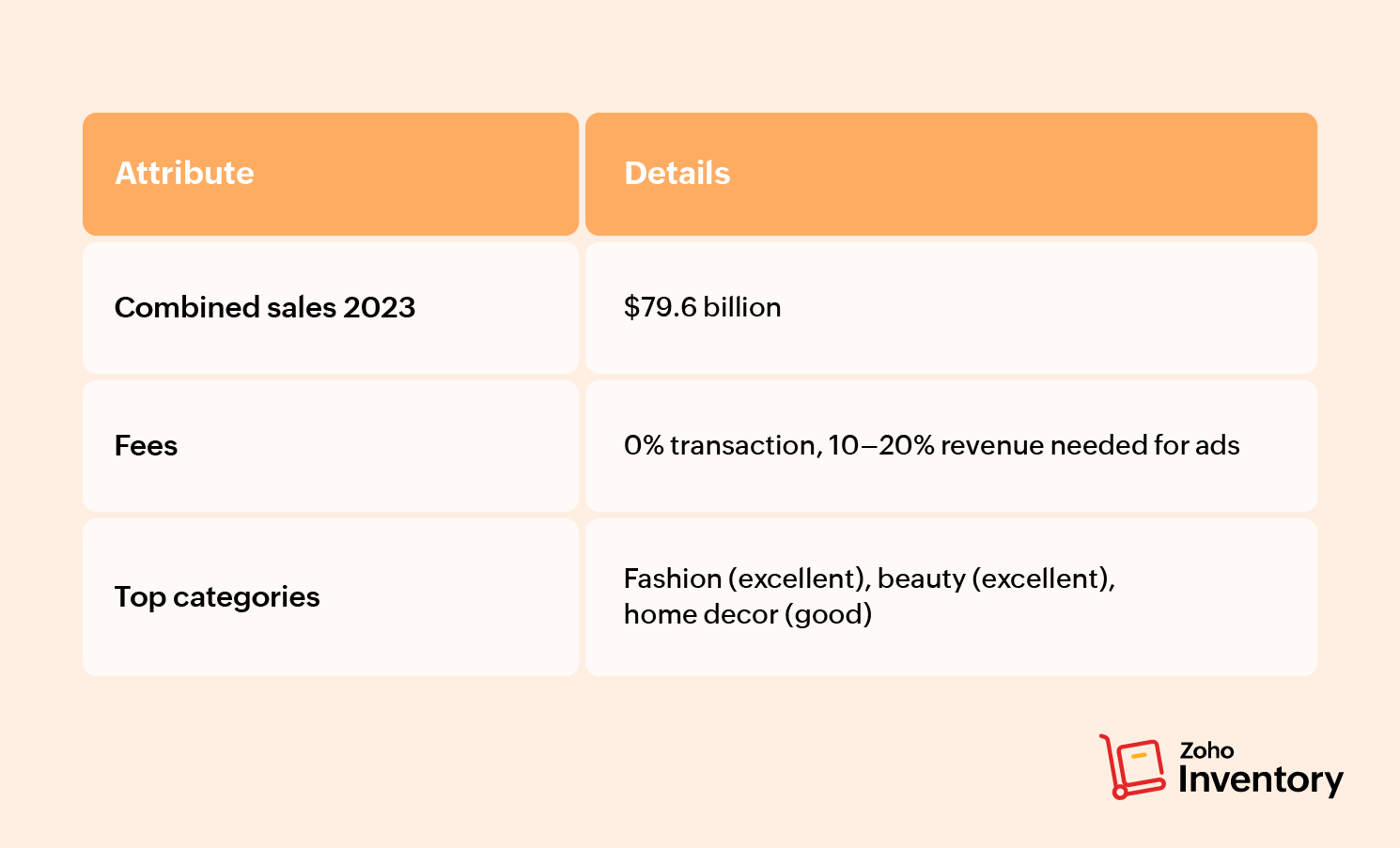

Facebook/Instagram: $79.6B sales 2023, social commerce

TikTok shop: Fast growth, entertainment-driven impulse purchases

Google shopping: High intent traffic, channel amplifier

1. Amazon - Best for high-volume sales and electronics

The buy box captures 82% of sales because 78% of Amazon traffic comes from mobile devices, where only the buy box winner displays prominently. Getting it requires competitive pricing (within 5% of the lowest offer), fast shipping through FBA, and 95% or higher performance ratings.

