Online Payments

Zoho Invoice is integrated with major online payment gateways to help you receive payments for your invoices online. This ensures faster and hassle free receipt of payments and further automates your cash flow and its book keeping. To set up a payment gateway, click the gear icon on the top right and select Integrations. Now choose Online Payments. You’ll find the list of payment gateways that Zoho Invoice supports.

When you integrate a payment gateway with your Zoho Invoice organization, your merchant account information will be shared with the gateway. Zoho Invoice will store only the last four digits of your customer’s card details.

Payment Gateways

Click on a payment gateway to find out how you can use it along with Zoho Invoice.

- Zoho Payments

- Stripe

- PayPal

- Square

- Authorize.net

- Payflow Pro

- Payments Pro

- 2 Checkout

- Braintree

- CSG Forte

- ACH Payments

Stripe

Integrate with Stripe and receive payments from your customers through their credit card and bank account details.

You can set up Stripe and receive payments from your customers using two different methods:

1. Credit Cards

Integrate your organization with Stripe and charge your customer’s credit card to receive payments. Learn more.

You can view the list of countries supported by stripe in this page. The online transaction fees will depend upon the charges specified by Stripe.

2. Bank Accounts using Stripe ACH (Global and US editions)

With Stripe ACH, you can charge your customer’s bank account (only for US customers) to receive payments. Learn more.

Square

To integrate your Zoho Invoice organization with Square:

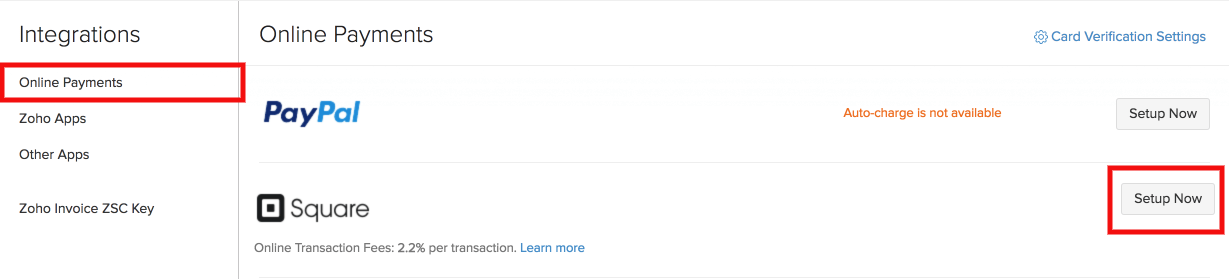

- Click on the gear icon on the top right corner and select Integrations > Online Payments.

- Click on the Setup Now button next to Square.

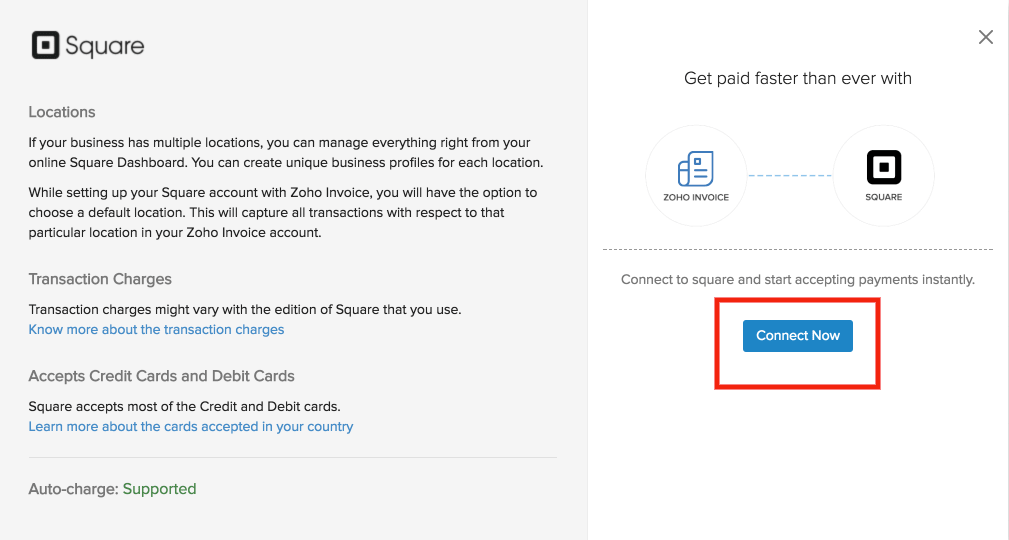

- A dialogue box opens up asking you to connect with square. Click on the Connect Now button.

