- HOME

- HR insights

- Gratuity for employees: Breaking down the basics

Gratuity for employees: Breaking down the basics

- Last Updated : May 14, 2024

- 2.1K Views

- 5 Min Read

For all the time and hard work that your employees put into your organization, they deserve appreciation that makes them feel valued and motivated. One of the rewards that organizations offer employees to thank them for their years of service is gratuity. If you're wondering what gratuity is and how it can help your organization and employees, check out the answers to commonly asked questions below.

What is gratuity?

Gratuity is a financial reward given to employees who have completed a certain amount of time at an organization—usually five years or more. By offering gratuity to employees, the organization can show gratitude toward an employee for their continuous efforts and services. This salary component is usually offered to employees when they resign or retire from the organization as part of their full and final settlement. Some organizations are mandated by law to offer a gratuity to their employees, whereas others can choose to decide.

What are the advantages of providing gratuity?

Gratuity can improve the employee's morale, aid in recognizing their efforts, and reassure them that their performance has made a difference for the organization. It creates a positive environment where employees know that they are valued, thus reducing work-related stress to a great extent.

Some regional and national labor laws make it mandatory for organizations to provide gratuity for their employees. For instance, gratuity payment in India is governed by the Payment of Gratuity Act of 1972. Offering gratuity helps India-based organizations keep hefty penalties and other compliance issues at bay.