Amazon's combined fees typically consume 15–35% of gross revenue, varying by product size and category. Advertising costs add 10–25% of revenue to maintain visibility because Amazon's algorithm increasingly prioritizes paid placements.

2. eBay - Best for collectibles and refurbished items

eBay buyers hunt for items they can't find elsewhere, like rare collectibles, second-hand goods, refurbished electronics, and auto parts. While the platform does use auctions, 88% of transactions happen through a "buy it now" option. The buyer base declined, but niche sellers face less competition than Amazon. Generic products available on Amazon also rarely work in comparison. Buyers come to eBay specifically for items unavailable elsewhere.

The platform skews older; 68% of US visitors use desktop computers and research extensively before purchasing.

3. Etsy - Best for handmade and vintage

Etsy enforces strict policies: handmade by seller, vintage (20+ years old), or craft supplies only. Mass-produced items and dropshipping gets banned.

It's reported that 30% of gross merchandise sales come from custom orders. Buyers accept one to three week processing times compared to Amazon's two-day expectation.

4. Walmart marketplace - Invitation-only platform

This marketplace requires approval and has strict requirements. To sell on the marketplace, businesses must be US-based and follow on-time delivery and two-day shipping requirements. Approximately 160,000 active sellers (92% fewer than Amazon) use the platform. Products priced below Amazon equivalents perform best. Sellers need less advertising spend because Walmart's algorithm weighs product relevance and price competitiveness more heavily than paid placements.

5. Facebook and Instagram - $79.6B in 2023 sales

Organic reach dropped for business pages as Meta's algorithm prioritizes paid content and personal posts. The platform monetizes by limiting organic business reach, forcing advertising purchases. Video content generates more reach than static posts because Meta rewards formats competing with TikTok.

6. TikTok shop - Entertainment-first selling

Success comes through creator partnerships, not search optimization. One video from a creator with 500,000 followers can move 2,000 units overnight. Fees run 2–8% depending on the category. Regulatory uncertainty continues into the end of 2025. Use it as one channel in a diversified strategy, not as the foundation.

7. Google shopping - High-intent traffic driver

Pay-per-click advertising ($0.50–$5.00 depending on category) drives traffic to your sales channels. It's not a marketplace where transactions occur. Products with competitive pricing and clear specifications convert at 2–3% for electronics and 1.5–2.5% for fashion. It works as a traffic amplifier, not a standalone platform.

What types of multichannel ecommerce platforms exist?

Inventory-first systems (designed for operations)

When a product sells, inventory updates everywhere simultaneously. Sales at 2:47 PM trigger updates across all channels by 2:47:02 PM through direct APIs. You pay flat fees based on order volume, not revenue. Solutions like Zoho Inventory provide centralized inventory with multichannel selling. The trade-off is basic marketing features compared to eCommerce-first platforms.