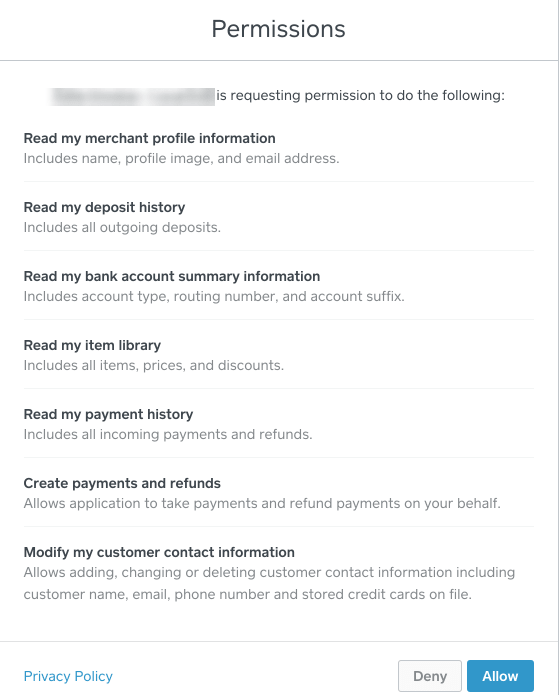

- You will be taken to the page where you will have to enter the square payment gateway credentials. Do so and click on the Sign In button.

- Another dialogue box asks for the permission to be granted for the integration process to continue. Click on the Allow button.

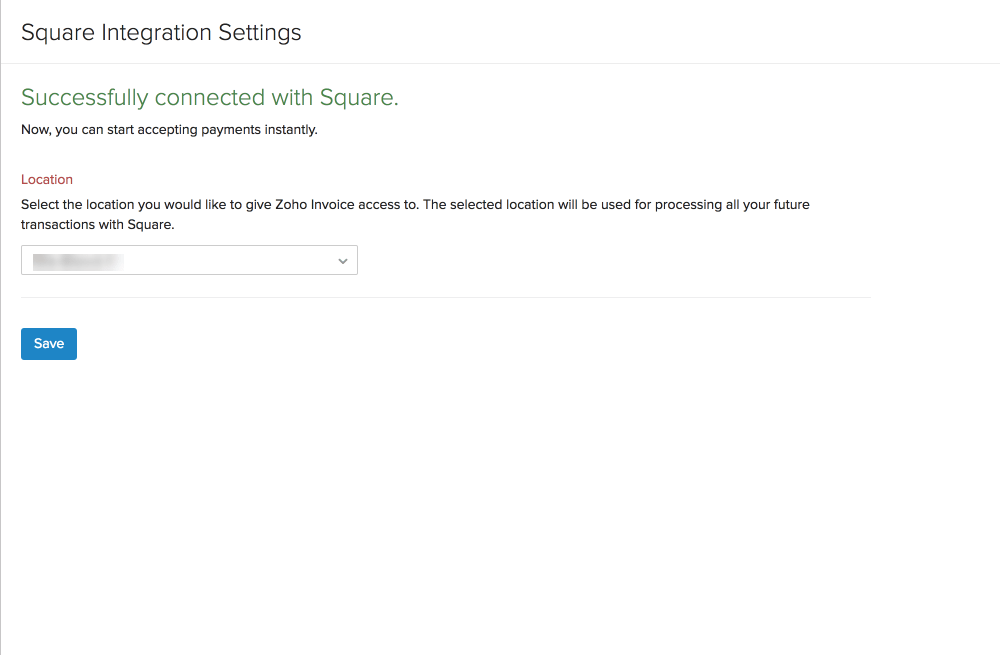

- After clicking on Allow, the page redirects to your Zoho Invoice organization, where you would be asked to choose the location to which you want the payments to be transferred.