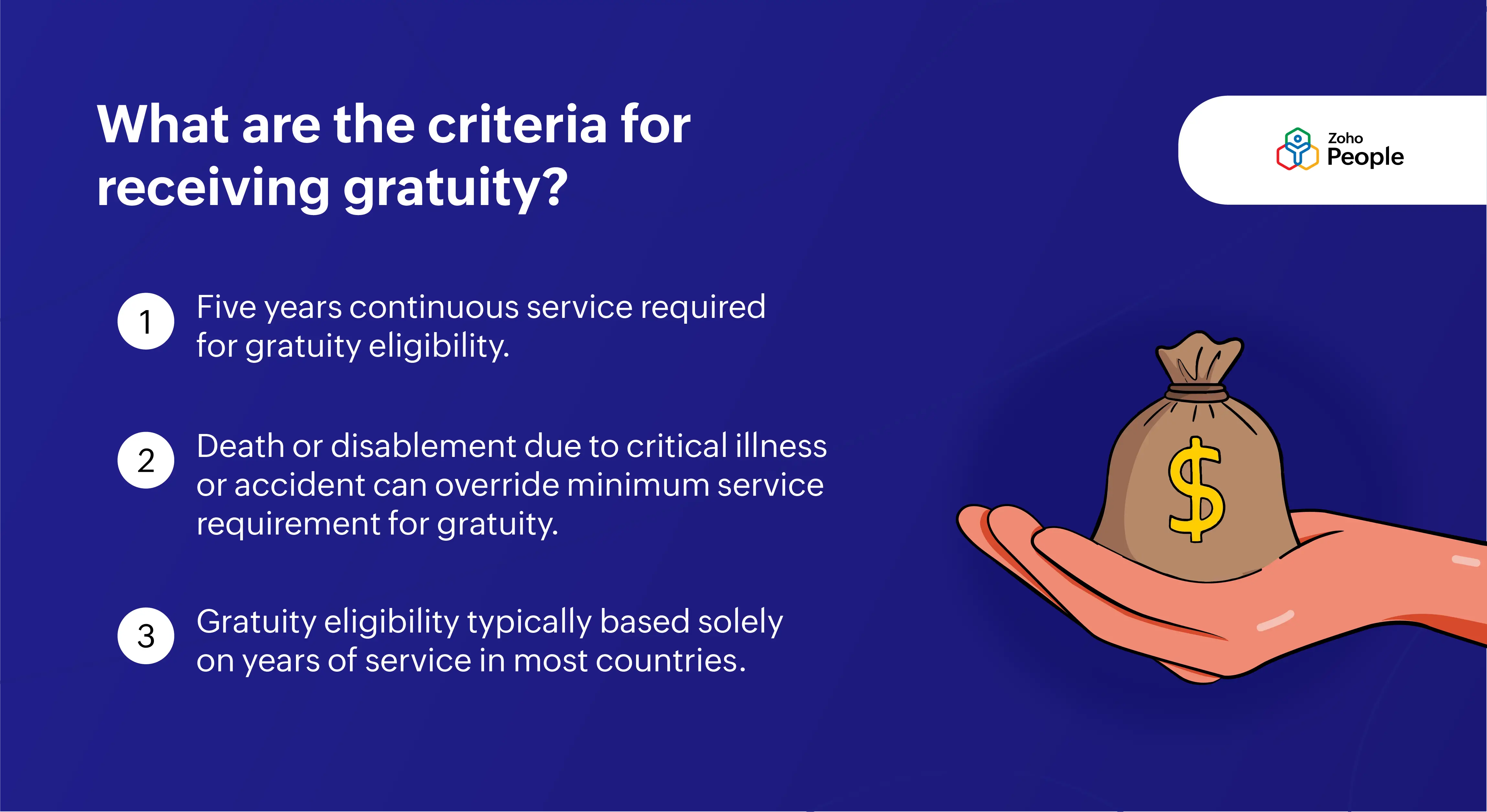

What are the criteria for receiving gratuity?

The criteria for gratuity may differ based on the laws in your organization's region, but here are some of the basic criteria that employees have to fulfill to receive gratuity:

Employees must have worked for a minimum of five years with an organization without any gaps in the years of service.

In some cases, if by chance an employee faces death or disablement due to a critical illness or an accident, they can be entitled to receive the gratuity even if they don't meet the minimum years of service.

In most nations, employees become eligible to receive gratuity just by their years of service, irrespective of their salary cutoff, experience, seniority, or designation.

Note: In some nations, if an employee is terminated due to misconduct, they won't be entitled to receive the gratuity as part of their full and final settlement.

How is gratuity calculated?