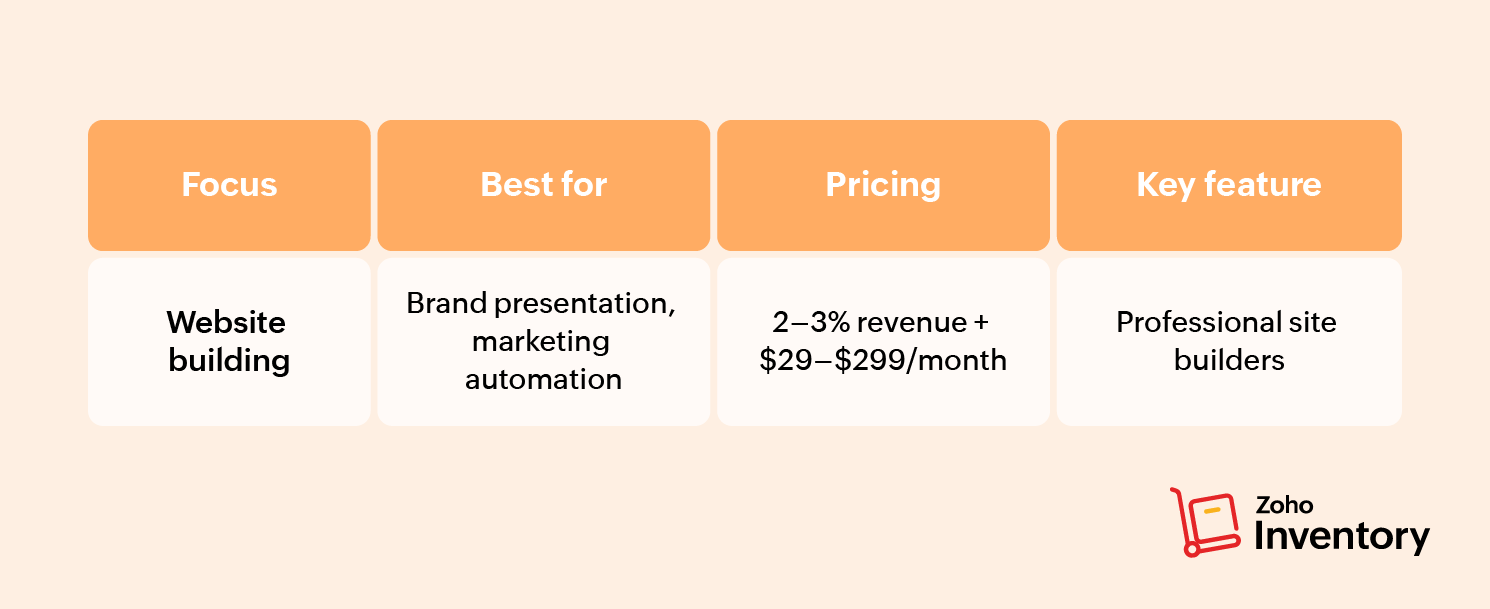

eCommerce-first platforms (designed for marketing)

Websites serve as a primary channel here. Multichannel capabilities depend on third-party apps with 15–60 minute sync delays. This type of platform excels at brand presentation and marketing automation. Costs scale with revenue. For example, $500K monthly = $10K–15K in platform fees.

Dedicated multichannel software

Specialized marketplace tools cost $500–2,000 monthly. This makes sense only if a business has $1M+ revenue where efficiency gains justify the cost. It provides bulk listing tools and repricing automation but requires separate systems for inventory management.

Understanding platform categories helps match technology to your business stage. But choosing the right sales channels matters more than choosing software. The best technology can't fix poor channel selection.

How to choose the right eCommerce channels for your products

Channel selection depends on product fit, customer behavior, and operational capacity. Wrong channels cost money through fees and lost time. But more importantly, they cost you opportunities. Time spent fighting the wrong channel means time not spent growing on the right channel.

Some businesses spread themselves across five channels and wonder why none work well. Others focus on two perfect-fit channels and dominate. Guess which approach builds more revenue?

Product-to-channel fit matrix

An "excellent" rating means the channel actively attracts buyers for that category. A "poor" rating indicates structural disadvantages. You can find successful sellers in any poor-fit category, but they're succeeding despite the channel, not because of it.