- Click on the Save button once you finish choosing the location and then you’re done!

Note: Payments cannot be received via square if the customer’s country differs from the organization’s country. For example, if it’s a US org, transactions raised for any country other than US cannot use Square payment gateway to receive payments.

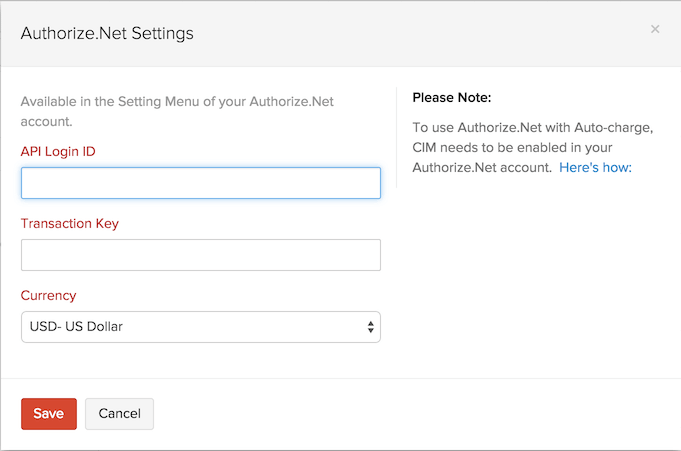

Authorize.Net

To configure Authorize.Net,

Click on the gear icon on the top right hand side corner of the screen and select More Settings.

Go to Integrations and select Online Payments and click the Setup Now button adjacent to Authorize.Net logo.

Enter the following information and click Save.

API LoginID: Enter the API Login ID given to you by Authorize.Net.

Transaction Key: Enter the Transaction Key given to you by Authorize.Net.

Currency: Enter the currency of receipt. Currently Authorise.net supports transactions only in US Dollars (USD), Canadian Dollars (CAD), Euro (EUR), Pound Sterling (GBP).

More information on API Login ID and Transaction Key can be found by clicking here.

Prerequisites for using with Auto-charge in Zoho Invoice

- Customers should have an active Authorize.Net account.

- This account should have been selected with Card Not Present option during account creation.

- Only on the above criteria, the customer will be able to view the CIM (Customer Information Manager) feature in their merchant account.

- CIM needs to be enabled. Once enabled, it will take 24-48 hours for a transaction to happen.

- Do not enable ARB (Auto Recurring Billing) feature provided in Authorize.Net.

Configuring Auto-charge Settings

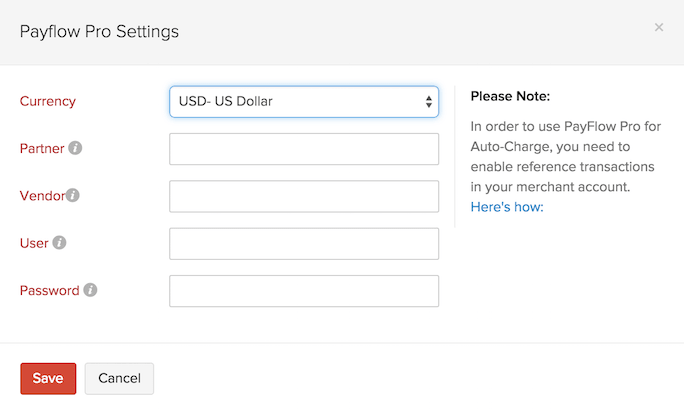

Payflow Pro

To set up Payflow Pro, click on the gear icon on the top right hand side corner of the screen and select More Settings. Go to Integrations and select Online Payments and click the Setup Now button adjacent to Payflow Pro logo. Enter the following information and click Save.

When you register for Payflow Pro, you will receive an email with information like your Partner ID and Vendor name. Please keep that email at hand while filling the details for Payflow Pro.

Then enter the following information and click Save.

Partner: The partner ID as mentioned in your Payflow Pro account.

Vendor: Your vendor name as mentioned in your Payflow Pro account.