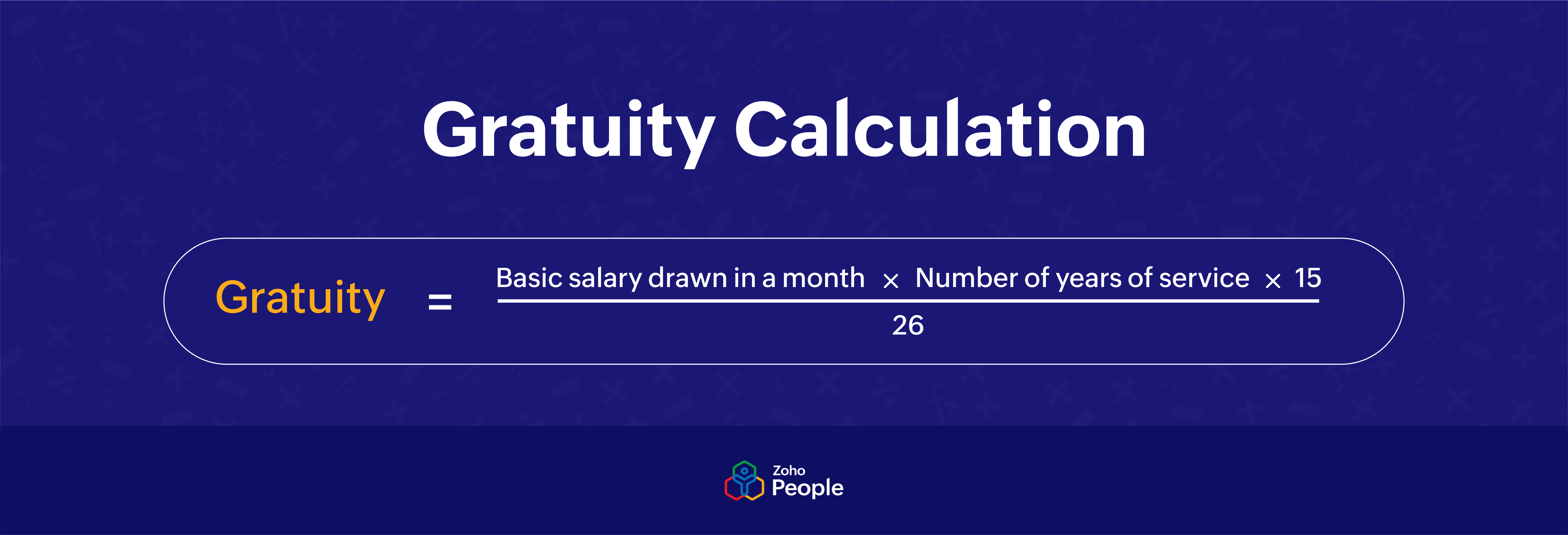

The formula for calculating the gratuity amount offered to employees may vary based on the region, but here's a general formula for calculating gratuity:

The basic salary in many cases also includes the dearness allowance provided to employees, which is usually the salary component that helps employees cope with inflation and adjust their cost of living accordingly.

15 in this calculation represents the number of working days considered for gratuity calculation.

26 represents the total number of working days in a month. This may differ based on certain laws. For instance, in India, while calculating the gratuity of employees who are not covered under the Payment of Gratuity Act of 1972, the total number of working days in a month is 30 instead of 26.

Note: Gratuity calculation may differ from region to region. In some countries, the per day wage of employees is usually multiplied by their total number of working days based on their years of service. In other countries, the length of service is usually used as the base for calculation.

What happens when gratuity is not offered to employees?

Refusing to pay gratuity to employees, especially when it is mandated by law, can cause severe legal issues. These include imprisonment, penalty, or even both in some cases. In countries where it's not mandatory (like the USA, UK, and Singapore), legal issues may not be an issue; however, it can raise engagement and satisfaction issues among employees.

Is gratuity and a provident fund (PF) the same?

No, a PF is quite different from gratuity. A PF is an amount that is usually contributed by both the employer and the employee to ensure that employees have some kind of savings for their retirement. It's often regulated by the government in the countries where it is offered. Gratuity, on the other hand, is an amount that only employers contribute as a means of thanking employees for their loyalty and years of service.

Is the gratuity amount taxable?

This again depends on the country in which your organization operates. In countries like the USA, where gratuity is considered another form of income, the gratuity amount is subject to taxes. In countries like India, the gratuity amount is non-taxable until it reaches a certain amount. In some cases, whether gratuity is taxable or non-taxable also depends on the sector that the organization belongs to.

Gratuity in different countries

Here's a quick gist of how employee gratuity is regulated in different countries:

Gratuity in India

In India, gratuity is governed by the Payment of Gratuity Act of 1972. According to this act, every organization that has a minimum of ten employees is liable to pay gratuity to employees either on their retirement or upon their resignation after being associated with their organization for a minimum of five years.

Gratuity in UAE

The UAE has labor laws that regulate how employees receive their gratuity based on the nature of their employment contract. Both UAE nationals and expatriates are entitled to receive gratuity by law from their employers; this is usually calculated based on their years of service and their basic salary without considering any additional allowances. Employees are usually entitled to receive their gratuity after a year of service.

Gratuity in Saudi Arabia

Gratuity is also called end-of-service benefits in Saudi Arabia, and it's offered to employees who have completed a minimum of two years of service at their organization. For the first five years, half a month's salary is provided as gratuity for each year of the employee's service. After five years, an employee's full month's salary is considered.

Gratuity in the USA

In the USA, employers are not mandated by any law to offer gratuity to their employees. The word gratuity typically refers to a tip, a monetary amount that customers provide in exchange for their service.

Wrapping up

Offering gratuity to employees is a wonderful way to thank them for their service, loyalty, and commitment to your organization. It can be super useful to employees while they navigate the transition from one role to another, or as they prepare for retirement. When offering a gratuity for your employees, read the applicable labor laws thoroughly to ensure compliance.

Tarika

TarikaContent Specialist at Zoho People