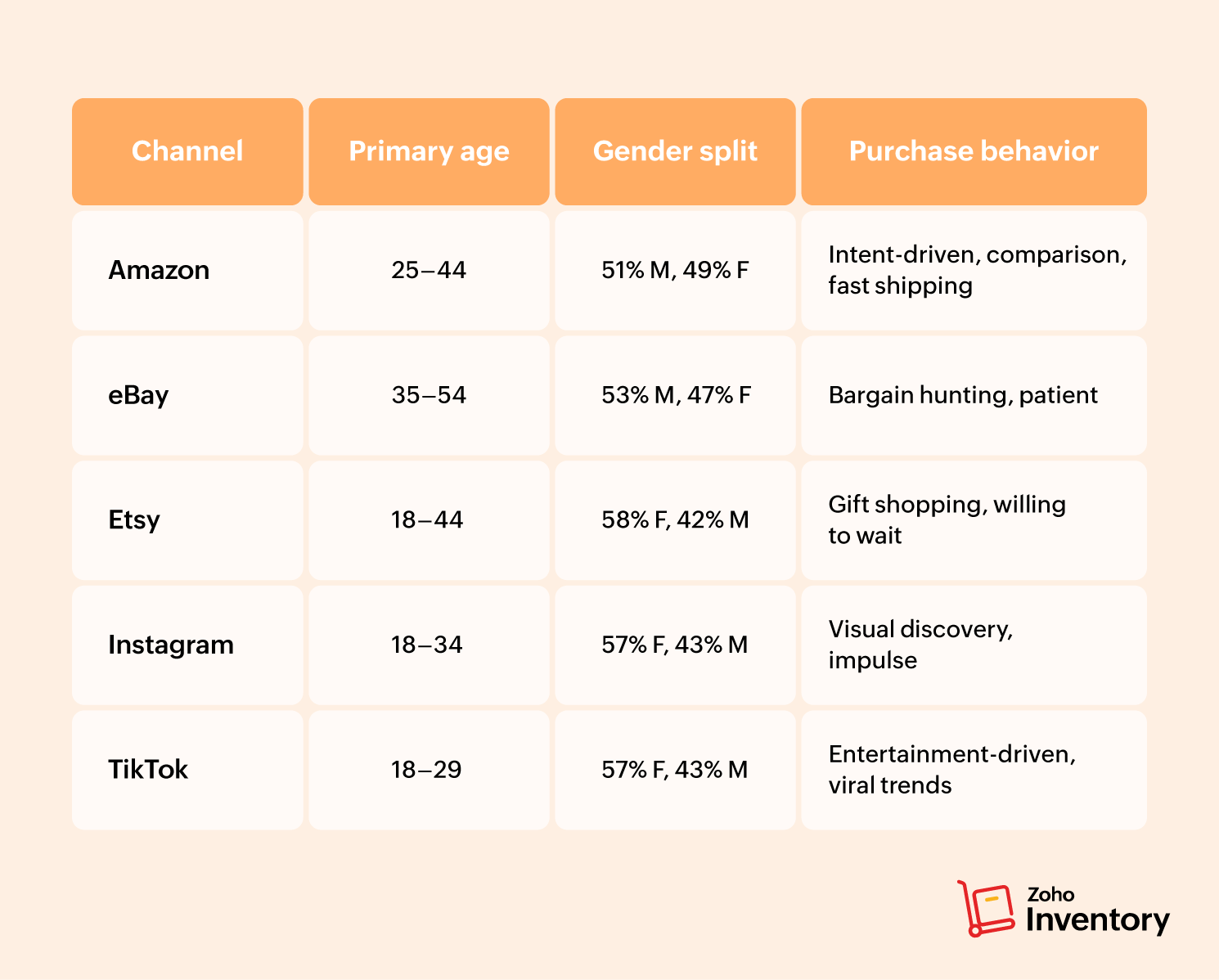

Product fit determines which channels can work. Customer demographics determine which channels will work.