User: Enter your Payflow Pro username.

Password: Enter your Payflow Pro password.

Prerequisites for using with Auto-charge in Zoho Invoice

In order to use PayFlow Pro for Auto-charge, you need to enable Reference transactions in their merchant account.

- Login to your PayPal account.

- Navigate to Account Administrator.

- Navigate to Manage Security > Transaction Settings and enable Allow reference transactions.

Configuring Auto-charge Settings

Insight: Countries supported by Payflow Pro: United States, Canada, Australia, and New Zealand.

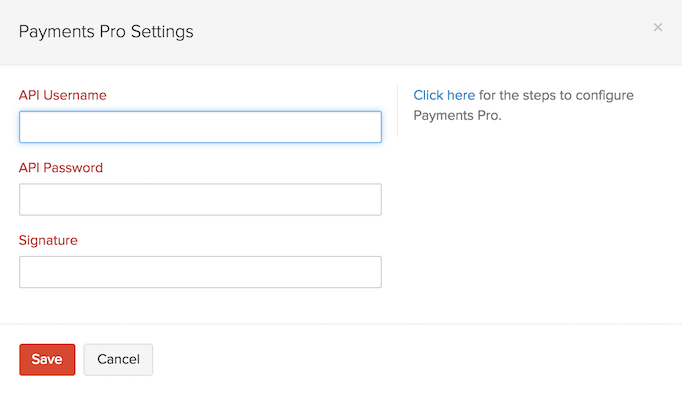

Payments Pro

To set up Payments Pro, click on the gear icon on the top right hand side corner of the screen and select More Settings. Go to Integrations and select Online Payments and click the Setup Now button adjacent to Payments Pro logo. Enter the following information and click Save.

API Username, API Password and Signature

- Login to your PayPal account. Go to Profile and click Request API Credentials under Account Information.

- Choose Set up PayPal API Credentials and Permissions under Option 1.

- Click View API Signature under Option 2.

- Copy the API Username, API password and Signature into corresponding fields in Zoho Invoice.

Insight: Countries supported by Payments Pro: United States, United Kingdom, Canada.

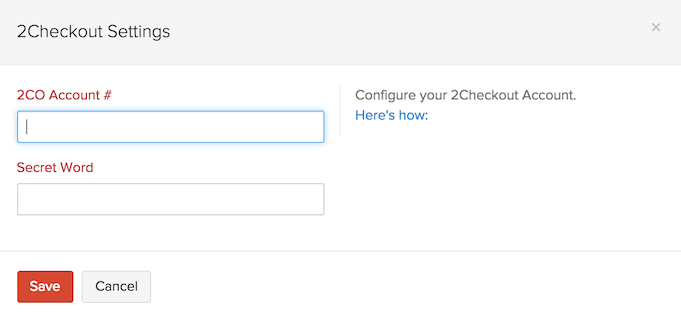

2Checkout

To configure 2CheckOut, click on the gear icon on the top right hand side corner of the screen and select More Settings. Go to Integrations and select Online Payments and click the Setup Now button adjacent to 2Checkout logo. Enter the following information and click Save.

2CO Account No: Enter your 2CO Account number provided to you. Ensure that you configure your 2CheckOut account by logging in to the 2CO control panel.

Secret Word: Enter the Secret word (Password) here.

If you haven’t created a 2Checkout merchant account yet, click here to sign up now.

Tip - Countries supported by 2Checkout: Supports all countries except North Korea, Iran, Sudan, Syria, Cuba, Myanmar (Burma).

