Integrating With Zoho Books

Keeping track of the salaries you pay your employees is important as paying them right on time.

The wages you pay and the taxes you deposit need to be kept track of with your accounting software; accounting entries need to be posted after every pay run.when this is done manually, it can take up a lot of your time.

This is where integrating Zoho Payroll with Zoho Books can come to your rescue.

When you connect with your Zoho Books account, all your payroll transactions are in sync with your books; all your payroll expenses and tax liabilities will automatically fall into the right journals.

This will be reflected in your Profit and Loss statement so that your Net Profit is accurate.

To set up the integration:

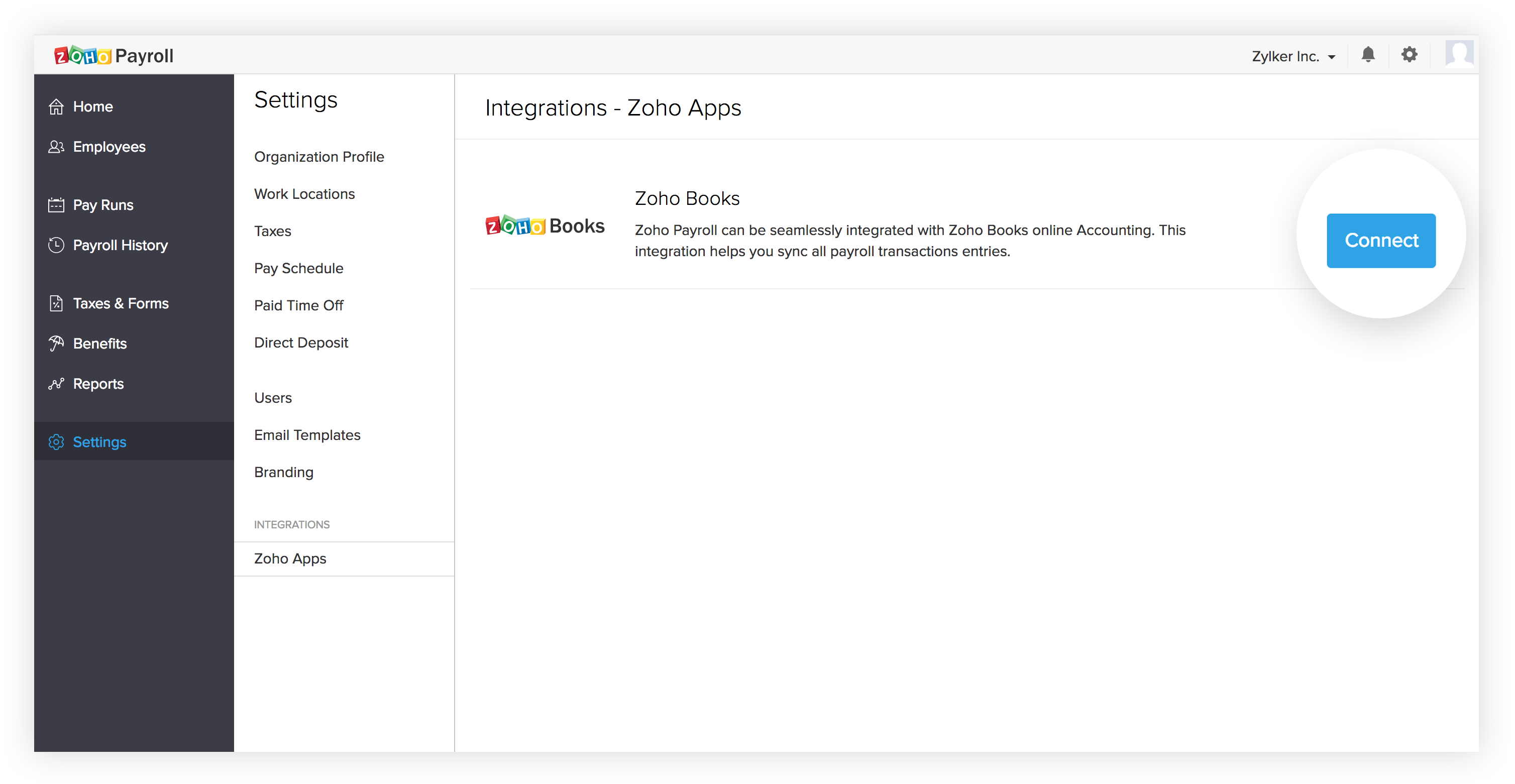

- Go to Settings >> Integrations >> Zoho Apps.