Channel audience demographics

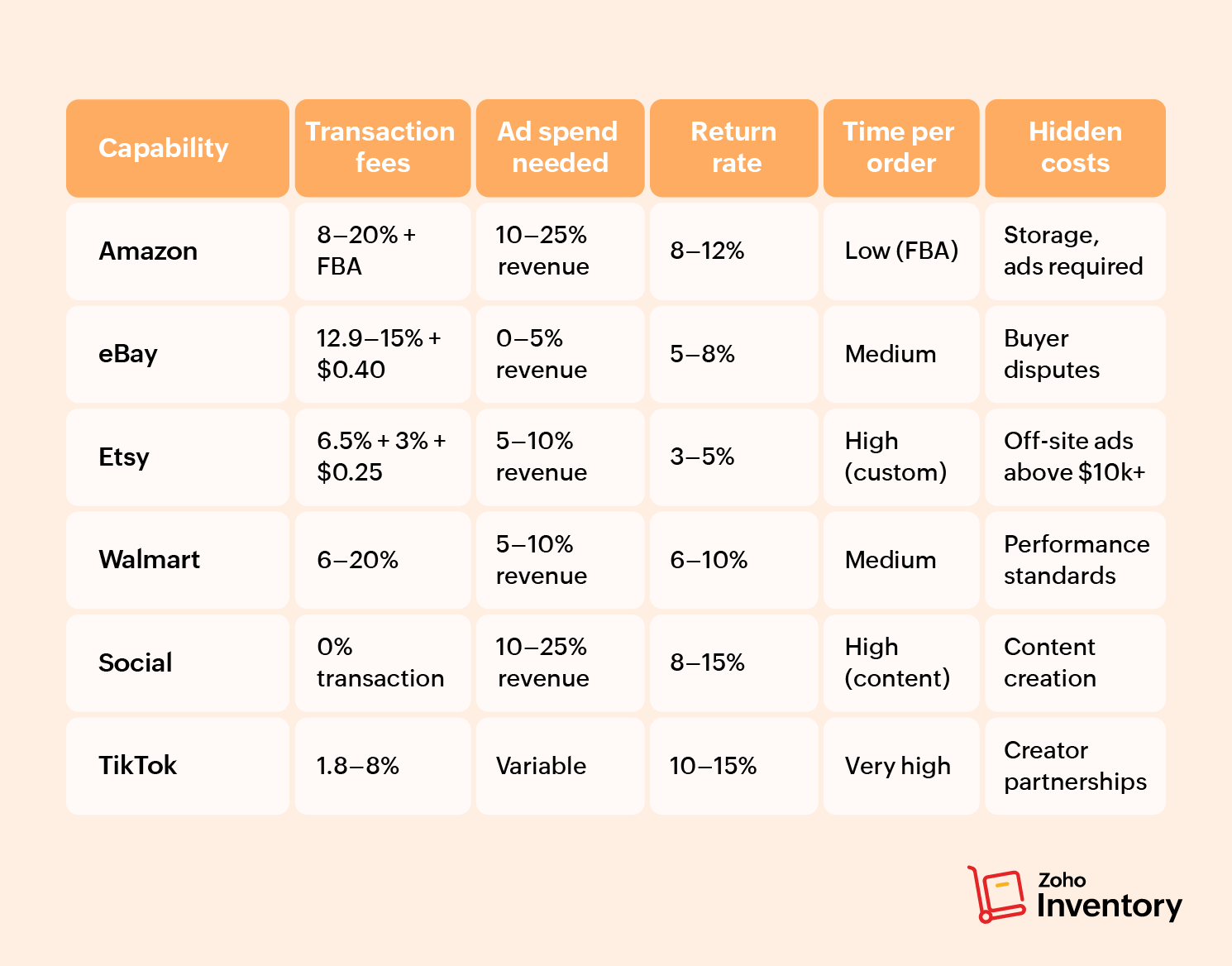

True channel costs

Calculate this:

True cost = Product cost + Channel fees + Advertising + Shipping + (Returns × Rate) + Time cost

Channels with lower transaction fees sometimes cost more overall. Amazon charges 15% fees but delivers traffic. Social commerce charges 0% transaction fees but requires 10–15 hours weekly creating content and 15% of revenue in advertising.