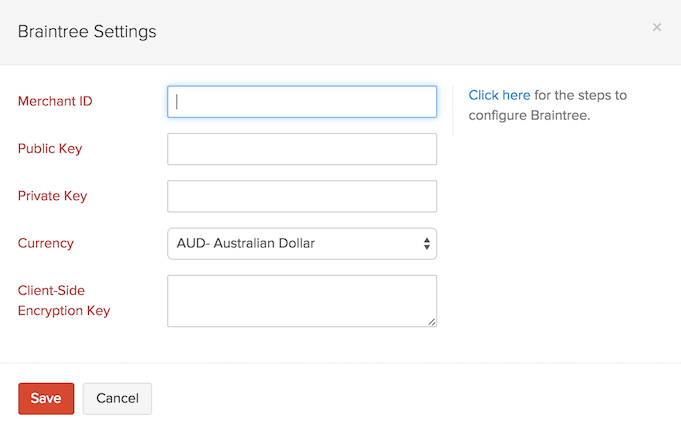

Braintree

To configure BrainTree, click on the gear icon on the top right hand side corner of the screen and select More Settings. Go to Integrations and select Online Payments and click the Setup Now button adjacent to Braintree logo. Enter the following information and click Save.

Merchant ID: Provide you Merchant ID here. Login to your BrainTree gateway account and find this detail in the API Keys section. You will also find the required following Key credentials

Public Key: Enter the Public Key here.

Private Key: Enter the Private Key here.

Client Side Encryption Key: You will need to paste your Client side Encryption Key here. To find this, log into your BrainTree account and click on API Key section provided on the right pane.

Insight: Countries supported by Braintree: Works for United States, Canada, Europe, Singapore, Hong Kong, Malaysia, Australia, and New Zealand.