- Click Connect next to Zoho Books.

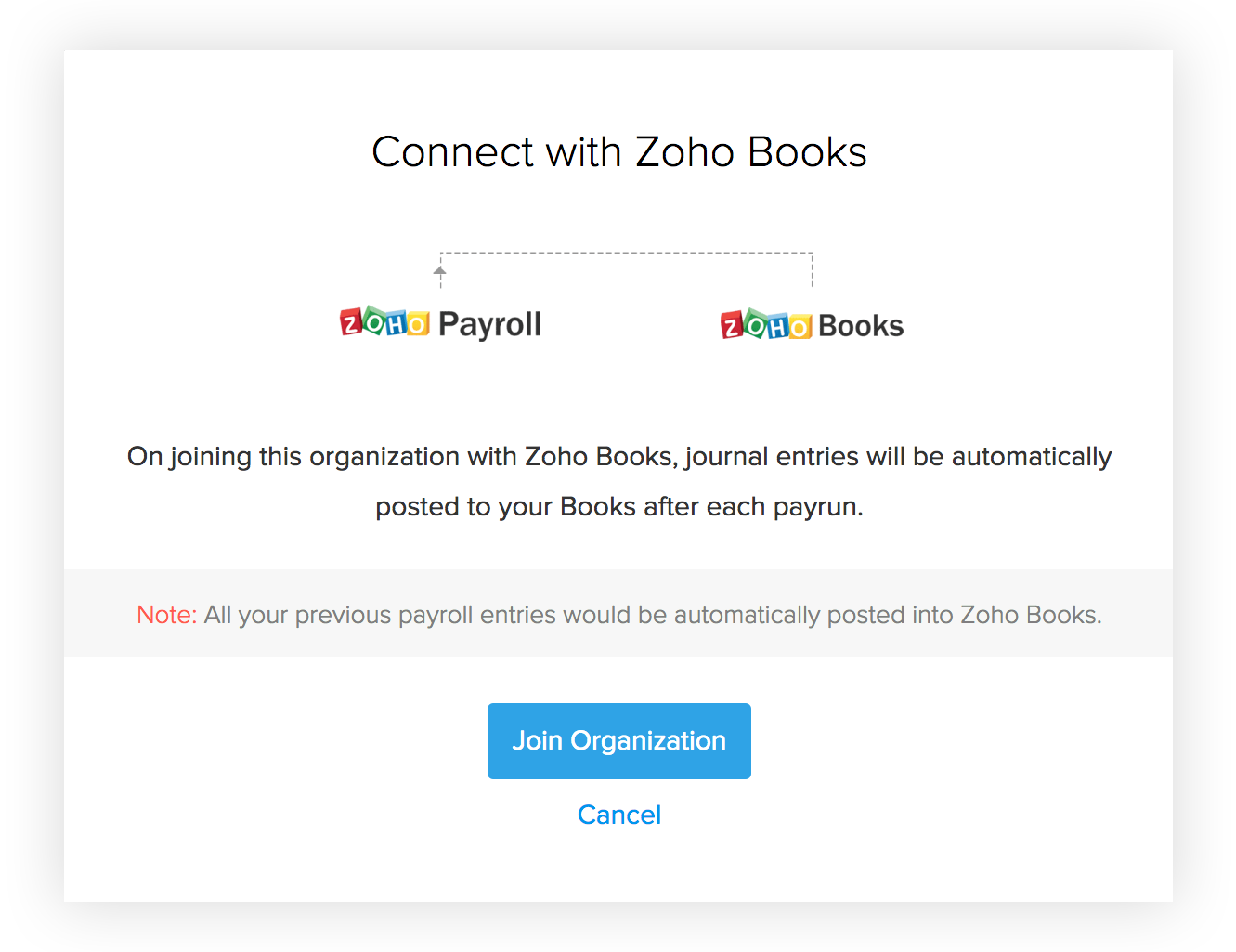

- In the pop-up that follows, click Join Organization to connect with your Zoho Books organization.