These cost realities dictate your channel expansion sequence. Adding channels before current ones generate profit compounds losses.

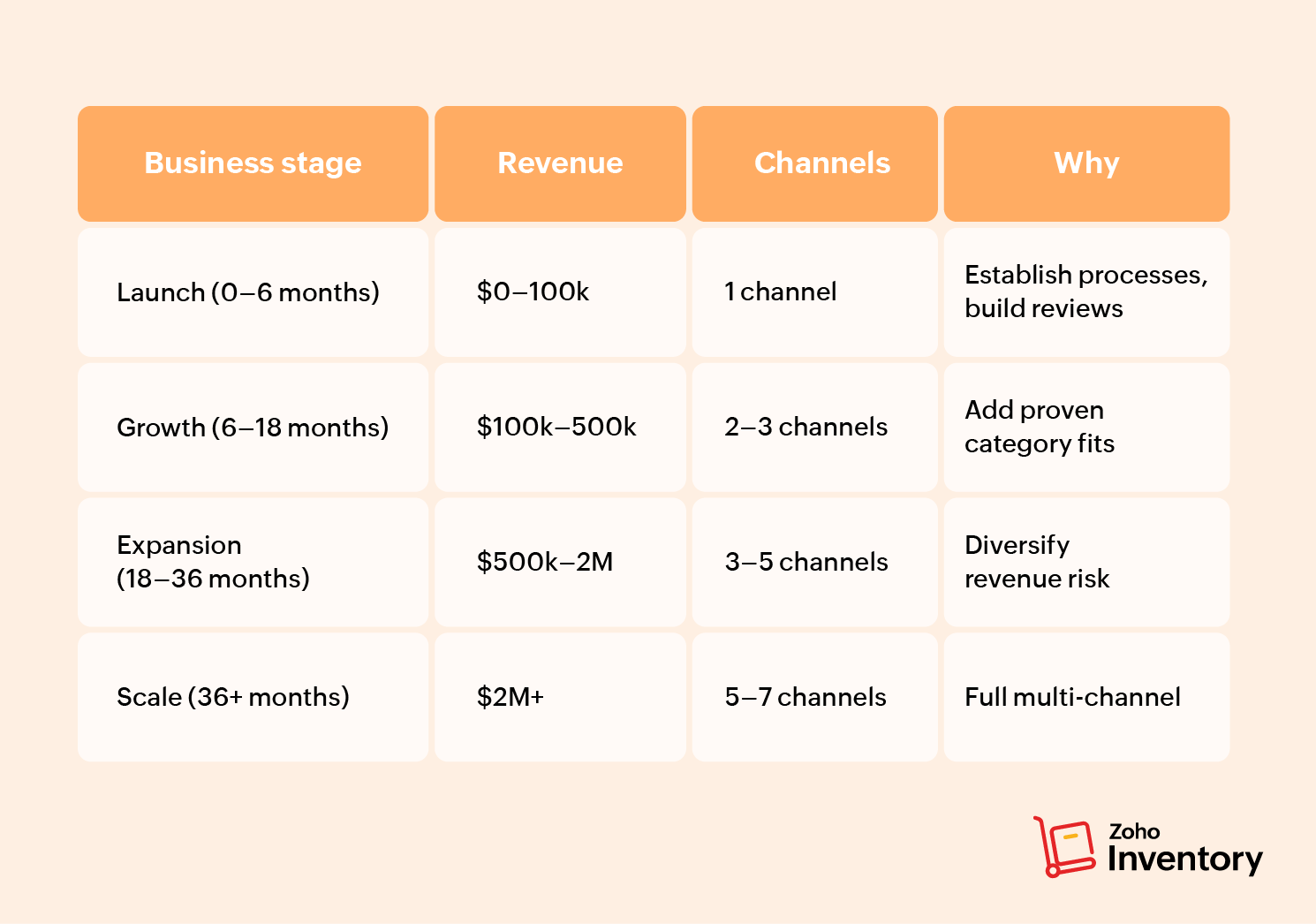

Recommended channel progression

Each channel needs 10–20 hours weekly. Add channels only when current ones run smoothly.