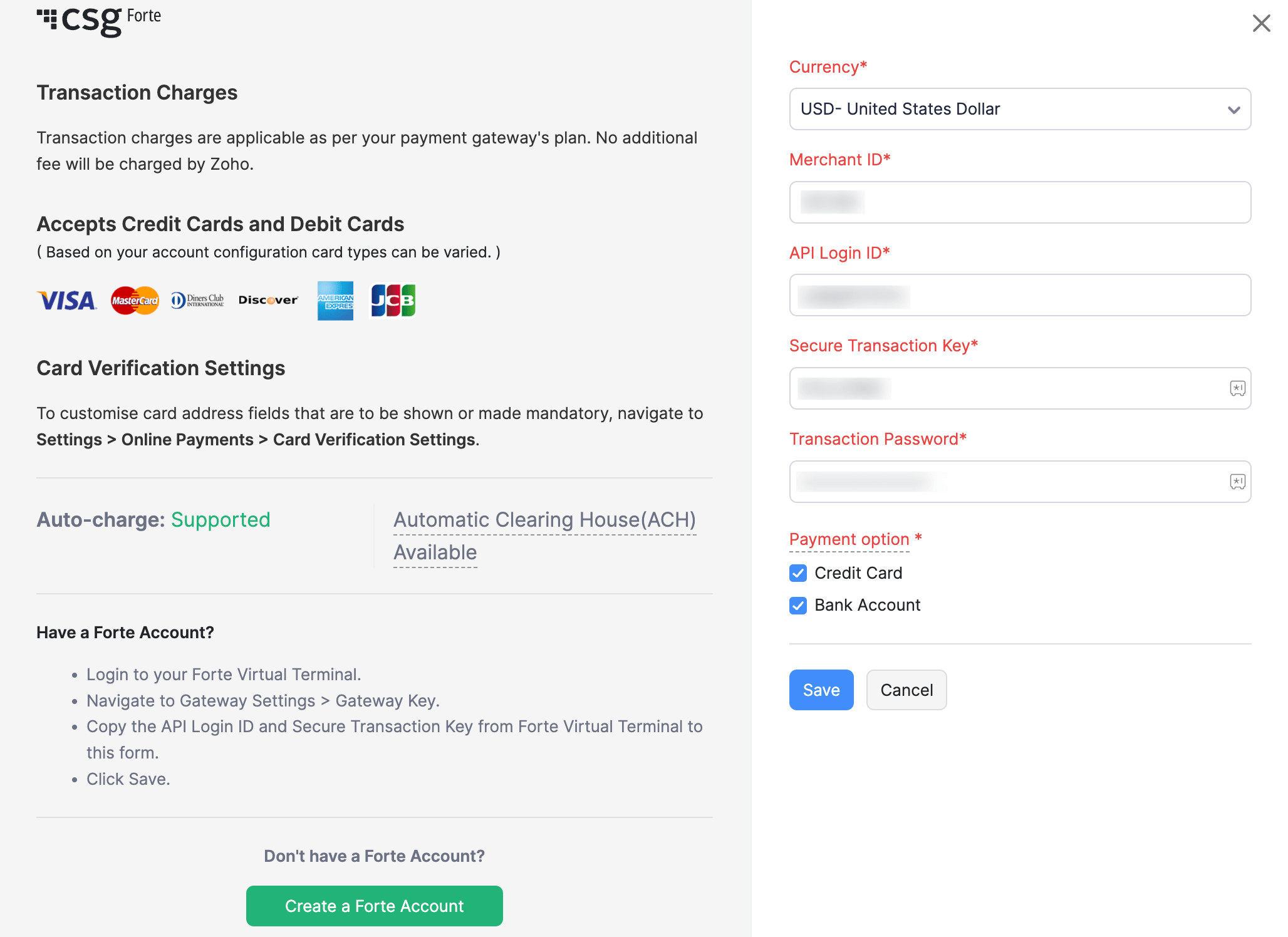

CSG Forte

To set up CSG Forte,

Click the Gear icon on the top right corner of the page and navigate to Online Payments.

Go to CSG Forte and click Set up Now.

Enter the following information:

- Merchant ID: Enter your CSG Forte Merchant ID.

- API Login ID and Secure Transaction Key should be the same as in the CSG Forte Virtual Terminal. You can find your API Login ID and Secure Transaction Key by logging into your CSG Forte Virtual Terminal and selecting Gateway Settings > Gateway Key.

- Transaction Password: Enter the transaction password provided to you by CSG Forte.

- Select the necessary Payment Options.

Click Save.

ACH Payments in Zoho Invoice

Zoho Invoice offers ACH payments via Authorize.net and CSG Forte gateways, payment gateways that specializes in ACH payments. This facility will allow you to debit payments directly from a customer’s authorized bank account.

Authorize.Net for ACH payments

Requirements to be met:-

- You must be a US merchant selling to US customers.

- You must have configured Authorize.Net account for your organization in Zoho Invoice.

- You must have an eCheck account approved by Authorize.Net.

CSG Forte for ACH payments

Requirements to be met:-

- You must either be a US merchant selling to US customers or a Canadian merchant selling to Canadian Customers.

- You must have configured CSG Forte account for your organization in Zoho Invoice.

- You must have Automated Clearing House account approved by CSG Forte.