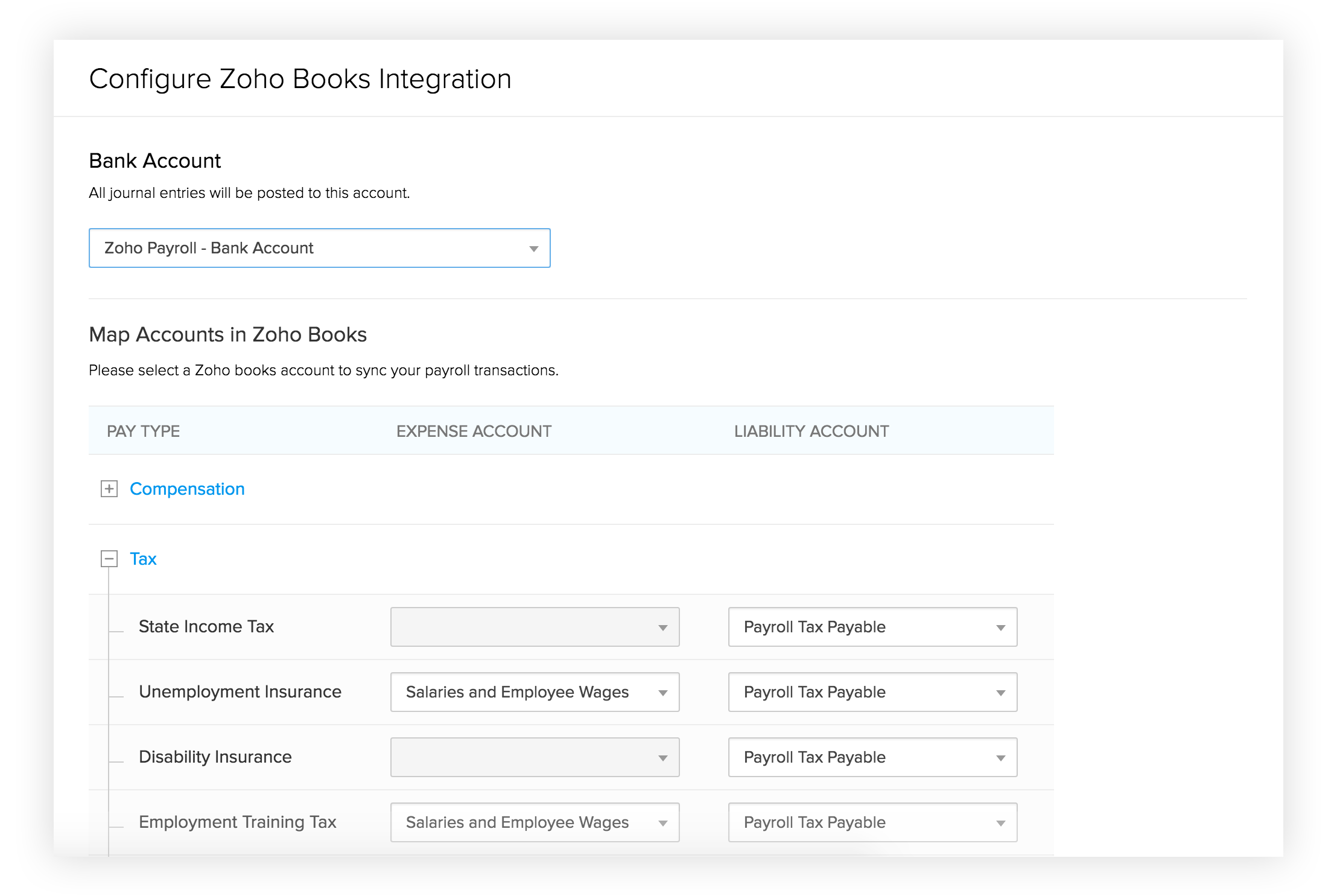

Now that you have linked both the organizations, you can set up the finer details as to what accounts must reflect the payroll transactions.

You can choose to track all taxes under a single account, or track State and Federal taxes under different accounts or even associate each tax with its own account in Zoho Books.

You can create sub-accounts depending on your requirement and select those in Zoho Payroll.

- Select the Bank account from which payroll expenses are paid.

- Select the Expense and Liability accounts for compensation, taxes, benefits, and deductions.

- Once you’re done, hit Save.

You can change these settings anytime. Changes will be reflected in future pay runs.