Getting started with multichannel selling

Multichannel selling expands reach when done systematically. The decisions you make now determine profitability and operational complexity for two to three years.

Here's your framework:

Match products to channels: Use the selection matrix to identify which two to three channels naturally attract your buyers.

Calculate real costs: Include transaction fees plus advertising, time, and returns. Some "low-fee" channels cost more overall.

Pick the right tech: Consider inventory-first solutions for operations complexity, and eCommerce-first for marketing sophistication.

Launch one channel first: Establish excellence before adding complexity.

The businesses that win do two things consistently: they choose channels where products naturally fit the customer base, and they implement systems managing inventory centrally across all channels.

Your next step? Pick one channel, list your first 10 products, and process your first 30 orders. You'll learn more from those 30 orders than from planning. The data from real sales (which products convert, what pricing works, and how customers behave) informs every decision about channel expansion.

Multichannel eCommerce isn't about being everywhere. It's about being in the right places with systems that let you operate efficiently.

Frequently Asked Questions

Start with a single marketplace like Etsy or eBay, not a website. They provide built-in traffic with minimal technical knowledge required. Etsy works for handmade items ($0.20 per listing, $100–300 startup cost). eBay works for reselling or collectibles (no monthly fees; list 250 items free). Wait until you hit 5,000 monthly sales for three months before adding channels or building a website.

Not necessarily. Choose inventory-first platforms (like Zoho Inventory) when inventory complexity drives operations: multiple warehouses, B2B sales, and manufacturing. Choose eCommerce-first platforms when website experience drives sales: brand presentation and content marketing. If a business has under $500k revenue, one platform handling everything works fine. For anything above $1M, specialized systems often make sense.

Three pricing models exist.

Flat monthly: $50–$500 based on order volume (inventory-first systems).

Percentage: 2–3% of GMV plus $29–$299 monthly (ecommerce-first).

Hybrid: $500–$2,000 monthly plus 0.5–1% GMV (dedicated multichannel).

Total platform costs typically run 3–7% of revenue, including software, integrations, and payment processing.

Yes. Inventory-first platforms like Zoho Inventory connect directly through APIs, syncing inventory in real time across all channels. When a product sells on Amazon, inventory updates immediately on eBay and Etsy. The limitation? Channel-specific features need individual attention. Expect 15–30 minute sync delays during high-volume periods. This system works well for businesses with under 500 SKUs.

eCommerce-first platforms treat your website as the primary channel, adding marketplaces through apps. They're better for brand presentation.

Dedicated multichannel software focuses exclusively on marketplace operations with bulk listing tools and repricing automation. There's no website building. Inventory-first platforms prioritize stock tracking with built-in multichannel support. Most businesses under $1M need only one system.

Start with marketplaces when products are commoditized, margins are under 40%, or startup capital is limited (under $5,000). Marketplaces provide immediate traffic but charge 8–20% fees. Start with a website when products are unique, margins exceed 50%, or brand building matters long-term. Most successful businesses eventually run both. Test product-market fit on marketplaces first (months 0–6).

Choose inventory-first when you operate multiple warehouses, run B2B and B2C simultaneously, manufacture products, or manage over 1,000 SKUs. Choose eCommerce-first when your website drives 60%+ of revenue, marketing automation matters, or brand presentation affects decisions. The test: if inventory errors cost more than lost website conversions, choose inventory-first. Otherwise, choose eCommerce-first.

Start with one channel matching your product. Etsy, if selling handmade or vintage items. eBay if selling collectibles or refurbished items. Amazon, if selling new products with existing demand (requires higher investment). Add a second channel only after achieving 30+ orders monthly for three months, a 4.5+ average star rating, a 20%+ net margin, and documented processes.