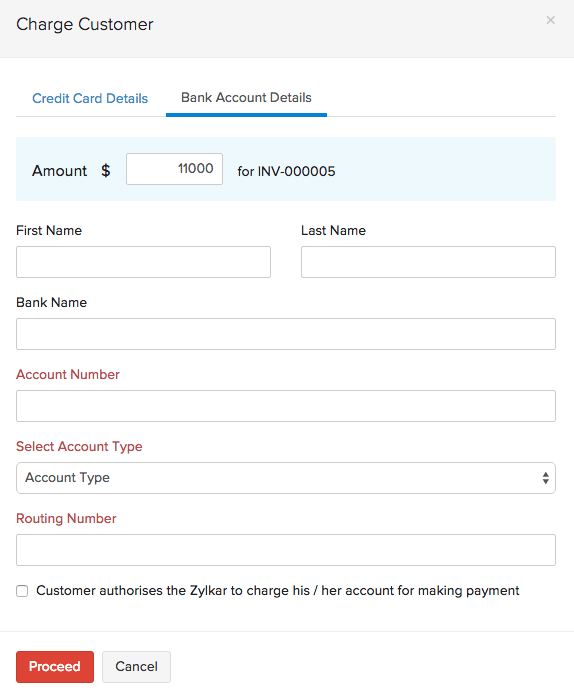

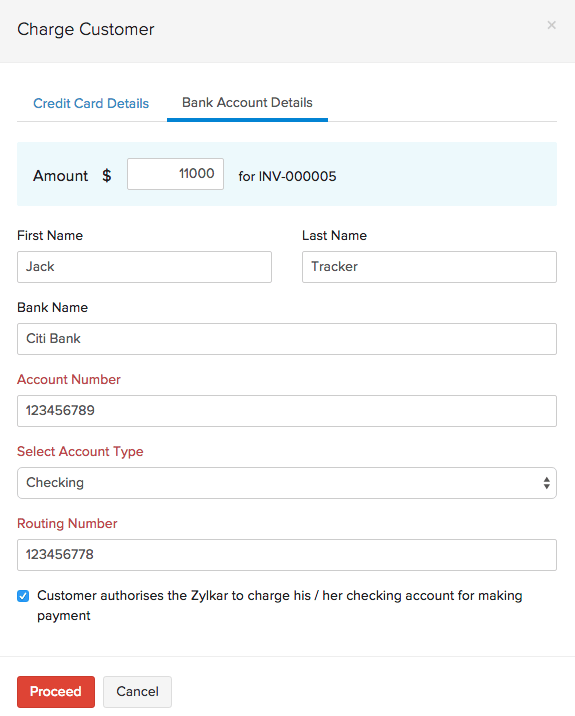

Setting up a bank account for ACH Payments

Step 1:

Go to the Invoices tab. Select the invoice for which a payment needs to be recorded. Click on the Record Payment drop-down and select Charge Customer. A Charge Customer screen will open up.

Step 2:

You will be asked to enter either Credit Card Details or Bank Account Details. In this case, select the tab Bank Account Details and enter the customer’s bank account details. Account number, Account type and Routing number are mandatory fields to configure the bank account.

Select the check-box against Customer authorises “Org Name” to charge his / her checking account for making payment and click on Proceed.

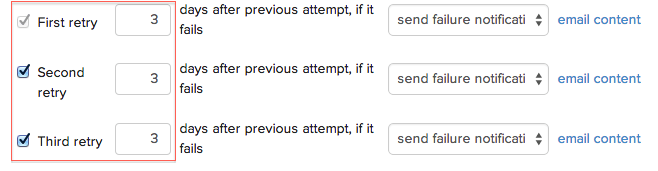

Configuring number of retries and intervals

Zoho Invoice allows you to configure the number of retries necessary in case of a transaction failure. The various configurations available are shown below.

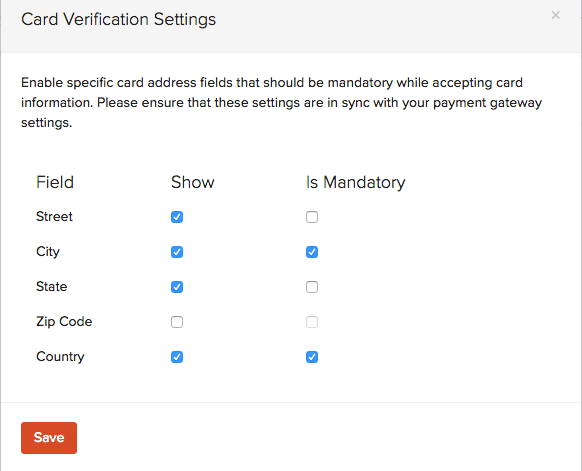

Card Verification Settings

Initially card address was made mandatory in Zoho Invoice. This was initiated by us to avoid confusions with respect to various payment gateways as different payment gateways have different validations. But now you are given that option to decide on whether the card address needs to be shown or not.

Depending on your choice of gateway you can enable the necessary fields of the card address to be shown or to be made mandatory by making the preferences in Card Verification Settings.

Kindly follow the steps below to make card address related changes:

- Click the Gear icon present at the top right corner of the screen.

- Go to Integrations and select Online Payments and click the Card Verification Settings button.

- Here you can customize card address details accordingly.

Transaction Fee of All the Payment Gateways

- Stripe - 2.9% + 30¢

- PayPal - 2.5% + Fixed Fee

- Square - 2.9% + 30¢

- Authorize.net - 2.9% + 30¢

- Payflow Pro - $25/month

- Payments Pro - 2.9% + $0.30

- 2 CheckOut - As per the chosen plan

- Braintree - 2.9% + $.30

- CSG Forte - 2.75%(3.50% on American Express) + 25¢ per transaction

Yes

Yes